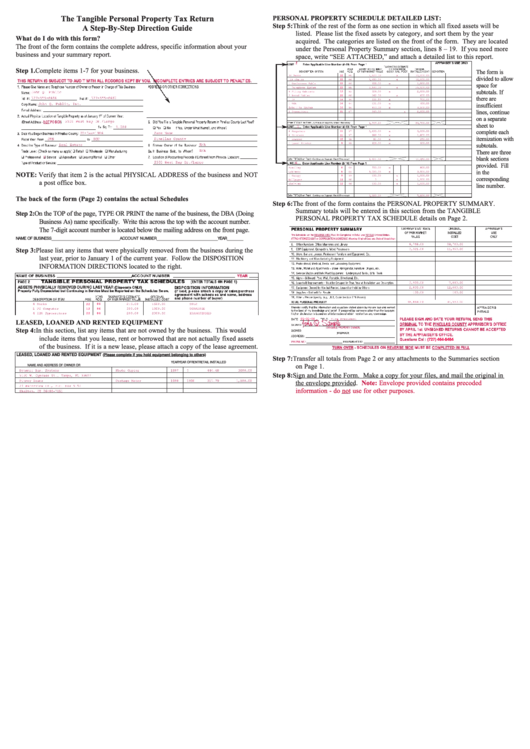

The Tangible Personal Property Tax Return A Step-By-Step Direction Guide Form

ADVERTISEMENT

PERSONAL PROPERTY SCHEDULE DETAILED LIST:

The Tangible Personal Property Tax Return

Step 5: Think of the rest of the form as one section in which all fixed assets will be

A Step-By-Step Direction Guide

listed. Please list the fixed assets by category, and sort them by the year

What do I do with this form?

acquired. The categories are listed on the front of the form. They are located

The front of the form contains the complete address, specific information about your

under the Personal Property Summary section, lines 8 – 19. If you need more

business and your summary report.

space, write “SEE ATTACHED,” and attach a detailed list to this report.

Step 1. Complete items 1-7 for your business.

The form is

22

divided to allow

22

22

space for

22

13

subtotals. If

22

there are

14

14

insufficient

14

21

lines, continue

on a separate

sheet to

11

complete each

11

itemization with

10

9

subtotals.

There are three

blank sections

provided. Fill

8

8

in the

NOTE: Verify that item 2 is the actual PHYSICAL ADDRESS of the business and NOT

9

corresponding

12

a post office box.

12

line number.

The back of the form (Page 2) contains the actual Schedules

Step 6: The front of the form contains the PERSONAL PROPERTY SUMMARY.

Summary totals will be entered in this section from the TANGIBLE

Step 2: On the TOP of the page, TYPE OR PRINT the name of the business, the DBA (Doing

PERSONAL PROPERTY TAX SCHEDULE details on Page 2.

Business As) name specifically. Write this across the top with the account number.

The 7-digit account number is located below the mailing address on the front page.

NAME OF BUSINESS_____________________________________ACCOUNT NUMBER_________________________________YEAR________

Step 3: Please list any items that were physically removed from the business during the

last year, prior to January 1 of the current year. Follow the DISPOSITION

INFORMATION DIRECTIONS located to the right.

22

86

12

96

22

86

01-31-08

LEASED, LOANED AND RENTED EQUIPMENT

Step 4: In this section, list any items that are not owned by the business. This would

include items that you lease, rent or borrowed that are not actually fixed assets

(727) 464-8484

of the business. If it is a new lease, please attach a copy of the lease agreement.

LEASED, LOANED AND RENTED EQUIPMENT

(Please complete if you hold equipment belonging to others)

Step 7: Transfer all totals from Page 2 or any attachments to the Summaries section

YEAR

YEAR OF

RENT

RETAIL INSTALLED

NAME AND ADDRESS OF OWNER OR LESSOR

DESCRIPTION

ACQUIRED

MFG.

PER MONTH

COST NEW

on Page 1.

Step 8: Sign and Date the Form. Make a copy for your files, and mail the original in

the envelope provided.

Note: Envelope provided contains precoded

information - do not use for other purposes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2