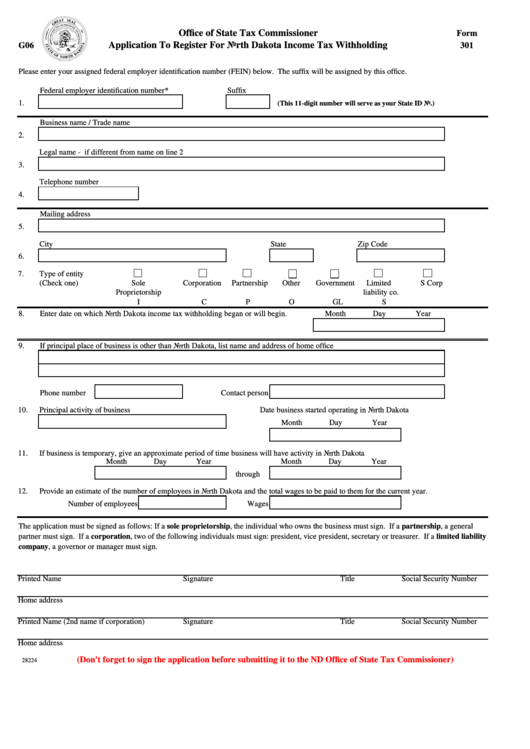

Office of State Tax Commissioner

Form

Application To Register For North Dakota Income Tax Withholding

G06

301

Please enter your assigned federal employer identification number (FEIN) below. The suffix will be assigned by this office.

Federal employer identification number*

Suffix

1.

(This 11-digit number will serve as your State ID No.)

Business name / Trade name

2.

Legal name - if different from name on line 2

3.

Telephone number

4.

Mailing address

5.

City

State

Zip Code

6.

7.

Type of entity

(Check one)

Sole

Corporation

Partnership

Other

Government

Limited

S Corp

Proprietorship

liability co.

I

C

P

O

G

L

S

8.

Enter date on which North Dakota income tax withholding began or will begin.

Month

Day

Year

9.

If principal place of business is other than North Dakota, list name and address of home office

Phone number

Contact person

10.

Principal activity of business

Date business started operating in North Dakota

Month

Day

Year

11.

If business is temporary, give an approximate period of time business will have activity in North Dakota

Month

Day

Year

Month

Day

Year

through

12.

Provide an estimate of the number of employees in North Dakota and the total wages to be paid to them for the current year.

Number of employees

Wages

The application must be signed as follows: If a sole proprietorship, the individual who owns the business must sign. If a partnership, a general

partner must sign. If a corporation, two of the following individuals must sign: president, vice president, secretary or treasurer. If a limited liability

company, a governor or manager must sign.

Printed Name

Signature

Title

Social Security Number

Home address

Printed Name (2nd name if corporation)

Signature

Title

Social Security Number

Home address

(Don't forget to sign the application before submitting it to the ND Office of State Tax Commissioner)

28224

1

1