Form Gt 5 - Instructions For Maine Gasoline Distribution Tax Return

ADVERTISEMENT

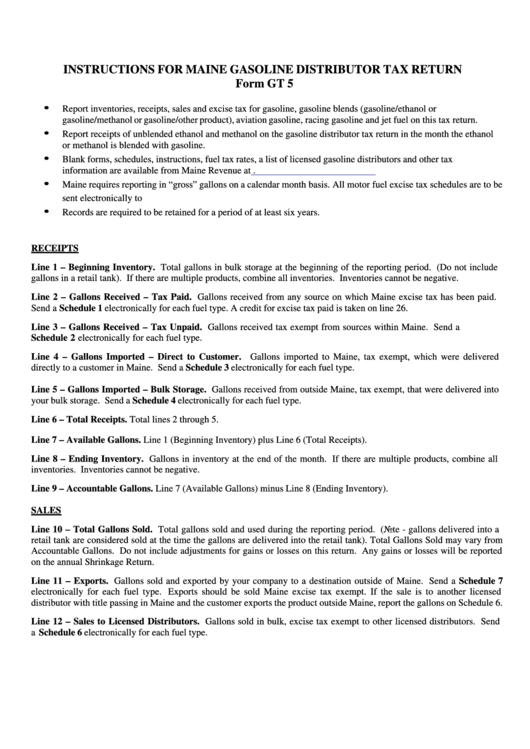

INSTRUCTIONS FOR MAINE GASOLINE DISTRIBUTOR TAX RETURN

Form GT 5

•

Report inventories, receipts, sales and excise tax for gasoline, gasoline blends (gasoline/ethanol or

gasoline/methanol or gasoline/other product), aviation gasoline, racing gasoline and jet fuel on this tax return.

•

Report receipts of unblended ethanol and methanol on the gasoline distributor tax return in the month the ethanol

or methanol is blended with gasoline.

•

Blank forms, schedules, instructions, fuel tax rates, a list of licensed gasoline distributors and other tax

information are available from Maine Revenue at

•

Maine requires reporting in “gross” gallons on a calendar month basis. All motor fuel excise tax schedules are to be

sent electronically to fuel.tax@maine.gov.

•

Records are required to be retained for a period of at least six years.

RECEIPTS

Line 1 – Beginning Inventory. Total gallons in bulk storage at the beginning of the reporting period. (Do not include

gallons in a retail tank). If there are multiple products, combine all inventories. Inventories cannot be negative.

Line 2 – Gallons Received – Tax Paid. Gallons received from any source on which Maine excise tax has been paid.

Send a Schedule 1 electronically for each fuel type. A credit for excise tax paid is taken on line 26.

Line 3 – Gallons Received – Tax Unpaid. Gallons received tax exempt from sources within Maine. Send a

Schedule 2 electronically for each fuel type.

Line 4 – Gallons Imported – Direct to Customer. Gallons imported to Maine, tax exempt, which were delivered

directly to a customer in Maine. Send a Schedule 3 electronically for each fuel type.

Line 5 – Gallons Imported – Bulk Storage. Gallons received from outside Maine, tax exempt, that were delivered into

your bulk storage. Send a Schedule 4 electronically for each fuel type.

Line 6 – Total Receipts. Total lines 2 through 5.

Line 7 – Available Gallons. Line 1 (Beginning Inventory) plus Line 6 (Total Receipts).

Line 8 – Ending Inventory. Gallons in inventory at the end of the month. If there are multiple products, combine all

inventories. Inventories cannot be negative.

Line 9 – Accountable Gallons. Line 7 (Available Gallons) minus Line 8 (Ending Inventory).

SALES

Line 10 – Total Gallons Sold. Total gallons sold and used during the reporting period. (Note - gallons delivered into a

retail tank are considered sold at the time the gallons are delivered into the retail tank). Total Gallons Sold may vary from

Accountable Gallons. Do not include adjustments for gains or losses on this return. Any gains or losses will be reported

on the annual Shrinkage Return.

Line 11 – Exports. Gallons sold and exported by your company to a destination outside of Maine. Send a Schedule 7

electronically for each fuel type. Exports should be sold Maine excise tax exempt. If the sale is to another licensed

distributor with title passing in Maine and the customer exports the product outside Maine, report the gallons on Schedule 6.

Line 12 – Sales to Licensed Distributors. Gallons sold in bulk, excise tax exempt to other licensed distributors. Send

a Schedule 6 electronically for each fuel type.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3