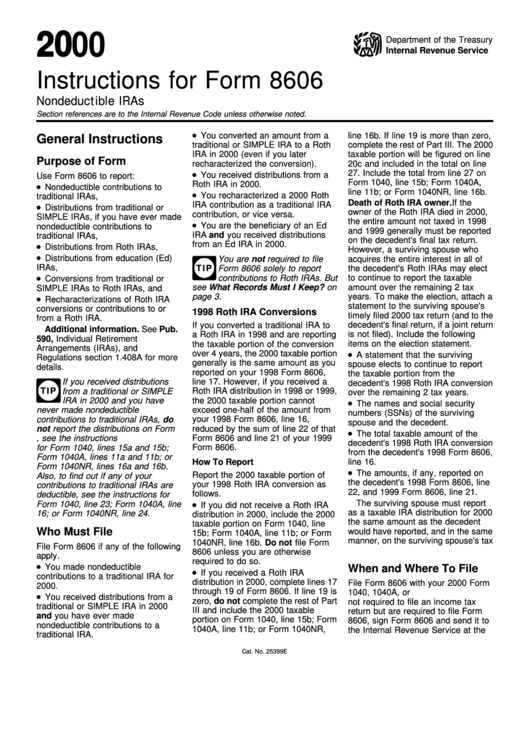

Instructions For Form 8606 - Nondeductible Iras - 2000

ADVERTISEMENT

2 0 00

Department of the Treasury

Internal Revenue Service

Instructions for Form 8606

Nondeductible IRAs

Section references are to the Internal Revenue Code unless otherwise noted.

You converted an amount from a

line 16b. If line 19 is more than zero,

General Instructions

traditional or SIMPLE IRA to a Roth

complete the rest of Part III. The 2000

IRA in 2000 (even if you later

taxable portion will be figured on line

Purpose of Form

recharacterized the conversion).

20c and included in the total on line

27. Include the total from line 27 on

You received distributions from a

Use Form 8606 to report:

Form 1040, line 15b; Form 1040A,

Roth IRA in 2000.

Nondeductible contributions to

line 11b; or Form 1040NR, line 16b.

You recharacterized a 2000 Roth

traditional IRAs,

Death of Roth IRA owner. If the

IRA contribution as a traditional IRA

Distributions from traditional or

owner of the Roth IRA died in 2000,

contribution, or vice versa.

SIMPLE IRAs, if you have ever made

the entire amount not taxed in 1998

You are the beneficiary of an Ed

nondeductible contributions to

and 1999 generally must be reported

IRA and you received distributions

traditional IRAs,

on the decedent's final tax return.

from an Ed IRA in 2000.

Distributions from Roth IRAs,

However, a surviving spouse who

Distributions from education (Ed)

You are not required to file

acquires the entire interest in all of

IRAs,

TIP

Form 8606 solely to report

the decedent's Roth IRAs may elect

to continue to report the taxable

contributions to Roth IRAs. But

Conversions from traditional or

see What Records Must I Keep? on

amount over the remaining 2 tax

SIMPLE IRAs to Roth IRAs, and

page 3.

years. To make the election, attach a

Recharacterizations of Roth IRA

statement to the surviving spouse's

conversions or contributions to or

1998 Roth IRA Conversions

timely filed 2000 tax return (and to the

from a Roth IRA.

decedent's final return, if a joint return

If you converted a traditional IRA to

Additional information. See Pub.

is not filed). Include the following

a Roth IRA in 1998 and are reporting

590, Individual Retirement

the taxable portion of the conversion

items on the election statement.

Arrangements (IRAs), and

over 4 years, the 2000 taxable portion

A statement that the surviving

Regulations section 1.408A for more

generally is the same amount as you

spouse elects to continue to report

details.

reported on your 1998 Form 8606,

the taxable portion from the

line 17. However, if you received a

If you received distributions

decedent's 1998 Roth IRA conversion

TIP

Roth IRA distribution in 1998 or 1999,

from a traditional or SIMPLE

over the remaining 2 tax years.

IRA in 2000 and you have

the 2000 taxable portion cannot

The names and social security

never made nondeductible

exceed one-half of the amount from

numbers (SSNs) of the surviving

your 1998 Form 8606, line 16,

contributions to traditional IRAs, do

spouse and the decedent.

reduced by the sum of line 22 of that

not report the distributions on Form

The total taxable amount of the

8606. Instead, see the instructions

Form 8606 and line 21 of your 1999

decedent's 1998 Roth IRA conversion

for Form 1040, lines 15a and 15b;

Form 8606.

from the decedent's 1998 Form 8606,

Form 1040A, lines 11a and 11b; or

line 16.

How To Report

Form 1040NR, lines 16a and 16b.

The amounts, if any, reported on

Report the 2000 taxable portion of

Also, to find out if any of your

the decedent's 1998 Form 8606, line

your 1998 Roth IRA conversion as

contributions to traditional IRAs are

22, and 1999 Form 8606, line 21.

follows.

deductible, see the instructions for

The surviving spouse must report

Form 1040, line 23; Form 1040A, line

If you did not receive a Roth IRA

as a taxable IRA distribution for 2000

16; or Form 1040NR, line 24.

distribution in 2000, include the 2000

the same amount as the decedent

taxable portion on Form 1040, line

Who Must File

would have reported, and in the same

15b; Form 1040A, line 11b; or Form

manner, on the surviving spouse's tax

1040NR, line 16b. Do not file Form

File Form 8606 if any of the following

return. See Pub. 590 for details.

8606 unless you are otherwise

apply.

required to do so.

You made nondeductible

When and Where To File

If you received a Roth IRA

contributions to a traditional IRA for

distribution in 2000, complete lines 17

File Form 8606 with your 2000 Form

2000.

through 19 of Form 8606. If line 19 is

1040, 1040A, or 1040NR. If you are

You received distributions from a

zero, do not complete the rest of Part

not required to file an income tax

traditional or SIMPLE IRA in 2000

III and include the 2000 taxable

return but are required to file Form

and you have ever made

portion on Form 1040, line 15b; Form

8606, sign Form 8606 and send it to

nondeductible contributions to a

1040A, line 11b; or Form 1040NR,

the Internal Revenue Service at the

traditional IRA.

Cat. No. 25399E

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8