Form Ct-W4p-2001 - Withholding Certificate For Pension Or Annuity Payments

ADVERTISEMENT

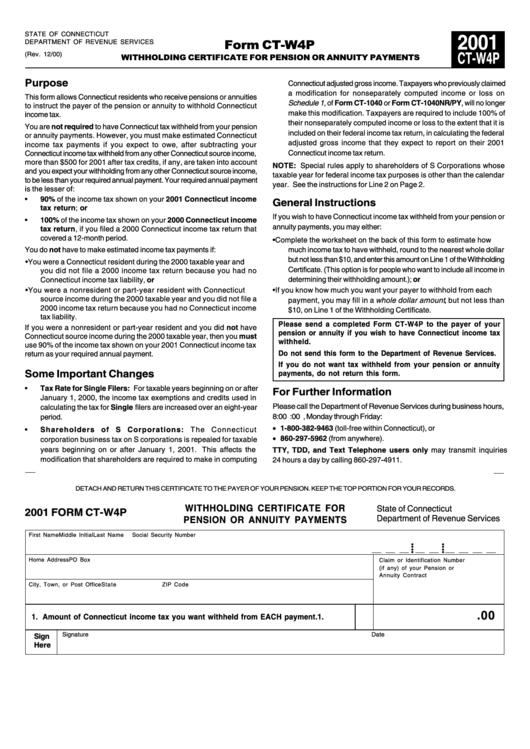

STATE OF CONNECTICUT

2001

Form CT-W4P

DEPARTMENT OF REVENUE SERVICES

WITHHOLDING CERTIFICATE FOR PENSION OR ANNUITY PAYMENTS

(Rev. 12/00)

CT-W4P

Purpose

Connecticut adjusted gross income. Taxpayers who previously claimed

a modification for nonseparately computed income or loss on

This form allows Connecticut residents who receive pensions or annuities

Schedule 1, of Form CT-1040 or Form CT-1040NR/PY, will no longer

to instruct the payer of the pension or annuity to withhold Connecticut

make this modification. Taxpayers are required to include 100% of

income tax.

their nonseparately computed income or loss to the extent that it is

You are not required to have Connecticut tax withheld from your pension

included on their federal income tax return, in calculating the federal

or annuity payments. However, you must make estimated Connecticut

adjusted gross income that they expect to report on their 2001

income tax payments if you expect to owe, after subtracting your

Connecticut income tax return.

Connecticut income tax withheld from any other Connecticut source income,

more than $500 for 2001 after tax credits, if any, are taken into account

NOTE: Special rules apply to shareholders of S Corporations whose

and you expect your withholding from any other Connecticut source income,

taxable year for federal income tax purposes is other than the calendar

to be less than your required annual payment. Your required annual payment

year. See the instructions for Line 2 on Page 2.

is the lesser of:

•

90% of the income tax shown on your 2001 Connecticut income

General Instructions

tax return; or

If you wish to have Connecticut income tax withheld from your pension or

•

100% of the income tax shown on your 2000 Connecticut income

annuity payments, you may either:

tax return, if you filed a 2000 Connecticut income tax return that

covered a 12-month period.

•

Complete the worksheet on the back of this form to estimate how

You do not have to make estimated income tax payments if:

much income tax to have withheld, round to the nearest whole dollar

but not less than $10, and enter this amount on Line 1 of the Withholding

•

You were a Connecticut resident during the 2000 taxable year and

Certificate. (This option is for people who want to include all income in

you did not file a 2000 income tax return because you had no

Connecticut income tax liability, or

determining their withholding amount.); or

•

If you know how much you want your payer to withhold from each

•

You were a nonresident or part-year resident with Connecticut

source income during the 2000 taxable year and you did not file a

payment, you may fill in a whole dollar amount , but not less than

2000 income tax return because you had no Connecticut income

$10, on Line 1 of the Withholding Certificate.

tax liability.

Please send a completed Form CT-W4P to the payer of your

If you were a nonresident or part-year resident and you did not have

pension or annuity if you wish to have Connecticut income tax

Connecticut source income during the 2000 taxable year, then you must

withheld.

use 90% of the income tax shown on your 2001 Connecticut income tax

Do not send this form to the Department of Revenue Services.

return as your required annual payment.

If you do not want tax withheld from your pension or annuity

Some Important Changes

payments, do not return this form.

•

Tax Rate for Single Filers: For taxable years beginning on or after

For Further Information

January 1, 2000, the income tax exemptions and credits used in

Please call the Department of Revenue Services during business hours,

calculating the tax for Single filers are increased over an eight-year

8:00 a.m. to 5:00 p.m., Monday through Friday:

period.

• 1-800-382-9463 (toll-free within Connecticut), or

•

Shareholders of S Corporations: The Connecticut

• 860-297-5962 (from anywhere).

corporation business tax on S corporations is repealed for taxable

years beginning on or after January 1, 2001. This affects the

TTY, TDD, and Text Telephone users only may transmit inquiries

modification that shareholders are required to make in computing

24 hours a day by calling 860-297-4911.

.......................................................................................................................

DETACH AND RETURN THIS CERTIFICATE TO THE PAYER OF YOUR PENSION. KEEP THE TOP PORTION FOR YOUR RECORDS.

WITHHOLDING CERTIFICATE FOR

State of Connecticut

2001 FORM CT-W4P

Department of Revenue Services

PENSION OR ANNUITY PAYMENTS

First Name

Middle Initial

Last Name

Social Security Number

• •

• •

___ ___ ___ ___ ___ ___ ___ ___ ___

• •

• •

Home Address

PO Box

Claim or Identification Number

(if any) of your Pension or

Annuity Contract

City, Town, or Post Office

State

ZIP Code

.00

1. Amount of Connecticut income tax you want withheld from EACH payment.

1.

Signature

Date

Sign

Here

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1