(

)

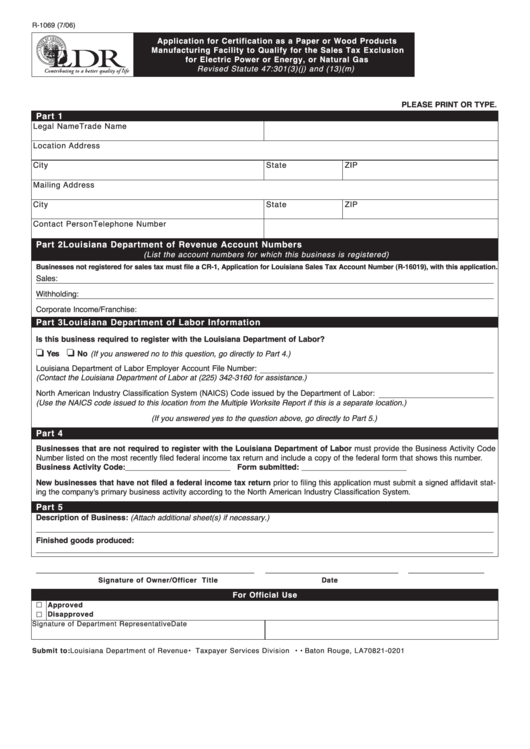

R-1069 (7/06)

Application for Certification as a Paper or Wood Products

Manufacturing Facility to Qualify for the Sales Tax Exclusion

for Electric Power or Energy, or Natural Gas

Revised Statute 47:301(3)(j) and (13)(m)

PLEASE PRINT OR TYPE.

Part 1

Legal Name

Trade Name

Location Address

City

State

ZIP

Mailing Address

City

State

ZIP

Contact Person

Telephone Number

Part 2

Louisiana Department of Revenue Account Numbers

(List the account numbers for which this business is registered)

Businesses not registered for sales tax must file a CR-1, Application for Louisiana Sales Tax Account Number (R-16019), with this application.

Sales:

Withholding:

Corporate Income/Franchise:

Part 3

Louisiana Department of Labor Information

Is this business required to register with the Louisiana Department of Labor?

❏

❏

Yes

No (If you answered no to this question, go directly to Part 4.)

Louisiana Department of Labor Employer Account File Number:

(Contact the Louisiana Department of Labor at (225) 342-3160 for assistance.)

North American Industry Classification System (NAICS) Code issued by the Department of Labor:

(Use the NAICS code issued to this location from the Multiple Worksite Report if this is a separate location.)

(If you answered yes to the question above, go directly to Part 5.)

Part 4

Businesses that are not required to register with the Louisiana Department of Labor must provide the Business Activity Code

Number listed on the most recently filed federal income tax return and include a copy of the federal form that shows this number.

Business Activity Code: ________________________ Form submitted: ________________________

New businesses that have not filed a federal income tax return prior to filing this application must submit a signed affidavit stat-

ing the company's primary business activity according to the North American Industry Classification System.

Part 5

Description of Business: (Attach additional sheet(s) if necessary.)

Finished goods produced:

______________________________________________

____________________________

________________

Signature of Owner/Officer

Title

Date

For Official Use

Approved

Disapproved

Signature of Department Representative

Date

Submit to:

Louisiana Department of Revenue • Taxpayer Services Division • P.O. Box 1323 • Baton Rouge, LA 70821-0201

1

1