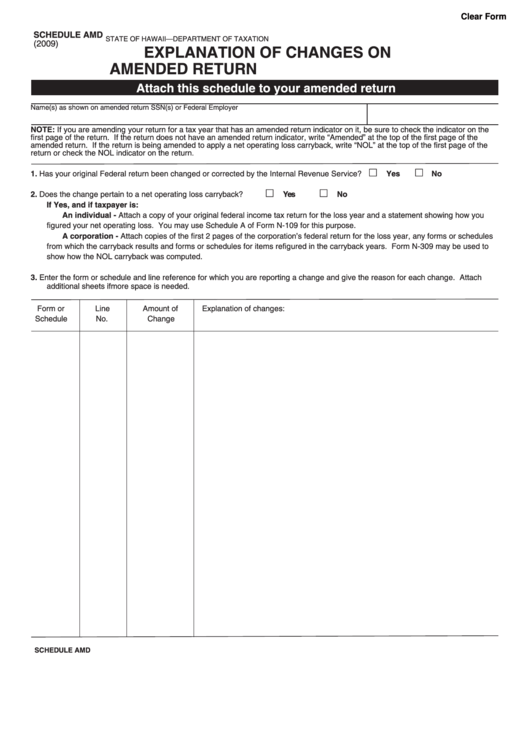

Clear Form

SCHEDULE AMD

STATE OF HAWAII—DEPARTMENT OF TAXATION

(2009)

EXPLANATION OF CHANGES ON

AMENDED RETURN

Attach this schedule to your amended return

Name(s) as shown on amended return

SSN(s) or Federal Employer I.D. No.

NOTE: If you are amending your return for a tax year that has an amended return indicator on it, be sure to check the indicator on the

first page of the return. If the return does not have an amended return indicator, write “Amended” at the top of the first page of the

amended return. If the return is being amended to apply a net operating loss carryback, write “NOL” at the top of the first page of the

return or check the NOL indicator on the return.

1.

Has your original Federal return been changed or corrected by the Internal Revenue Service?

Yes

No

2.

Does the change pertain to a net operating loss carryback?

Yes

No

If Yes, and if taxpayer is:

An individual - Attach a copy of your original federal income tax return for the loss year and a statement showing how you

figured your net operating loss. You may use Schedule A of Form N-109 for this purpose.

A corporation - Attach copies of the first 2 pages of the corporation’s federal return for the loss year, any forms or schedules

from which the carryback results and forms or schedules for items refigured in the carryback years. Form N-309 may be used to

show how the NOL carryback was computed.

3.

Enter the form or schedule and line reference for which you are reporting a change and give the reason for each change. Attach

additional sheets if more space is needed.

Form or

Line

Amount of

Explanation of changes:

Schedule

No.

Change

SCHEDULE AMD

1

1 2

2