Form I301 - Local Earned Income Tax Return - Berkheimer Tax Administrator

ADVERTISEMENT

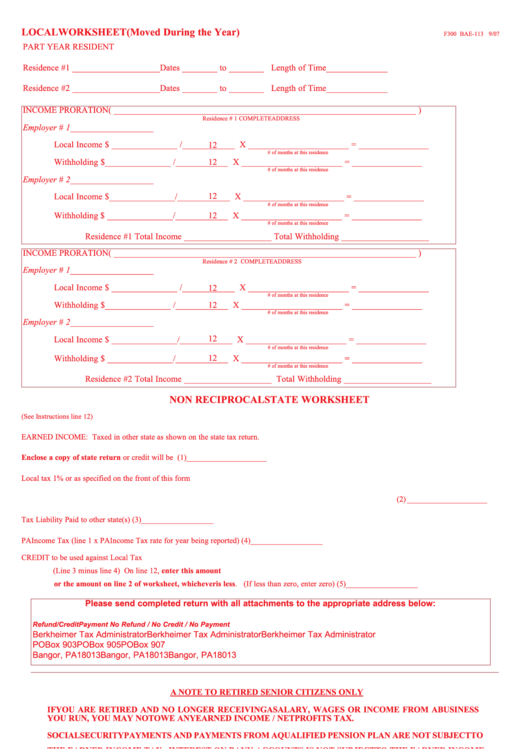

LOCAL WORKSHEET (Moved During the Year)

F300 BAE-113 9/07

PART YEAR RESIDENT

Residence #1 ____________________

Dates ________ to ________ Length of Time______________

Residence #2 ____________________

Dates ________ to ________ Length of Time______________

INCOME PRORATION ( _____________________________________________________________________ )

Residence # 1 COMPLETE ADDRESS

Employer # 1 ___________________

Local Income $ _______________ / ____________ X _______________________ = ________________

12

# of months at this residence

Withholding $ _______________ / ____________ X _______________________ = ________________

12

# of months at this residence

Employer # 2 ___________________

12

Local Income

$ _______________ / ____________ X _______________________ = ________________

# of months at this residence

Withholding

$ _______________ / ____________ X _______________________ = ________________

12

# of months at this residence

Residence #1

Total Income ____________________ Total Withholding ____________________

INCOME PRORATION ( _____________________________________________________________________ )

Residence # 2 COMPLETE ADDRESS

Employer # 1 ___________________

Local Income $ _______________ / ____________ X _______________________ = ________________

12

# of months at this residence

Withholding $ _______________ / ____________ X _______________________ = ________________

12

# of months at this residence

Employer # 2 ___________________

12

Local Income $ _______________ / ____________ X _______________________ = ________________

# of months at this residence

12

Withholding $ _______________ / ____________ X _______________________ = ________________

# of months at this residence

Residence #2

Total Income ____________________ Total Withholding ____________________

NON RECIPROCAL STATE WORKSHEET

(See Instructions line 12)

EARNED INCOME: Taxed in other state as shown on the state tax return.

Enclose a copy of state return or credit will be disallowed ..........................................................................................

(1) ____________________

Local tax 1% or as specified on the front of this form ..................................................................................................

X ____________________

(2) ____________________

Tax Liability Paid to other state(s) ......................................................................................

(3) __________________

PA Income Tax (line 1 x PA Income Tax rate for year being reported) ..............................

(4) __________________

CREDIT to be used against Local Tax

(Line 3 minus line 4) On line 12, enter this amount

or the amount on line 2 of worksheet, whichever is less. (If less than zero, enter zero) ............................

(5) __________________

Please send completed return with all attachments to the appropriate address below:

Refund/Credit

Payment

No Refund / No Credit / No Payment

Berkheimer Tax Administrator

Berkheimer Tax Administrator

Berkheimer Tax Administrator

PO Box 903

PO Box 905

PO Box 907

Bangor, PA 18013

Bangor, PA 18013

Bangor, PA 18013

A NOTE TO RETIRED SENIOR CITIZENS ONLY

IF YOU ARE RETIRED AND NO LONGER RECEIVING A SALARY, WAGES OR INCOME FROM A BUSINESS

YOU RUN, YOU MAY NOT OWE ANY EARNED INCOME / NET PROFITS TAX.

SOCIAL SECURITY PAYMENTS AND PAYMENTS FROM A QUALIFIED PENSION PLAN ARE NOT SUBJECT TO

THE EARNED INCOME TAX. INTEREST ON BANK ACCOUNTS IS NOT SUBJECT TO THE EARNED INCOME

TAX EITHER.

IF YOU RECEIVE A FINAL EARNED INCOME TAX RETURN YOU SHOULD RETURN THE FORM SHOWING

THAT YOU HAD NO EARNINGS. CHECK THE APPROPRIATE BOX ON THE RETURN STATING THAT YOU

ARE RETIRED.

IF YOU ARE SEMI-RETIRED AND STILL RECEIVE WAGES FROM A PART-TIME JOB OR BUSINESS YOU

STILL RUN, YOU MUST STILL PAY THE EARNED INCOME / NET PROFITS TAX.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5