Form 2004tx - City Of Pell City Tax Return Form

ADVERTISEMENT

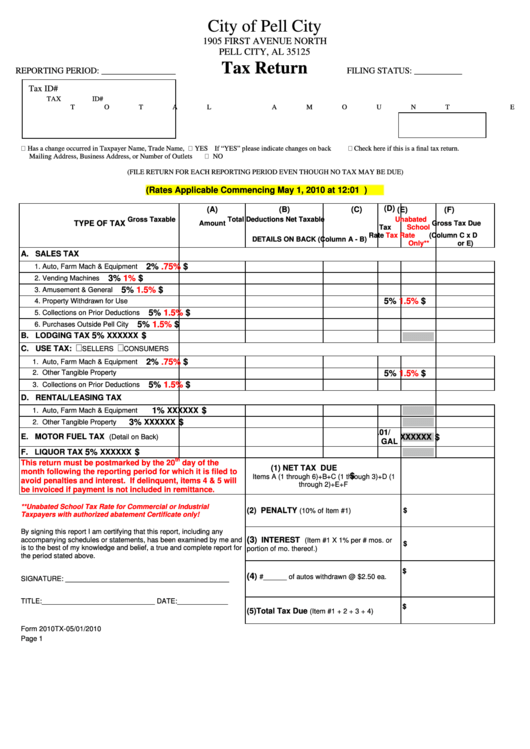

City of Pell City

1905 FIRST AVENUE NORTH

PELL CITY, AL 35125

Tax Return

REPORTING PERIOD: _________________

FILING STATUS: ___________

Tax ID#

TAX ID#

TOTAL AMOUNT ENCLOSED

Has a change occurred in Taxpayer Name, Trade Name,

YES If “YES” please indicate changes on back

Check here if this is a final tax return.

Mailing Address, Business Address, or Number of Outlets

NO

(FILE RETURN FOR EACH REPORTING PERIOD EVEN THOUGH NO TAX MAY BE DUE)

(Rates Applicable Commencing May 1, 2010 at 12:01 a.m.)

(D)

(A)

(B)

(C)

(E)

(F)

Gross Taxable

Unabated

TYPE OF TAX

Total Deductions

Net Taxable

Gross Tax Due

Amount

Tax

School

Rate

Tax Rate

(Column C x D

DETAILS ON BACK

(Column A - B)

Only**

or E)

A. SALES TAX

2%

.75%

$

1. Auto, Farm Mach & Equipment

3%

1%

$

2. Vending Machines

5%

1.5%

$

3. Amusement & General

5%

1.5%

$

4. Property Withdrawn for Use

5%

1.5%

$

5. Collections on Prior Deductions

5%

1.5%

$

6. Purchases Outside Pell City

B. LODGING TAX

5%

XXXXXX

$

C. USE TAX:

SELLERS

CONSUMERS

2%

.75%

$

1. Auto, Farm Mach & Equipment

5%

1.5%

$

2. Other Tangible Property

5%

1.5%

$

3. Collections on Prior Deductions

D. RENTAL/LEASING TAX

1%

$

1. Auto, Farm Mach & Equipment

XXXXXX

3%

XXXXXX

$

2. Other Tangible Property

.01/

E. MOTOR FUEL TAX

XXXXXX

$

(Detail on Back)

GAL

5%

$

F. LIQUOR TAX

XXXXXX

th

This return must be postmarked by the 20

day of the

(1) NET TAX DUE

month following the reporting period for which it is filed to

$

Items A (1 through 6)+B+C (1 through 3)+D (1

avoid penalties and interest. If delinquent, items 4 & 5 will

through 2)+E+F

be invoiced if payment is not included in remittance.

**Unabated School Tax Rate for Commercial or Industrial

(2) PENALTY

(10% of Item #1)

$

Taxpayers with authorized abatement Certificate only!

By signing this report I am certifying that this report, including any

(3

accompanying schedules or statements, has been examined by me and

) INTEREST

(Item #1 X 1% per # mos. or

$

is to the best of my knowledge and belief, a true and complete report for

portion of mo. thereof.)

the period stated above.

$

(4

)

#______ of autos withdrawn @ $2.50 ea.

SIGNATURE: __________________________________________

$

TITLE:_____________________________ DATE:_____________

(5)Total Tax Due

(Item #1 + 2 + 3 + 4)

Form 2010TX-05/01/2010

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2