Clear form

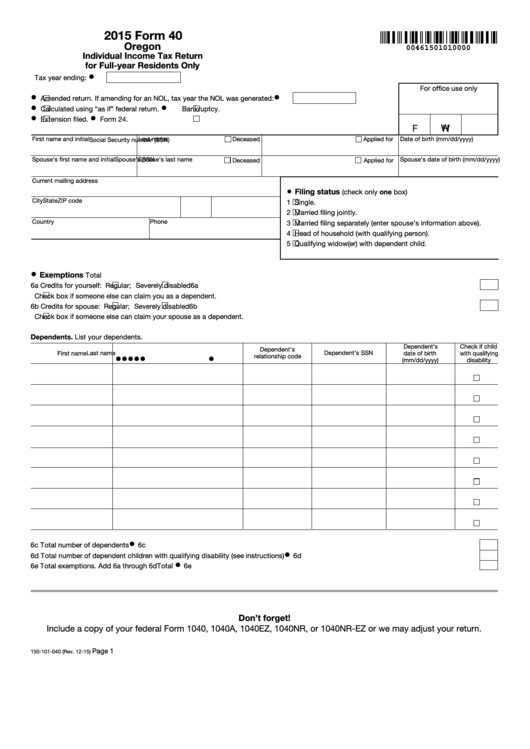

2015 Form 40

Oregon

00461501010000

Individual Income Tax Return

for Full-year Residents Only

•

Tax year ending:

For office use only

•

•

Amended return. If amending for an NOL, tax year the NOL was generated:

•

•

Calculated using “as if” federal return.

Bankruptcy.

•

•

Extension filed.

Form 24.

W

F

H

First name and initial

Last name

Deceased

Applied for

Date of birth (mm/dd/yyyy)

Social Security number (SSN)

Spouse’s first name and initial

Spouse’s last name

Spouse’s SSN

Spouse’s date of birth (mm/dd/yyyy)

Deceased

Applied for

Current mailing address

•

Filing status

(check only one box)

City

State

ZIP code

1

Single.

2

Married filing jointly.

Country

Phone

3

Married filing separately (enter spouse’s information above).

4

Head of household (with qualifying person).

5

Qualifying widow(er) with dependent child.

•

Exemptions

Total

6a Credits for yourself:

Regular;

Severely disabled ............................................................................................................................. 6a

Check box if someone else can claim you as a dependent.

6b Credits for spouse:

Regular;

Severely disabled ............................................................................................................................. 6b

Check box if someone else can claim your spouse as a dependent.

Dependents. List your dependents.

Dependent’s

Check if child

Dependent’s

First name

Last name

Dependent’s SSN

date of birth

with qualifying

•

•

•

•

•

•

relationship code

disability

(mm/dd/yyyy)

•

6c Total number of dependents ...........................................................................................................................................................................

6c

•

6d Total number of dependent children with qualifying disability (see instructions) ............................................................................................

6d

•

6e Total exemptions. Add 6a through 6d .................................................................................................................................................... Total

6e

Don’t forget!

Include a copy of your federal Form 1040, 1040A, 1040EZ, 1040NR, or 1040NR-EZ or we may adjust your return.

Page 1

150-101-040 (Rev. 12-15)

1

1 2

2 3

3 4

4