Form St Wc Nr - Nonresident Watercraft And/or Outboard Motor Sales Tax Return

ADVERTISEMENT

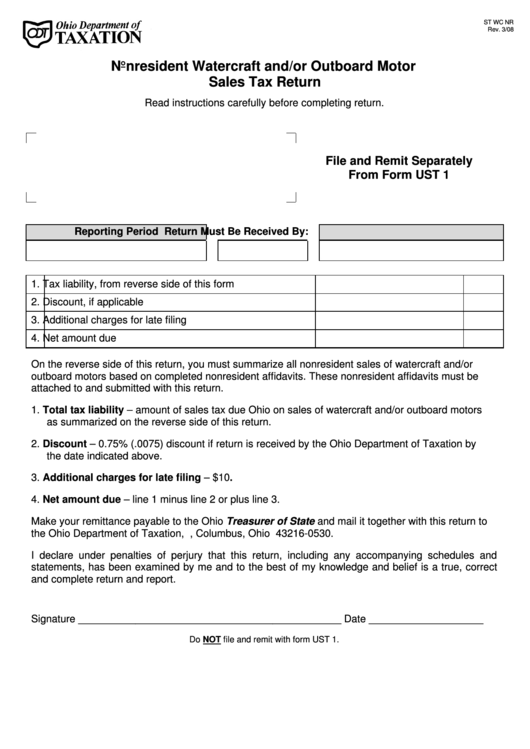

ST WC NR

Rev. 3/08

Nonresident Watercraft and/or Outboard Motor

Sales Tax Return

Read instructions carefully before completing return.

File and Remit Separately

From Form UST 1

Reporting Period

Return Must Be Received By:

1. Tax liability, from reverse side of this form

2. Discount, if applicable

3. Additional charges for late filing

4. Net amount due

On the reverse side of this return, you must summarize all nonresident sales of watercraft and/or

outboard motors based on completed nonresident affidavits. These nonresident affidavits must be

attached to and submitted with this return.

1. Total tax liability – amount of sales tax due Ohio on sales of watercraft and/or outboard motors

as summarized on the reverse side of this return.

2. Discount – 0.75% (.0075) discount if return is received by the Ohio Department of Taxation by

the date indicated above.

3. Additional charges for late filing – $10.

4. Net amount due – line 1 minus line 2 or plus line 3.

Make your remittance payable to the Ohio Treasurer of State and mail it together with this return to

the Ohio Department of Taxation, P.O. Box 530, Columbus, Ohio 43216-0530.

I declare under penalties of perjury that this return, including any accompanying schedules and

statements, has been examined by me and to the best of my knowledge and belief is a true, correct

and complete return and report.

Signature ______________________________________________ Date ____________________

Do NOT file and remit with form UST 1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2