01-790-1

(Rev.12-02/10)

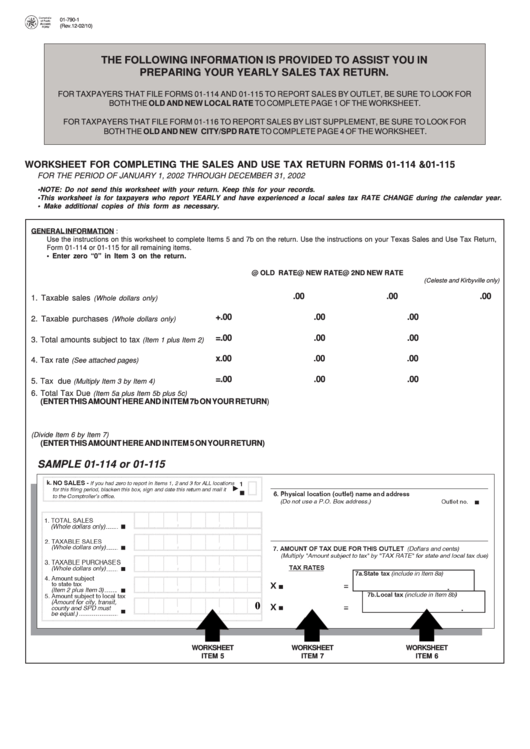

THE FOLLOWING INFORMATION IS PROVIDED TO ASSIST YOU IN

PREPARING YOUR YEARLY SALES TAX RETURN.

FOR TAXPAYERS THAT FILE FORMS 01-114 AND 01-115 TO REPORT SALES BY OUTLET, BE SURE TO LOOK FOR

BOTH THE OLD AND NEW LOCAL RATE TO COMPLETE PAGE 1 OF THE WORKSHEET.

FOR TAXPAYERS THAT FILE FORM 01-116 TO REPORT SALES BY LIST SUPPLEMENT, BE SURE TO LOOK FOR

BOTH THE OLD AND NEW CITY/SPD RATE TO COMPLETE PAGE 4 OF THE WORKSHEET.

WORKSHEET FOR COMPLETING THE SALES AND USE TAX RETURN FORMS 01-114 & 01-115

FOR THE PERIOD OF JANUARY 1, 2002 THROUGH DECEMBER 31, 2002

• NOTE: Do not send this worksheet with your return. Keep this for your records.

• This worksheet is for taxpayers who report YEARLY and have experienced a local sales tax RATE CHANGE during the calendar year.

• Make additional copies of this form as necessary.

GENERAL INFORMATION :

Use the instructions on this worksheet to complete Items 5 and 7b on the return. Use the instructions on your Texas Sales and Use Tax Return,

Form 01-114 or 01-115 for all remaining items.

• Enter zero “0” in Item 3 on the return.

@ OLD RATE

@ NEW RATE

@ 2ND NEW RATE

(Celeste and Kirbyville only)

.00

.00

.00

1. Taxable sales

.............................. 1a. ________________

1b. ________________

1c. ________________

(Whole dollars only)

+

.00

.00

.00

2. Taxable purchases

..................... 2a. ________________

2b. ________________

2c. ________________

(Whole dollars only)

=

.00

.00

.00

3. Total amounts subject to tax

........ 3a. ________________

3b. ________________

3c. ________________

(Item 1 plus Item 2)

x

.00

.00

.00

4. Tax rate

...................................... 4a. ________________

4b. ________________

4c. ________________

(See attached pages)

=

.00

.00

.00

5. Tax due

............................... 5a. ________________

5b. ________________

5c. ________________

(Multiply Item 3 by Item 4)

6. Total Tax Due

(Item 5a plus Item 5b plus 5c)

(ENTER THIS AMOUNT HERE AND IN ITEM 7b ON YOUR RETURN) .............................................................

6. ________________

7. Enter the tax rate preprinted on your return ..................................................................................................

7. ________________

8. Amount subject to tax for 2002

(Divide Item 6 by Item 7)

(ENTER THIS AMOUNT HERE AND IN ITEM 5 ON YOUR RETURN) ...............................................................

8. ________________

SAMPLE 01-114 or 01-115

0

WORKSHEET

WORKSHEET

WORKSHEET

ITEM 6

ITEM 5

ITEM 7

1

1 2

2 3

3 4

4