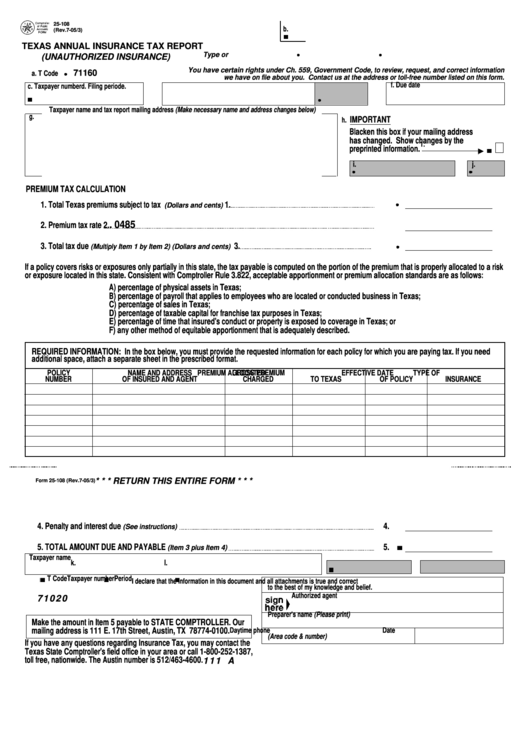

25-108

b.

(Rev.7-05/3)

TEXAS ANNUAL INSURANCE TAX REPORT

Type or print.

Do NOT write in shaded areas.

(UNAUTHORIZED INSURANCE)

You have certain rights under Ch. 559, Government Code, to review, request, and correct information

71160

a. T Code

we have on file about you. Contact us at the address or toll-free number listed on this form.

f. Due date

c. Taxpayer number

d. Filing period

e.

Taxpayer name and tax report mailing address (Make necessary name and address changes below)

g.

IMPORTANT

h.

Blacken this box if your mailing address

has changed. Show changes by the

1.

preprinted information.

i.

j.

PREMIUM TAX CALCULATION

1. Total Texas premiums subject to tax

1.

(Dollars and cents)

.0485

2. Premium tax rate

2.

3. Total tax due

3.

(Multiply Item 1 by Item 2) (Dollars and cents)

If a policy covers risks or exposures only partially in this state, the tax payable is computed on the portion of the premium that is properly allocated to a risk

or exposure located in this state. Consistent with Comptroller Rule 3.822, acceptable apportionment or premium allocation standards are as follows:

A) percentage of physical assets in Texas;

B) percentage of payroll that applies to employees who are located or conducted business in Texas;

C) percentage of sales in Texas;

D) percentage of taxable capital for franchise tax purposes in Texas;

E) percentage of time that insured's conduct or property is exposed to coverage in Texas; or

F) any other method of equitable apportionment that is adequately described.

REQUIRED INFORMATION: In the box below, you must provide the requested information for each policy for which you are paying tax. If you need

additional space, attach a separate sheet in the prescribed format.

GROSS PREMIUM

POLICY

NAME AND ADDRESS

PREMIUM ALLOCATED

EFFECTIVE DATE

TYPE OF

NUMBER

OF INSURED AND AGENT

CHARGED

TO TEXAS

OF POLICY

INSURANCE

* * * RETURN THIS ENTIRE FORM * * *

Form 25-108 (Rev.7-05/3)

4. Penalty and interest due

4.

(See instructions)

5.

5. TOTAL AMOUNT DUE AND PAYABLE

(Item 3 plus Item 4)

Taxpayer name

k.

l.

T Code

Taxpayer number

Period

I declare that the information in this document and all attachments is true and correct

to the best of my knowledge and belief.

Authorized agent

71020

Preparer's name (Please print)

Make the amount in Item 5 payable to STATE COMPTROLLER. Our

mailing address is 111 E. 17th Street, Austin, TX 78774-0100.

Daytime phone

Date

(Area code & number)

If you have any questions regarding Insurance Tax, you may contact the

Texas State Comptroller's field office in your area or call 1-800-252-1387,

toll free, nationwide. The Austin number is 512/463-4600.

111 A

1

1 2

2