01-790-1

(Rev.11-15/24)

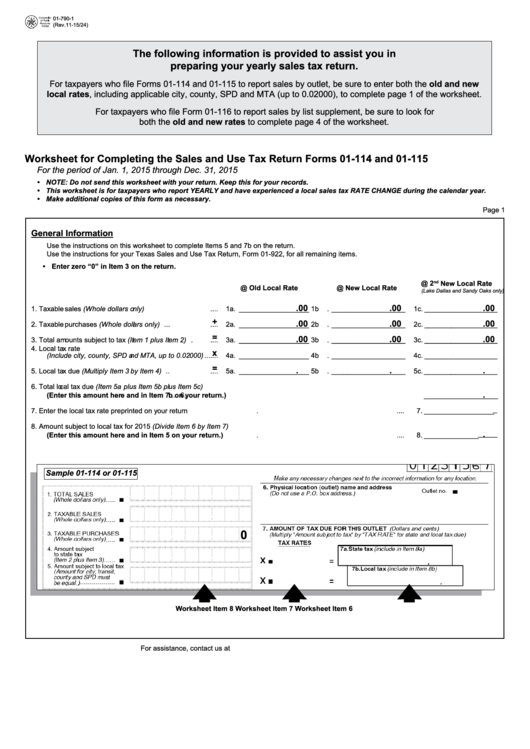

The following information is provided to assist you in

preparing your yearly sales tax return.

For taxpayers who file Forms 01-114 and 01-115 to report sales by outlet, be sure to enter both the old and new

local rates, including applicable city, county, SPD and MTA (up to 0.02000), to complete page 1 of the worksheet.

For taxpayers who file Form 01-116 to report sales by list supplement, be sure to look for

both the old and new rates to complete page 4 of the worksheet.

Worksheet for Completing the Sales and Use Tax Return Forms 01-114 and 01-115

For the period of Jan. 1, 2015 through Dec. 31, 2015

• NOTE: Do not send this worksheet with your return. Keep this for your records.

• This worksheet is for taxpayers who report YEARLY and have experienced a local sales tax RATE CHANGE during the calendar year.

• Make additional copies of this form as necessary.

Page 1

General Information

CLEAR FIELDS

Use the instructions on this worksheet to complete Items 5 and 7b on the return.

Use the instructions for your Texas Sales and Use Tax Return, Form 01-922, for all remaining items.

• Enter zero “0” in Item 3 on the return.

@ 2

New Local Rate

nd

@ Old Local Rate

@ New Local Rate

(Lake Dallas and Sandy Oaks only)

.00

.00

.00

1. Taxable

sales (Whole dollars o

nly) ...........

............

......

....

.

...

1

a

.

__

________________

1b

.

___

_

______________

_

1c.

_

______

_

___________

+

.00

.00

.00

2. Taxable

purchases (Whole doll

ars only) ...

............

......

....

.

...

2

a

.

__

________________

2b

.

___

_

______________

_

2c.

_

______

_

___________

=

.00

.00

.00

3. Total am

ounts subject to tax (It

em 1 plus It

em 2) .

......

....

.

...

3

a

.

__

________________

3b

.

___

_

______________

_

3c.

_

______

_

___________

4.

Local ta

x rate

x

(Incl

ude city, county, SPD a

nd MTA, up

to 0.02

000)

.

..

.

...

4

a

.

__

________________

4b

.

___

_

______________

_

4c.

_

______

_

___________

=

.

.

.

5. Local ta

x due (Multiply Item 3

by Item 4) ..

............

......

....

.

...

5

a

.

__

________________

5b

.

___

_

______________

_

5c.

_

______

_

___________

6. Total lo

cal tax due (Item 5a

plu

s Item 5b pl

us Ite m 5c)

.

(Enter this amount her

e a

nd in Item 7

b on your return.)

........................................................................................ ...

6.

___________________

7. Enter the local tax rate preprinted on your return ..................................

.

.....................................

.....

..............................

.

...

7.

__________________

_

8. Amount subject to local tax for 2015 (Divide Item 6 by Item 7)

.

(Enter this amount here and in Item 5 on your return.) ................

.

.....................................

.....

..............................

.

...

8.

______________

_____

Sample 01-114 or 01-115

0

Worksheet Item 8

Worksheet Item 7

Worksheet Item 6

For assistance, contact us at or call 1-800-252-5555.

1

1 2

2