01-797-1

(Rev.11-15/27)

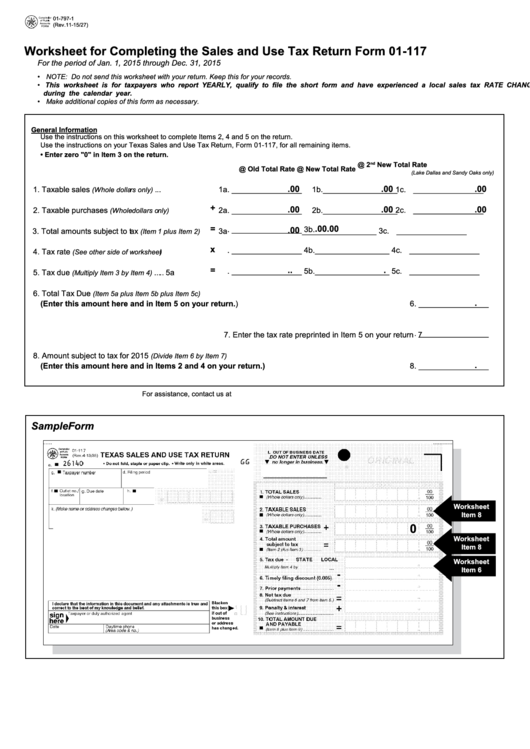

Worksheet for Completing the Sales and Use Tax Return Form 01-117

For the period of Jan. 1, 2015 through Dec. 31, 2015

• NOTE: Do not send this worksheet with your return. Keep this for your records.

• This worksheet is for taxpayers who report YEARLY, qualify to file the short form and have experienced a local sales tax RATE CHANGE

during the calendar year.

• Make additional copies of this form as necessary.

CLEAR FIELDS

General Information

Use the instructions on this worksheet to complete Items 2, 4 and 5 on the return.

Use the instructions on your Texas Sales and Use Tax Return, Form 01-117, for all remaining items.

• Enter zero "0" in Item 3 on the return.

@ 2

New Total Rate

nd

@ Old Total Rate

@ New Total Rate

(Lake Dallas and Sandy Oaks only)

.00

.00

.00

1. Taxable sales

.

..

..........................

1a. ________________

1b._________________

1c. ________________

(Whole dolla

rs only)

+

.00

.00

.00

2. Taxable purchases

....................

2a. ________________

2b._________________

2c. ________________

(Whole

dollars o

nly)

=

.00

.00

.00

3. Total amounts subject to t

ax

.......

3a

. ________________

3b.

_________________

3c. ________________

(Item

1

plus Item 2)

x

4. Tax rate

........................ 4a

. ________________

4b._________________

4c. ________________

(See other side of worksheet

)

=

.

.

.

5. Tax due

...

..

........................ 5a

. ________________

5b._________________

5c. ________________

(Multiply Item 3 by Item 4)

6. Total Tax Due

(Item 5a plus Item 5b plus Item 5c)

.

(Enter this amount here and in Item 5 on your return.) .............................................................................

6. ________________

7. Enter the tax rate preprinted in Item 5 on your return ..................................................................................... 7

. ________________

8. Amount subject to tax for 2015

(Divide Item 6 by Item 7)

.

(Enter this amount here and in Items 2 and 4 on your return.) ................................................................

8. ________________

For assistance, contact us at or call 1-800-252-5555.

Sample Form

Worksheet

Item 8

0

Worksheet

Item 8

Worksheet

Item 6

1

1