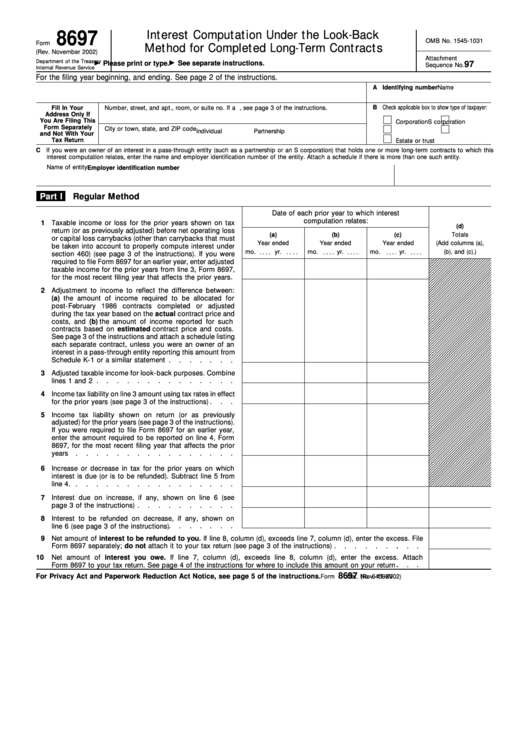

8697

Interest Computation Under the Look-Back

OMB No. 1545-1031

Form

Method for Completed Long-Term Contracts

(Rev. November 2002)

Attachment

Department of the Treasury

See separate instructions.

Please print or type.

97

Sequence No.

Internal Revenue Service

For the filing year beginning

, and ending

. See page 2 of the instructions.

Name

A

Identifying number

B Check applicable box to show type of taxpayer:

Fill In Your

Number, street, and apt., room, or suite no. If a P.O. box, see page 3 of the instructions.

Address Only If

You Are Filing This

Corporation

S corporation

Form Separately

City or town, state, and ZIP code

Individual

Partnership

and Not With Your

Tax Return

Estate or trust

C If you were an owner of an interest in a pass-through entity (such as a partnership or an S corporation) that holds one or more long-term contracts to which this

interest computation relates, enter the name and employer identification number of the entity. Attach a schedule if there is more than one such entity.

Name of entity

Employer identification number

Part I

Regular Method

Date of each prior year to which interest

computation relates:

1

Taxable income or loss for the prior years shown on tax

(d)

return (or as previously adjusted) before net operating loss

(a)

(b)

(c)

Totals

or capital loss carrybacks (other than carrybacks that must

Year ended

Year ended

Year ended

(Add columns (a),

be taken into account to properly compute interest under

mo.

yr.

mo.

yr.

mo.

yr.

(b), and (c).)

section 460) (see page 3 of the instructions). If you were

required to file Form 8697 for an earlier year, enter adjusted

taxable income for the prior years from line 3, Form 8697,

for the most recent filing year that affects the prior years

2

Adjustment to income to reflect the difference between:

(a) the amount of income required to be allocated for

post-February 1986 contracts completed or adjusted

during the tax year based on the actual contract price and

costs, and (b) the amount of income reported for such

contracts based on estimated contract price and costs.

See page 3 of the instructions and attach a schedule listing

each separate contract, unless you were an owner of an

interest in a pass-through entity reporting this amount from

Schedule K-1 or a similar statement

3

Adjusted taxable income for look-back purposes. Combine

lines 1 and 2

4

Income tax liability on line 3 amount using tax rates in effect

for the prior years (see page 3 of the instructions)

5

Income tax liability shown on return (or as previously

adjusted) for the prior years (see page 3 of the instructions).

If you were required to file Form 8697 for an earlier year,

enter the amount required to be reported on line 4, Form

8697, for the most recent filing year that affects the prior

years

6

Increase or decrease in tax for the prior years on which

interest is due (or is to be refunded). Subtract line 5 from

line 4.

7

Interest due on increase, if any, shown on line 6 (see

page 3 of the instructions)

8

Interest to be refunded on decrease, if any, shown on

line 6 (see page 3 of the instructions)

9

Net amount of interest to be refunded to you. If line 8, column (d), exceeds line 7, column (d), enter the excess. File

Form 8697 separately; do not attach it to your tax return (see page 3 of the instructions)

10

Net amount of interest you owe. If line 7, column (d), exceeds line 8, column (d), enter the excess. Attach

Form 8697 to your tax return. See page 4 of the instructions for where to include this amount on your return

8697

For Privacy Act and Paperwork Reduction Act Notice, see page 5 of the instructions.

Cat. No. 64598V

Form

(Rev. 11-2002)

1

1 2

2