Form 103 - Era - Schedule Of Deduction From Assessed Valuation Personal Property In Economic Revitalization Area - Department Of Local Government Finance Of Indiana Page 2

ADVERTISEMENT

Assessing Official

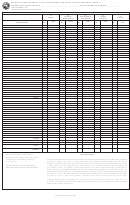

SECTION 3 Cont’d.

ABATED EQUIPMENT POOLING SCHEDULE

Use Only

103 Schedule A

True Tax Value

Abatement

POOL NUMBER 3:

* TTV %

Deduction

Column C

[per 103 or per IC 6-

Deduction Claimed

)

(9 TO 12 YEAR LIFE

(circle one)

Approved

Adjusted Cost

1.1-12.1-4.5 (f)] **

Year

Percent

$

28

from

to

3-1-06 *** $

40% 30% $

1

% $

29

3-2-05

to

3-1-06

40% 30%

1

30

3-2-04

to

3-1-05

60% 30%

2

31

3-2-03

to

3-1-04

55% 30%

3

32

3-2-02

to

3-1-03

45% 30%

4

33

3-2-01

to

3-1-02

37% 30%

5

34

3-2-00

to

3-1-01

**40% 30%

6

35

3-2-99

to

3-1-00

**40% 30%

7

36

3-2-98

to

3-1-99

**40% 30%

8

37

3-2-97

to

3-1-98

**40% 30%

9

38

3-2-96

to

3-1-97

**40% 30%

10

$

40

TOTAL POOL NUMBER 3

--

$

--

--

103 Schedule A

True Tax Value

Abatement

POOL NUMBER 4: (13 YEAR AND

* TTV %

Deduction

Column C

[per 103 or per IC 6-

Deduction Claimed

LONGER LIVES)

(circle one)

Approved

Year

Percent

Adjusted Cost

1.1-12.1-4.5 (f)] **

$

41

from

to

3-1-06 *** $

40% 30% $

1

% $

42

3-2-05

to

3-1-06

40% 30%

1

43

3-2-04

to

3-1-05

60% 30%

2

44

3-2-03

to

3-1-04

63% 30%

3

45

3-2-02

to

3-1-03

54% 30%

4

46

3-2-01

to

3-1-02

46% 30%

5

47

3-2-00

to

3-1-01

**40% 30%

6

48

3-2-99

to

3-1-00

**40% 30%

7

49

3-2-98

to

3-1-99

**40% 30%

8

50

3-2-97

to

3-1-98

**40% 30%

9

51

3-2-96

to

3-1-97

**40% 30%

10

$

55

TOTAL POOL NUMBER 4

--

$

--

--

$

SUB-TOTAL- POOLS 3 and 4 (Total lines 40 and 55. Enter at right and below)

$

Assessing

SPECIAL TOOLING

Official Use Only

True Tax Value

Abatement

Round all figures to the nearest $1. Report only the cost

Deduction

[included on Form 103-T or

Deduction Claimed

of abated special tools, dies, jigs, etc. (50 IAC 4.2-6-2)

Approved

Year

Percent

per IC 6-1.1-12.1-4.5 (f)] **

$

S1

Value of acquisitions

to 3-1-06 ***

30%

1

% $

S2

Value of acquisitions 3-2-05 to 3-1-06

30%

1

S3

Value of acquisitions 3-2-04 to 3-1-05

3%

2

S4

Value of acquisitions 3-2-03 to 3-1-04

3%

3

S5

Value of acquisitions 3-2-02 to 3-1-03

3%

4

S6

Value of acquisitions 3-2-01 to 3-1-02

3%

5

S7

Value of acquisitions 3-2-00 to 3-1-01

**30%

6

S8

Value of acquisitions 3-2-99 to 3-1-00

**30%

7

S9

Value of acquisitions 3-2-98 to 3-1-99

**30%

8

S10

Value of acquisitions 3-2-97 to 3-1-98

**30%

9

S11

Value of acquisitions 3-2-96 to 3-1-97

**30%

10

$

S12

TOTAL SPECIAL TOOLS

-

--

--

$

$

SUB-TOTAL POOLS 1 and 2 (from Page 1)

$

SUB-TOTAL POOLS 3 and 4 (from above)

SUB-TOTAL SPECIAL TOOLING (from above - line S12)

$

TOTAL ALL POOLS AND SPECIAL TOOLING

$

Cost

AV

LIMIT ON AMOUNT OF ABATEMENT STATED IN RESOLUTION

$

OR

$

AMOUNT OF DEDUCTION CLAIMED -- Lesser of Resolution Limit on Abatement or Total All Pools.

$

$

(Carry deduction forward to the Summary Section on page 1 of the Form 103.)

NOTE: If obsolescence claimed on depreciable assets, the applicable adjustment must be

Obsolescence claimed on Form 106?

NO

YES

taken on the Abatement Deduction being claimed. Show calculations on the Form 106.

Line numbers reference pooling schedule line numbers on the Form 103 – Additions (alphas) and deleted numbers accommodate the ten (10) year abatement limitation.

*

**If taxpayer elects to report cost on a federal tax year basis, assets acquired from the end of the prior federal tax year to March 1 are reported on the first line.

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2