Registration Form For Albion City Income Tax

ADVERTISEMENT

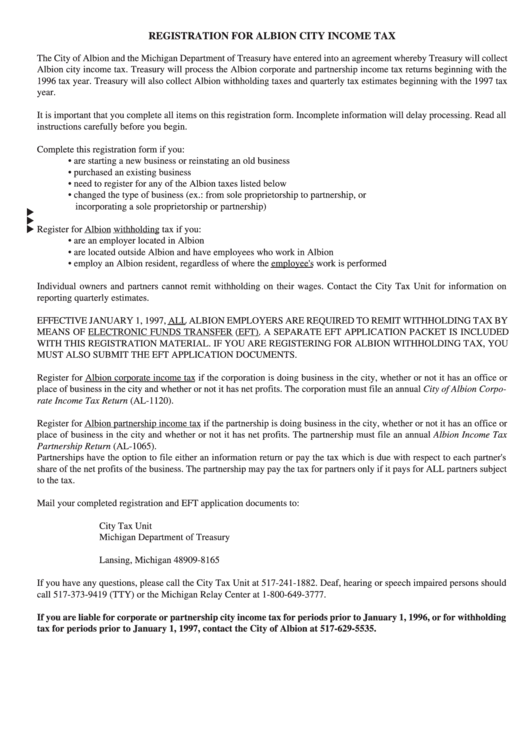

REGISTRATION FOR ALBION CITY INCOME TAX

The City of Albion and the Michigan Department of Treasury have entered into an agreement whereby Treasury will collect

Albion city income tax. Treasury will process the Albion corporate and partnership income tax returns beginning with the

1996 tax year. Treasury will also collect Albion withholding taxes and quarterly tax estimates beginning with the 1997 tax

year.

It is important that you complete all items on this registration form. Incomplete information will delay processing. Read all

instructions carefully before you begin.

Complete this registration form if you:

• are starting a new business or reinstating an old business

• purchased an existing business

• need to register for any of the Albion taxes listed below

• changed the type of business (ex.: from sole proprietorship to partnership, or

incorporating a sole proprietorship or partnership)

Register for Albion withholding tax if you:

• are an employer located in Albion

• are located outside Albion and have employees who work in Albion

• employ an Albion resident, regardless of where the employee's work is performed

Individual owners and partners cannot remit withholding on their wages. Contact the City Tax Unit for information on

reporting quarterly estimates.

EFFECTIVE JANUARY 1, 1997, ALL ALBION EMPLOYERS ARE REQUIRED TO REMIT WITHHOLDING TAX BY

MEANS OF ELECTRONIC FUNDS TRANSFER (EFT). A SEPARATE EFT APPLICATION PACKET IS INCLUDED

WITH THIS REGISTRATION MATERIAL. IF YOU ARE REGISTERING FOR ALBION WITHHOLDING TAX, YOU

MUST ALSO SUBMIT THE EFT APPLICATION DOCUMENTS.

Register for Albion corporate income tax if the corporation is doing business in the city, whether or not it has an office or

place of business in the city and whether or not it has net profits. The corporation must file an annual City of Albion Corpo-

rate Income Tax Return (AL-1120).

Register for Albion partnership income tax if the partnership is doing business in the city, whether or not it has an office or

place of business in the city and whether or not it has net profits. The partnership must file an annual Albion Income Tax

Partnership Return (AL-1065).

Partnerships have the option to file either an information return or pay the tax which is due with respect to each partner's

share of the net profits of the business. The partnership may pay the tax for partners only if it pays for ALL partners subject

to the tax.

Mail your completed registration and EFT application documents to:

City Tax Unit

Michigan Department of Treasury

P.O. Box 30665

Lansing, Michigan 48909-8165

If you have any questions, please call the City Tax Unit at 517-241-1882. Deaf, hearing or speech impaired persons should

call 517-373-9419 (TTY) or the Michigan Relay Center at 1-800-649-3777.

If you are liable for corporate or partnership city income tax for periods prior to January 1, 1996, or for withholding

tax for periods prior to January 1, 1997, contact the City of Albion at 517-629-5535.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1