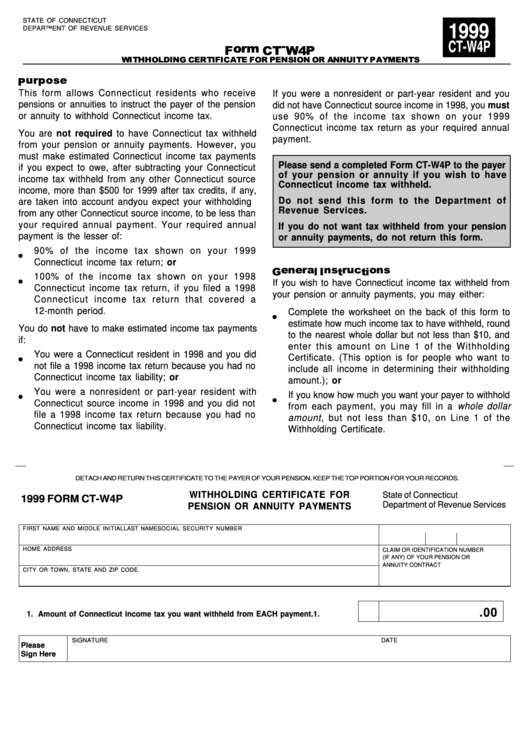

STATE OF CONNECTICUT

1999

DEPARTMENT OF REVENUE SERVICES

CT-W4P

This form allows Connecticut residents who receive

If you were a nonresident or part-year resident and you

pensions or annuities to instruct the payer of the pension

did not have Connecticut source income in 1998, you must

or annuity to withhold Connecticut income tax.

use 90% of the income tax shown on your 1999

Connecticut income tax return as your required annual

You are not required to have Connecticut tax withheld

payment.

from your pension or annuity payments. However, you

must make estimated Connecticut income tax payments

Please send a completed Form CT-W4P to the payer

if you expect to owe, after subtracting your Connecticut

of your pension or annuity if you wish to have

income tax withheld from any other Connecticut source

Connecticut income tax withheld.

income, more than $500 for 1999 after tax credits, if any,

Do not send this form to the Department of

are taken into account and you expect your withholding

Revenue Services.

from any other Connecticut source income, to be less than

your required annual payment. Your required annual

If you do not want tax withheld from your pension

payment is the lesser of:

or annuity payments, do not return this form.

90% of the income tax shown on your 1999

Connecticut income tax return; or

100% of the income tax shown on your 1998

If you wish to have Connecticut income tax withheld from

Connecticut income tax return, if you filed a 1998

your pension or annuity payments, you may either:

Connecticut income tax return that covered a

12-month period.

Complete the worksheet on the back of this form to

estimate how much income tax to have withheld, round

You do not have to make estimated income tax payments

to the nearest whole dollar but not less than $10, and

if:

enter this amount on Line 1 of the Withholding

You were a Connecticut resident in 1998 and you did

Certificate. (This option is for people who want to

not file a 1998 income tax return because you had no

include all income in determining their withholding

Connecticut income tax liability; or

amount.); or

You were a nonresident or part-year resident with

If you know how much you want your payer to withhold

Connecticut source income in 1998 and you did not

from each payment, you may fill in a whole dollar

file a 1998 income tax return because you had no

amount , but not less than $10, on Line 1 of the

Connecticut income tax liability.

Withholding Certificate.

.......................................................................................................................

DETACH AND RETURN THIS CERTIFICATE TO THE PAYER OF YOUR PENSION. KEEP THE TOP PORTION FOR YOUR RECORDS.

WITHHOLDING CERTIFICATE FOR

State of Connecticut

1999 FORM CT-W4P

Department of Revenue Services

PENSION OR ANNUITY PAYMENTS

FIRST NAME AND MIDDLE INITIAL

LAST NAME

SOCIAL SECURITY NUMBER

HOME ADDRESS

CLAIM OR IDENTIFICATION NUMBER

(IF ANY) OF YOUR PENSION OR

ANNUITY CONTRACT

CITY OR TOWN, STATE AND ZIP CODE

.00

1. Amount of Connecticut income tax you want withheld from EACH payment.

1.

SIGNATURE

DATE

Please

Sign Here

1

1 2

2