Form F1 - Local Earned Income Tax Return - Pennsylvania

ADVERTISEMENT

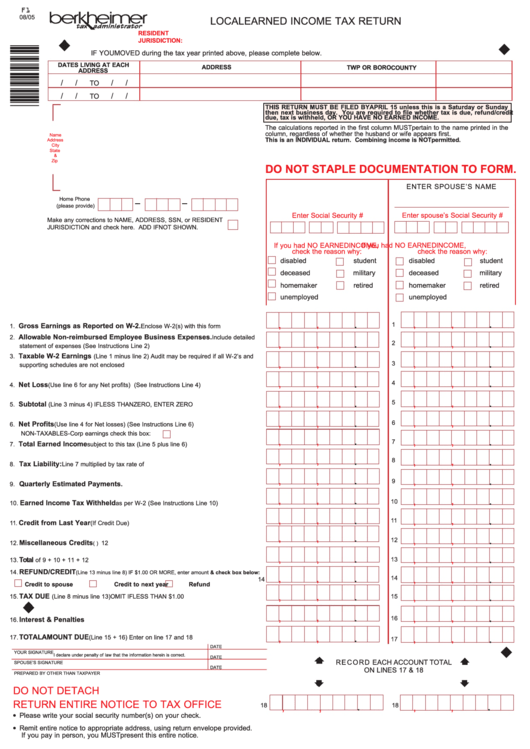

F1

08/05

LOCAL EARNED INCOME TAX RETURN

RESIDENT

JURISDICTION:

IF YOU MOVED during the tax year printed above, please complete below.

DATES LIVING AT EACH

ADDRESS

TWP OR BORO

COUNTY

ADDRESS

/

/

/

/

TO

/

/

/

/

TO

THIS RETURN MUST BE FILED BY APRIL 15 unless this is a Saturday or Sunday

then next business day. You are required to file whether tax is due, refund/credit

due, tax is withheld, OR YOU HAVE NO EARNED INCOME.

The calculations reported in the first column MUST pertain to the name printed in the

column, regardless of whether the husband or wife appears first.

Name

This is an INDIVIDUAL return. Combining income is NOT permitted.

Address

City

State

&

Zip

DO NOT STAPLE DOCUMENTATION TO FORM.

ENTER SPOUSE’S NAME

Home Phone

(please provide)

Enter Social Security #

Enter spouse’s Social Security #

Make any corrections to NAME, ADDRESS, SSN, or RESIDENT

JURISDICTION and check here. ADD IF NOT SHOWN.

If you had NO EARNED INCOME,

If you had NO EARNED INCOME,

check the reason why:

check the reason why:

disabled

student

disabled

student

deceased

military

deceased

military

homemaker

retired

homemaker

retired

unemployed

unemployed

.

.

,

,

,

,

1

Gross Earnings as Reported on W-2.

1.

Enclose W-2(s) with this form ................... 1

Allowable Non-reimbursed Employee Business Expenses.

2.

Include detailed

.

.

,

,

,

,

2

statement of expenses (See Instructions Line 2) ................................................................ 2

Taxable W-2 Earnings

3.

(Line 1 minus line 2) Audit may be required if all W-2’s and

.

.

,

,

,

,

3

supporting schedules are not enclosed ............................................................................... 3

.

.

,

,

,

,

4

Net Loss

4.

(Use line 6 for any Net profits) (See Instructions Line 4) ................................ 4

.

.

,

,

,

,

5

Subtotal

5.

(Line 3 minus 4) IF LESS THAN ZERO, ENTER ZERO .................................... 5

.

.

,

,

,

,

6

Net Profits

6.

(Use line 4 for Net losses) (See Instructions Line 6) ..................................... 6

NON-TAXABLE S-Corp earnings check this box:

.

.

,

,

,

,

7

Total Earned Income

7.

subject to this tax (Line 5 plus line 6) ........................................ 7

.

.

,

,

8

,

,

Tax Liability:

8.

Line 7 multiplied by tax rate of

................................... 8

.

.

,

,

,

,

9

Quarterly Estimated Payments.

9.

.............................................................................. 9

.

.

,

,

,

,

10

Earned Income Tax Withheld

10.

as per W-2 (See Instructions Line 10) ......................10

.

.

,

,

,

,

11

Credit from Last Year

11.

(If Credit Due) .......................................................................... 11

.

,

,

.

,

,

12

Miscellaneous Credits

12.

12

(i.e. Philadelphia Tax or Out-of-State Tax Credit - see instructions) ......

.

.

,

,

,

,

Total

13

13.

of 9 + 10 + 11 + 12 .................................................................................................. 13

REFUND/CREDIT

14.

(Line 13 minus line 8) IF $1.00 OR MORE, enter amount & check box below:

.

.

,

,

,

,

14

14

Credit to spouse

Credit to next year

Refund

.

.

,

TAX DUE

,

,

15.

(Line 8 minus line 13) OMIT IF LESS THAN $1.00 ........................................ 15

,

15

.

.

,

,

,

,

16

Interest & Penalties

16.

..................................................................................................... 16

.

.

TOTAL AMOUNT DUE

,

17.

(Line 15 + 16) Enter on line 17 and 18 .................................. 17

,

,

,

17

DATE

YOUR SIGNATURE

I declare under penalty of law that the information herein is correct.

DATE

R E C O R D EACH ACCOUNT TOTAL

SPOUSE’S SIGNATURE

DATE

ON LINES 17 & 18

PREPARED BY OTHER THAN TAXPAYER

DO NOT DETACH

RETURN ENTIRE NOTICE TO TAX OFFICE

.

.

18

18

,

,

,

,

Please write your social security number(s) on your check.

●

Remit entire notice to appropriate address, using return envelope provided.

●

If you pay in person, you MUST present this entire notice.

Include all required documentation with this form. Photocopies of W-2’s and

●

schedules ARE accepted. DO NOT STAPLE DOCUMENTATION TO FORM.

There will be a $20.00 fee for returned checks for insufficient funds.

●

AMOUNT OF

●

There may be a $12.50 fee if no check enclosed for tax due at time of filing.

ENCLOSED CHECK

To ensure proper credit to your account, please remit to the appropriate address.

19

To contact Berkheimer call

Website:

MAKE CHECK PAYABLE TO: HAB-EIT

Email:

50 N. Seventh Street

Bangor, PA 18013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1