The Tangible Personal Property Tax Return A Step-By-Step Direction Guide Form Page 2

ADVERTISEMENT

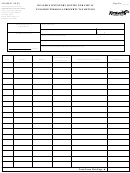

TANGIBLE PERSONAL PROPERTY TAX RETURN

Line 16 - Leasehold Improvements:

GENERAL INSTRUCTIONS

If improvements have been made (including modifications and additions) to property which

you lease, list the original installed cost, and description of these improvements.

Complete this Personal Property Tax Return in accordance with these instructions, as your

Improvements must be grouped by type and year of installation. Leasehold improvements

declaration of personal property situated in Pinellas County. If any schedule has insufficient

include Paneling, Shelving, Cabinets, etc.

space, attach a separate sheet. Please print or type except for signature.

IMPORTANT: ATTACH ITEMIZED LIST OR DEPRECIATION SCHEDULE SHOWING

WHAT TO REPORT ON THIS RETURN:

INVENTORY OF INDIVIDUAL IMPROVEMENTS AS LISTED IN SUBSIDIARY LEDGER.

1. Tangible Personal Property - include all goods, and other articles of value as defined in

Line 17: Equipment Owned by You but Rented, Leased or Held by Others:

Florida Statute 192.001 - to include all fixed assets of a business.

If you own equipment that is out on a loan, rental or lease basis to others, report it on the

2. Items of inventory held for lease to customers in the ordinary course of business, rather

appropriate schedule and enter the totals on line 17.

than for sale, shall be deemed inventory only prior to the initial lease of such items and

MUST be reported after their initial lease or rental as equipment and/or fixtures.

Line 18: Supplies:

3. ALL FULLY DEPRECIATED ITEMS MUST BE REPORTED AT ORIGINAL

Enter the monthly average cost of supplies including expensed supplies such as stationary and

INSTALLED COST WHETHER WRITTEN OFF OR NOT.

janitorial supplies, linens, silverware, etc. that may not have been recorded separately on your

books. Include items that you carry in an inventory account but DO NOT come within the

DO NOT INCLUDE ON THIS RETURN:

definition of “inventory” subject to exemption.

1. Intangible Personal Property - that is, money, all evidences of debt owed to the taxpayer,

Line 19: I.R.S. Code Section 179 Assets:

all evidence of ownership in a corporation, etc.

A taxpayer may elect to treat the cost of any section 179 property as an expense which is not

2. Automobiles, Trucks, and other Licensed Vehicles - These are not taxable as personal

chargeable to capital account, however,

ALL 179 property must be reported.

property (EXCEPTION: Certain vehicles, and the equipment on them, are taxable as

personal property and must be reported. Example - truck cranes, air compressors, and other

INFORMATION REGARDING THE TAX LAWS OF FLORIDA:

equipment designed as a tool - class 94 vehicle, rather than primarily as a hauling vehicle.)

§192.042, Florida Statutes - DATE OF ASSESSMENT - Tangible Personal Property as

3. Real Property

of January 1.

4. Inventory- Those assets consisting of items commonly referred to as goods, wares and

§193.062, Florida Statutes - DATES FOR FILING RETURNS - Tangible Personal

merchandise that are held for sale or lease to customers in the ordinary course of business.

Property on April 1.

COST BASIS OF PERSONAL PROPERTY:

§193.072, Florida Statutes - PENALTIES - For failure to file a return, 25% of the total tax

levied against the property for each year that no return is filed; for filing after

All property located in Pinellas County as of January 1 st must be reported at 100% of the

the due date, 5% of the total tax levied against the property covered by the

original installed cost including transportation, handling installation charges, and sales tax.

return for each year, for each month, or portion thereof, that a return is filed

Report the total acquisition costs of new installed assets.

after the due date, but not to exceed 25% of the total tax; for unlisted property,

15% of the tax attributed to the omitted property.

Add back investment credits, taken for federal income tax purposes if those were deducted

from the ORIGINAL cost.

INCLUDE ALL FULLY DEPRECIATED ITEMS AT

§196.011, Florida Statutes - ANNUAL APPLICATION REQUIRED FOR EXEMPTION

ORIGINAL INSTALLED COST, WHETHER WRITTEN OFF OR NOT.

Every person or organization who, on January 1, has the legal title to real or

The figure entered as “original installed cost” must include the total cost of equipment, before

personal property, except inventory, which is entitled by law to exemption from

any allowances for depreciation. Include freight-in handling, installation costs, and sales tax.

taxation as a result of its ownership and use shall, on or before March 1 of each

If a trade-in was deducted from the invoice price, enter the original invoice price.

year, file an application for exemption with the county property appraiser,

listing and describing the property for which exemption is claimed and

ADJUSTMENTS TO VALUES - TAXPAYER’S ESTIMATE OF

certifying its ownership and use.

FAIR MARKET VALUE:

§196.021, Florida Statutes -TAX RETURNS TO SHOW ALL EXEMPTIONS AND

Enter only UNADJUSTED figures in areas requesting ORIGINAL Installed Cost. However,

CLAIMS - It is the duty of the taxpayer to set forth any legal exemption from

Florida law provides that the taxpayer shall also provide an estimate of the current fair market

taxation to which he may be entitled. The failure to do so shall result in any

value of the property. An adjustment is a variation from purchase price paid. Adjusted

such exemption being disallowed for that tax year.

figures MUST be explained on an attached supplemental schedule. Such schedules are

considered part of the return.

§837.06,

Florida Statutes - FALSE OFFICIAL STATEMENTS - Whoever knowingly

makes a false statement in writing with the intent to mislead a public servant in

LOCATION OF PERSONAL PROPERTY:

the performance of his official duty shall be guilty of a misdemeanor in the

second degree, punishable as provided in §775.082, §775.083, or §775.084.

A separate personal property return must be filed for each individual location owned by a

business, listing all locations. Additional forms will be mailed on request: Contact the

Pinellas County Property Appraiser’s office at (727) 582-3160.

EXCEPTIONS:

Owners of vending machines, LP/Propane tanks and similar property at many locations may

submit a single schedule in lieu of individual property statements.

For additional forms, please visit our website at

SPECIFIC INSTRUCTIONS For Page 2

(line by line)

If you have any questions, give us a call at

In the appropriate schedule sections provided on page 2, list the original installed cost for

assets of your business. Assets in each schedule must be grouped by year of acquisition.

(727) 464-8484.

List each item of tangible personal property separately in the appropriate schedule except for

A current economic schedule and instruction forms

“classes” of personal property. A class is defined as items which are SUBSTANTIALLY

similar in function, use, and age.

Do not use the terms “VARIOUS,” or “SAME AS LAST

are available at the above website.

YEAR.” This is inadequate reporting subjecting you to penalties for FAILURE TO FILE.

List all items of furniture and fixtures, all machinery and equipment, and all supplies. All

expensed items must be entered at original installed cost.

For each item, report your estimate of the current fair market value of the property, and your

estimate of the condition of that item (Good, Average, Poor).

Line 13 - Hotel, Motel and Apartments:

List all rental contents, i.e., furniture, appliances and equipment used in rental or other

commercial property.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2