Form 300 - Instructions

ADVERTISEMENT

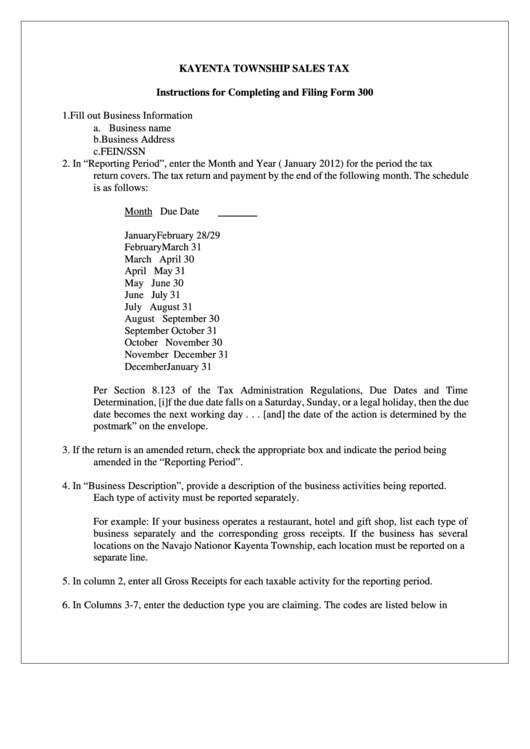

KAYENTA TOWNSHIP SALES TAX

Instructions for Completing and Filing Form 300

1.

Fill out Business Information

a. Business name

b. Business Address

c. FEIN/SSN

2.

In “Reporting Period”, enter the Month and Year (i.e. January 2012) for the period the tax

return covers. The tax return and payment by the end of the following month. The schedule

is as follows:

Month

Due Date

January

February 28/29

February

March 31

March

April 30

April

May 31

May

June 30

June

July 31

July

August 31

August

September 30

September

October 31

October

November 30

November

December 31

December

January 31

Per Section 8.123 of the Tax Administration Regulations, Due Dates and Time

Determination, [i]f the due date falls on a Saturday, Sunday, or a legal holiday, then the due

date becomes the next working day . . . [and] the date of the action is determined by the

postmark” on the envelope.

3.

If the return is an amended return, check the appropriate box and indicate the period being

amended in the “Reporting Period”.

4.

In “Business Description”, provide a description of the business activities being reported.

Each type of activity must be reported separately.

For example: If your business operates a restaurant, hotel and gift shop, list each type of

business separately and the corresponding gross receipts. If the business has several

locations on the Navajo Nation or Kayenta Township, each location must be reported on a

separate line.

5.

In column 2, enter all Gross Receipts for each taxable activity for the reporting period.

6.

In Columns 3-7, enter the deduction type you are claiming. The codes are listed below in

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2