Form Au-72 - Cash Bond - Department Of Revenue Services Of State Of Connecticut

ADVERTISEMENT

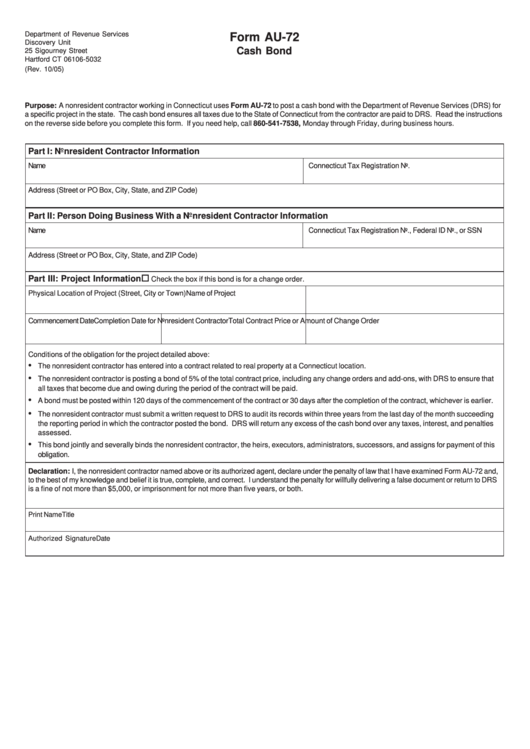

Department of Revenue Services

Form AU-72

Discovery Unit

Cash Bond

25 Sigourney Street

Hartford CT 06106-5032

(Rev. 10/05)

Purpose: A nonresident contractor working in Connecticut uses Form AU-72 to post a cash bond with the Department of Revenue Services (DRS) for

a specific project in the state. The cash bond ensures all taxes due to the State of Connecticut from the contractor are paid to DRS. Read the instructions

on the reverse side before you complete this form. If you need help, call 860-541-7538, Monday through Friday, during business hours.

Part I: Nonresident Contractor Information

Name

Connecticut Tax Registration No.

Address (Street or PO Box, City, State, and ZIP Code)

Part II: Person Doing Business With a Nonresident Contractor Information

Name

Connecticut Tax Registration No., Federal ID No., or SSN

Address (Street or PO Box, City, State, and ZIP Code)

Part III: Project Information

Check the box if this bond is for a change order.

Physical Location of Project (Street, City or Town)

Name of Project

Commencement Date

Completion Date for Nonresident Contractor Total Contract Price or Amount of Change Order

Conditions of the obligation for the project detailed above:

•

The nonresident contractor has entered into a contract related to real property at a Connecticut location.

•

The nonresident contractor is posting a bond of 5% of the total contract price, including any change orders and add-ons, with DRS to ensure that

all taxes that become due and owing during the period of the contract will be paid.

•

A bond must be posted within 120 days of the commencement of the contract or 30 days after the completion of the contract, whichever is earlier.

•

The nonresident contractor must submit a written request to DRS to audit its records within three years from the last day of the month succeeding

the reporting period in which the contractor posted the bond. DRS will return any excess of the cash bond over any taxes, interest, and penalties

assessed.

•

This bond jointly and severally binds the nonresident contractor, the heirs, executors, administrators, successors, and assigns for payment of this

obligation.

Declaration: I, the nonresident contractor named above or its authorized agent, declare under the penalty of law that I have examined Form AU-72 and,

to the best of my knowledge and belief it is true, complete, and correct. I understand the penalty for willfully delivering a false document or return to DRS

is a fine of not more than $5,000, or imprisonment for not more than five years, or both.

Print Name

Title

Authorized Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2