Enclosure Sequence No. 1040-07

1998

DLN

FORM

MISSOURI DEPARTMENT OF REVENUE

MO-PTC

PROPERTY TAX CREDIT CLAIM

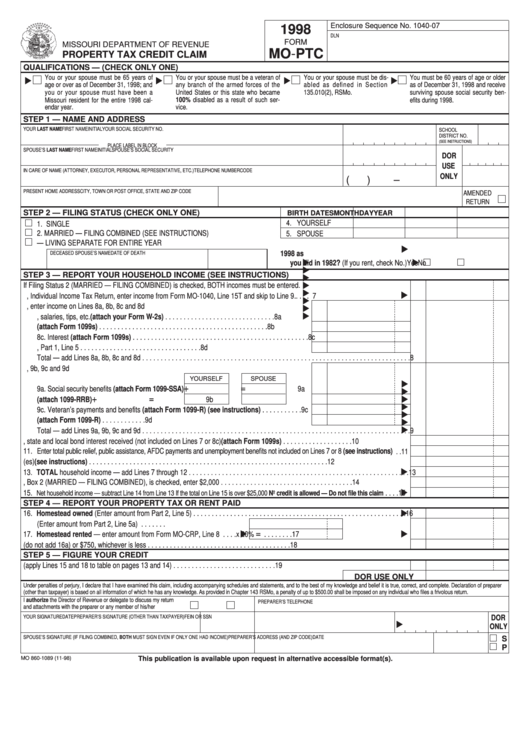

QUALIFICATIONS — (CHECK ONLY ONE)

You or your spouse must be 65 years of

You or your spouse must be a veteran of

You or your spouse must be dis-

You must be 60 years of age or older

age or over as of December 31, 1998; and

any branch of the armed forces of the

abled as defined in Section

as of December 31, 1998 and receive

you or your spouse must have been a

United States or this state who became

135.010(2), RSMo.

surviving spouse social security ben-

Missouri resident for the entire 1998 cal-

100% disabled as a result of such ser-

efits during 1998.

endar year.

vice.

STEP 1 — NAME AND ADDRESS

YOUR LAST NAME

FIRST NAME

INITIAL YOUR SOCIAL SECURITY NO.

SCHOOL

DISTRICT NO.

(SEE INSTRUCTIONS)

PLACE LABEL IN BLOCK

SPOUSE’S LAST NAME

FIRST NAME

INITIAL SPOUSE’S SOCIAL SECURITY NO.

PM

DOR

USE

IN CARE OF NAME (ATTORNEY, EXECUTOR, PERSONAL REPRESENTATIVE, ETC.)

TELEPHONE NUMBER

CODE

ONLY

(

)

–

PRESENT HOME ADDRESS

CITY, TOWN OR POST OFFICE, STATE AND ZIP CODE

AMENDED

RETURN

STEP 2 — FILING STATUS (CHECK ONLY ONE)

BIRTH DATES

MONTH

DAY

YEAR

4. YOURSELF

1. SINGLE

2. MARRIED — FILING COMBINED (SEE INSTRUCTIONS)

5. SPOUSE

3. MARRIED — LIVING SEPARATE FOR ENTIRE YEAR

6. Did you occupy and pay real estate tax on the same homestead in 1998 as

DECEASED SPOUSE’S NAME

DATE OF DEATH

you did in 1982? (If you rent, check No.)

Yes

No

STEP 3 — REPORT YOUR HOUSEHOLD INCOME (SEE INSTRUCTIONS)

If Filing Status 2 (MARRIED — FILING COMBINED) is checked, BOTH incomes must be entered.

7. If you file a Form MO-1040, Individual Income Tax Return, enter income from Form MO-1040, Line 15T and skip to Line 9 . . . . .

7

8. If you do not file a Form MO-1040, enter income on Lines 8a, 8b, 8c and 8d

8a. Wages, salaries, tips, etc. (attach your Form W-2s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8a

8b. Dividends (attach Form 1099s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8b

8c. Interest (attach Form 1099s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8c

8d. Other income or loss from Page 2, Part 1, Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8d

Total — add Lines 8a, 8b, 8c and 8d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9. Enter total amounts before any deductions on Lines 9a, 9b, 9c and 9d

YOURSELF

SPOUSE

+

=

9a. Social security benefits (attach Form 1099-SSA)

9a

+

=

9b. Railroad retirement benefits (attach 1099-RRB)

9b

9c. Veteran’s payments and benefits (attach Form 1099-R) (see instructions) . . . . . . . . . . .

9c

9d. Pensions and annuities not included on Lines 7 or 8 (attach Form 1099-R) . . . . . . . . . . . .

9d

Total — add Lines 9a, 9b, 9c and 9d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10. Enter federal, state and local bond interest received (not included on Lines 7 or 8c) (attach Form 1099s) . . . . . . . . . . . . . . . . . . .

10

11. Enter total public relief, public assistance, AFDC payments and unemployment benefits not included on Lines 7 or 8 (see instructions) . .

11

12. Enter nonbusiness loss(es) (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13. TOTAL household income — add Lines 7 through 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14. If Filing Status, Box 2 (MARRIED — FILING COMBINED), is checked, enter $2,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15.

. . . .

15

Net household income — subtract Line 14 from Line 13 If the total on Line 15 is over $25,000 No credit is allowed — Do not file this claim

STEP 4 — REPORT YOUR PROPERTY TAX OR RENT PAID

16. Homestead owned (Enter amount from Part 2, Line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

16a. Homestead school tax (Enter amount from Part 2, Line 5a) . . . . . . .

=

17. Homestead rented — enter amount from Form MO-CRP, Line 8 . . . .

x 20%

. . . . . . . .

17

18. Total amount from Lines 16 and 17 (do not add 16a) or $750, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

STEP 5 — FIGURE YOUR CREDIT

19. PROPERTY TAX CREDIT OR REFUND (apply Lines 15 and 18 to table on pages 13 and 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

DOR USE ONLY

Under penalties of perjury, I declare that I have examined this claim, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct, and complete. Declaration of preparer

(other than taxpayer) is based on all information of which he has any knowledge. As provided in Chapter 143 RSMo, a penalty of up to $500.00 shall be imposed on any individual who files a frivolous return.

I authorize the Director of Revenue or delegate to discuss my return

PREPARER’S TELEPHONE

and attachments with the preparer or any member of his/her firm.

YES

NO

YOUR SIGNATURE

DATE

PREPARER’S SIGNATURE (OTHER THAN TAXPAYER)

FEIN OR SSN

DOR

ONLY

SPOUSE’S SIGNATURE (IF FILING COMBINED, BOTH MUST SIGN EVEN IF ONLY ONE HAD INCOME)

PREPARER’S ADDRESS (AND ZIP CODE)

DATE

S

P

MO 860-1089 (11-98)

This publication is available upon request in alternative accessible format(s).

1

1 2

2