Instructions Sheet For The Quarterly Wage Report And Unemployment Tax Return

ADVERTISEMENT

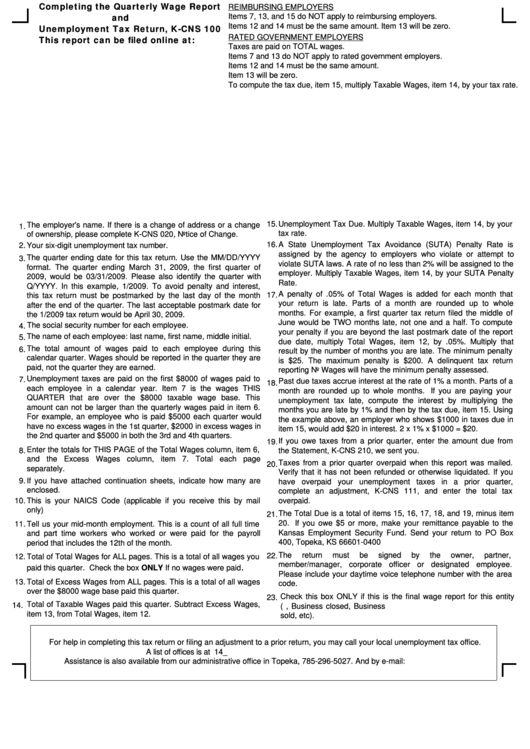

Completing the Quarterly Wage Report

REIMBURSING EMPLOYERS

and

Items 7, 13, and 15 do NOT apply to reimbursing employers.

Unemployment Tax Return, K-CNS 100

Items 12 and 14 must be the same amount. Item 13 will be zero.

This report can be filed online at:

RATED GOVERNMENT EMPLOYERS

Taxes are paid on TOTAL wages.

Items 7 and 13 do NOT apply to rated government employers.

Items 12 and 14 must be the same amount.

Item 13 will be zero.

To compute the tax due, item 15, multiply Taxable Wages, item 14, by your tax rate.

15.

Unemployment Tax Due. Multiply Taxable Wages, item 14, by your

The employer's name. If there is a change of address or a change

1.

tax rate.

of ownership, please complete K-CNS 020, Notice of Change.

16.

A State Unemployment Tax Avoidance (SUTA) Penalty Rate is

2.

Your six-digit unemployment tax number.

assigned by the agency to employers who violate or attempt to

The quarter ending date for this tax return. Use the MM/DD/YYYY

3.

violate SUTA laws. A rate of no less than 2% will be assigned to the

format. The quarter ending March 31, 2009, the first quarter of

employer. Multiply Taxable Wages, item 14, by your SUTA Penalty

2009, would be 03/31/2009. Please also identify the quarter with

Rate.

Q/YYYY. In this example, 1/2009. To avoid penalty and interest,

A penalty of .05% of Total Wages is added for each month that

17.

this tax return must be postmarked by the last day of the month

your return is late. Parts of a month are rounded up to whole

after the end of the quarter. The last acceptable postmark date for

months. For example, a first quarter tax return filed the middle of

the 1/2009 tax return would be April 30, 2009.

June would be TWO months late, not one and a half. To compute

4. The social security number for each employee.

your penalty if you are beyond the last postmark date of the report

The name of each employee: last name, first name, middle initial.

5.

due date, multiply Total Wages, item 12, by .05%. Multiply that

The total amount of wages paid to each employee during this

6.

result by the number of months you are late. The minimum penalty

calendar quarter. Wages should be reported in the quarter they are

is $25. The maximum penalty is $200. A delinquent tax return

paid, not the quarter they are earned.

reporting No Wages will have the minimum penalty assessed.

Unemployment taxes are paid on the first $8000 of wages paid to

7.

Past due taxes accrue interest at the rate of 1% a month. Parts of a

18.

each employee in a calendar year. Item 7 is the wages THIS

month are rounded up to whole months. If you are paying your

QUARTER that are over the $8000 taxable wage base. This

unemployment tax late, compute the interest by multiplying the

amount can not be larger than the quarterly wages paid in item 6.

months you are late by 1% and then by the tax due, item 15. Using

For example, an employee who is paid $5000 each quarter would

the example above, an employer who shows $1000 in taxes due in

have no excess wages in the 1st quarter, $2000 in excess wages in

item 15, would add $20 in interest. 2 x 1% x $1000 = $20.

the 2nd quarter and $5000 in both the 3rd and 4th quarters.

If you owe taxes from a prior quarter, enter the amount due from

19.

Enter the totals for THIS PAGE of the Total Wages column, item 6,

8.

the Statement, K-CNS 210, we sent you.

and the Excess Wages column, item 7. Total each page

Taxes from a prior quarter overpaid when this report was mailed.

20.

separately.

Verify that it has not been refunded or otherwise liquidated. If you

9.

If you have attached continuation sheets, indicate how many are

have overpaid your unemployment taxes in a prior quarter,

enclosed.

complete an adjustment, K-CNS 111, and enter the total tax

10.

This is your NAICS Code (applicable if you receive this by mail

overpaid.

only)

The Total Due is a total of items 15, 16, 17, 18, and 19, minus item

21.

20. If you owe $5 or more, make your remittance payable to the

11.

Tell us your mid-month employment. This is a count of all full time

Kansas Employment Security Fund. Send your return to PO Box

and part time workers who worked or were paid for the payroll

400, Topeka, KS 66601-0400

period that includes the 12th of the month.

The

return

must

be

signed

by

the

owner,

partner,

22.

12.

Total of Total Wages for ALL pages. This is a total of all wages you

member/manager, corporate officer or designated employee.

.

paid this quarter. Check the box ONLY If no wages were paid

Please include your daytime voice telephone number with the area

13.

Total of Excess Wages from ALL pages. This is a total of all wages

code.

over the $8000 wage base paid this quarter.

Check this box ONLY if this is the final wage report for this entity

23.

Total of Taxable Wages paid this quarter. Subtract Excess Wages,

14.

(i.e. Business no longer paying wages, Business closed, Business

item 13, from Total Wages, item 12.

sold, etc).

For help in completing this tax return or filing an adjustment to a prior return, you may call your local unemployment tax office.

A list of offices is at

Assistance is also available from our administrative office in Topeka, 785-296-5027. And by e-mail: uitax@dol.ks.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1