Form Bw-1 Instructions & Worksheet

ADVERTISEMENT

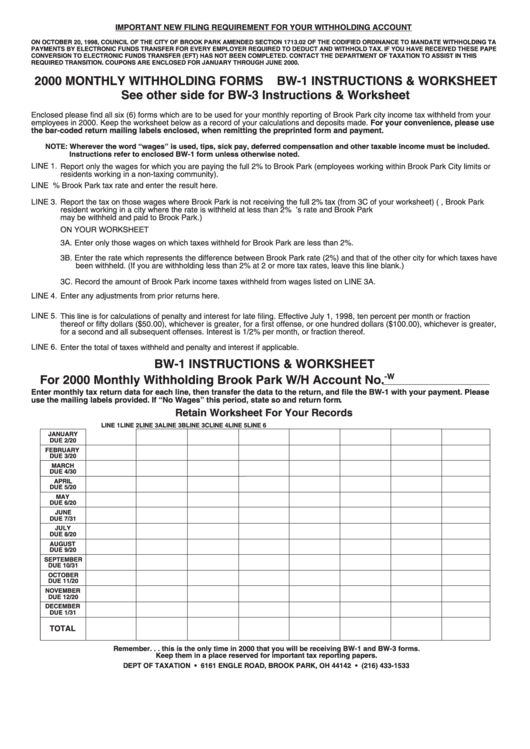

IMPORTANT NEW FILING REQUIREMENT FOR YOUR WITHHOLDING ACCOUNT

ON OCTOBER 20, 1998, COUNCIL OF THE CITY OF BROOK PARK AMENDED SECTION 1713.02 OF THE CODIFIED ORDINANCE TO MANDATE WITHHOLDING TAX

PAYMENTS BY ELECTRONIC FUNDS TRANSFER FOR EVERY EMPLOYER REQUIRED TO DEDUCT AND WITHHOLD TAX . IF YO U HAVE RECEIVED THESE PAPERS,

CONVERSION TO ELECTRONIC FUNDS TRANSFER (EFT) HAS NOT BEEN COMPLETED. CONTACT THE DEPA RTMENT OF TA XATION TO ASSIST IN THIS

REQUIRED TRANSITION . COUPONS ARE ENCLOSED FOR JANUARY THROUGH JUNE 2000 .

2000 MONTHLY WITHHOLDING FORMS

BW-1 INSTRUCTIONS & WORKSHEET

See other side for BW-3 Instructions & Worksheet

Enclosed please find all six (6) forms which are to be used for your monthly reporting of Brook Park city income tax withheld from your

employees in 2000. Keep the worksheet below as a record of your calculations and deposits made. For your convenience, please use

the bar-coded return mailing labels enclosed, when remitting the preprinted form and payment .

NOTE: Wherever the word “wages” is used, tips, sick pay, deferred compensation and other taxable income must be included .

Instructions refer to enclosed BW-1 form unless otherwise noted.

LINE 1. Report only the wages for which you are paying the full 2% to Brook Park (employees working within Brook Park City limits or

residents working in a non-taxing community).

LINE 2. Multiply LINE 1 by the 2% Brook Park tax rate and enter the result here.

LINE 3. Report the tax on those wages where Brook Park is not receiving the full 2% tax (from 3C of your worksheet) (e.g., Brook Park

resident working in a city where the rate is withheld at less than 2% ...the difference between that city’s rate and Brook Park

may be withheld and paid to Brook Park.)

ON YOUR WORKSHEET

3A. Enter only those wages on which taxes withheld for Brook Park are less than 2%.

3B. Enter the rate which represents the difference between Brook Park rate (2%) and that of the other city for which taxes have

been withheld. (If you are withholding less than 2% at 2 or more tax rates, leave this line blank .)

3C. Record the amount of Brook Park income taxes withheld from wages listed on LINE 3A.

LINE 4. Enter any adjustments from prior returns here.

LINE 5. This line is for calculations of penalty and interest for late filing. Effective July 1, 1998, ten percent per month or fraction

thereof or fifty dollars ($50.00), whichever is greater, for a first offense, or one hundred dollars ($100.00), whichever is greater,

for a second and all subsequent offenses. Interest is 1/2% per month, or fraction thereof.

LINE 6. Enter the total of taxes withheld and penalty and interest if applicable.

BW-1 INSTRUCTIONS & WORKSHEET

-W

For 2000 Monthly Withholding Brook Park W/H Account No .

Enter monthly tax return data for each line, then transfer the data to the return, and file the BW-1 with your payment. Please

use the mailing labels provided. If “No Wages” this period, state so and return form

.

Retain Worksheet For Your Records

LINE 1

LINE 2

LINE 3A

LINE 3B

LINE 3C

LINE 4

LINE 5

LINE 6

JANUARY

DUE 2/20

FEBRUARY

DUE 3/20

MARCH

DUE 4/30

APRIL

DUE 5/20

MAY

DUE 6/20

JUNE

DUE 7/31

JULY

DUE 8/20

AUGUST

DUE 9/20

SEPTEMBER

DUE 10/31

OCTOBER

DUE 11/20

NOVEMBER

DUE 12/20

DECEMBER

DUE 1/31

TOTAL

Remember. . . this is the only time in 2000 that you will be receiving BW-1 and BW-3 forms .

Keep them in a place reserved for important tax reporting papers.

DEPT OF TAXATION • 6161 ENGLE ROAD, BROOK PARK, OH 44142 • (216) 433-1533

.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1