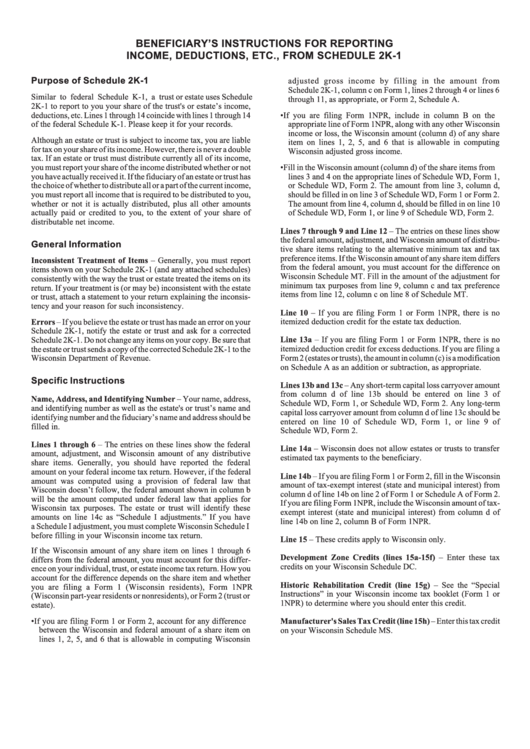

Beneficiary'S Instructions For Reporting Income, Deductions, Etc., From Schedule 2k-1

ADVERTISEMENT

BENEFICIARY’S INSTRUCTIONS FOR REPORTING

INCOME, DEDUCTIONS, ETC., FROM SCHEDULE 2K-1

Purpose of Schedule 2K-1

adjusted gross income by filling in the amount from

Schedule 2K-1, column c on Form 1, lines 2 through 4 or lines 6

Similar to federal Schedule K-1, a trust or estate uses Schedule

through 11, as appropriate, or Form 2, Schedule A.

2K-1 to report to you your share of the trust's or estate’s income,

deductions, etc. Lines 1 through 14 coincide with lines 1 through 14

• If you are filing Form 1NPR, include in column B on the

of the federal Schedule K-1. Please keep it for your records.

appropriate line of Form 1NPR, along with any other Wisconsin

income or loss, the Wisconsin amount (column d) of any share

Although an estate or trust is subject to income tax, you are liable

item on lines 1, 2, 5, and 6 that is allowable in computing

for tax on your share of its income. However, there is never a double

Wisconsin adjusted gross income.

tax. If an estate or trust must distribute currently all of its income,

you must report your share of the income distributed whether or not

• Fill in the Wisconsin amount (column d) of the share items from

you have actually received it. If the fiduciary of an estate or trust has

lines 3 and 4 on the appropriate lines of Schedule WD, Form 1,

the choice of whether to distribute all or a part of the current income,

or Schedule WD, Form 2. The amount from line 3, column d,

you must report all income that is required to be distributed to you,

should be filled in on line 3 of Schedule WD, Form 1 or Form 2.

whether or not it is actually distributed, plus all other amounts

The amount from line 4, column d, should be filled in on line 10

actually paid or credited to you, to the extent of your share of

of Schedule WD, Form 1, or line 9 of Schedule WD, Form 2.

distributable net income.

Lines 7 through 9 and Line 12 – The entries on these lines show

the federal amount, adjustment, and Wisconsin amount of distribu-

General Information

tive share items relating to the alternative minimum tax and tax

preference items. If the Wisconsin amount of any share item differs

Inconsistent Treatment of Items – Generally, you must report

from the federal amount, you must account for the difference on

items shown on your Schedule 2K-1 (and any attached schedules)

Wisconsin Schedule MT. Fill in the amount of the adjustment for

consistently with the way the trust or estate treated the items on its

minimum tax purposes from line 9, column c and tax preference

return. If your treatment is (or may be) inconsistent with the estate

items from line 12, column c on line 8 of Schedule MT.

or trust, attach a statement to your return explaining the inconsis-

tency and your reason for such inconsistency.

Line 10 – If you are filing Form 1 or Form 1NPR, there is no

itemized deduction credit for the estate tax deduction.

Errors – If you believe the estate or trust has made an error on your

Schedule 2K-1, notify the estate or trust and ask for a corrected

Line 13a – If you are filing Form 1 or Form 1NPR, there is no

Schedule 2K-1. Do not change any items on your copy. Be sure that

the estate or trust sends a copy of the corrected Schedule 2K-1 to the

itemized deduction credit for excess deductions. If you are filing a

Wisconsin Department of Revenue.

Form 2 (estates or trusts), the amount in column (c) is a modification

on Schedule A as an addition or subtraction, as appropriate.

Specific Instructions

Lines 13b and 13c – Any short-term capital loss carryover amount

from column d of line 13b should be entered on line 3 of

Name, Address, and Identifying Number – Your name, address,

Schedule WD, Form 1, or Schedule WD, Form 2. Any long-term

and identifying number as well as the estate's or trust’s name and

capital loss carryover amount from column d of line 13c should be

identifying number and the fiduciary’s name and address should be

entered on line 10 of Schedule WD, Form 1, or line 9 of

filled in.

Schedule WD, Form 2.

Lines 1 through 6 – The entries on these lines show the federal

Line 14a – Wisconsin does not allow estates or trusts to transfer

amount, adjustment, and Wisconsin amount of any distributive

estimated tax payments to the beneficiary.

share items. Generally, you should have reported the federal

amount on your federal income tax return. However, if the federal

Line 14b – If you are filing Form 1 or Form 2, fill in the Wisconsin

amount was computed using a provision of federal law that

amount of tax-exempt interest (state and municipal interest) from

Wisconsin doesn’t follow, the federal amount shown in column b

column d of line 14b on line 2 of Form 1 or Schedule A of Form 2.

will be the amount computed under federal law that applies for

If you are filing Form 1NPR, include the Wisconsin amount of tax-

Wisconsin tax purposes. The estate or trust will identify these

exempt interest (state and municipal interest) from column d of

amounts on line 14c as “Schedule I adjustments.” If you have

line 14b on line 2, column B of Form 1NPR.

a Schedule I adjustment, you must complete Wisconsin Schedule I

before filling in your Wisconsin income tax return.

Line 15 – These credits apply to Wisconsin only.

If the Wisconsin amount of any share item on lines 1 through 6

Development Zone Credits (lines 15a-15f) – Enter these tax

differs from the federal amount, you must account for this differ-

credits on your Wisconsin Schedule DC.

ence on your individual, trust, or estate income tax return. How you

account for the difference depends on the share item and whether

Historic Rehabilitation Credit (line 15g) – See the “Special

you are filing a Form 1 (Wisconsin residents), Form 1NPR

Instructions” in your Wisconsin income tax booklet (Form 1 or

(Wisconsin part-year residents or nonresidents), or Form 2 (trust or

1NPR) to determine where you should enter this credit.

estate).

• If you are filing Form 1 or Form 2, account for any difference

Manufacturer's Sales Tax Credit (line 15h) – Enter this tax credit

between the Wisconsin and federal amount of a share item on

on your Wisconsin Schedule MS.

lines 1, 2, 5, and 6 that is allowable in computing Wisconsin

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1