Form Tsb-M-06(3)c - Supplemental Summary Of Corporation Tax Legislative Changes Enacted In 2005 - Office Of Tax Policy Analysis Technical Services Division

ADVERTISEMENT

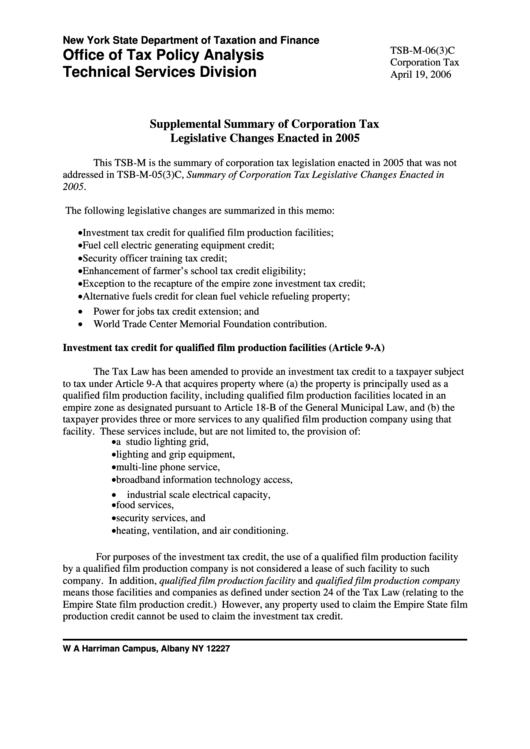

New York State Department of Taxation and Finance

TSB-M-06(3)C

Office of Tax Policy Analysis

Corporation Tax

Technical Services Division

April 19, 2006

Supplemental Summary of Corporation Tax

Legislative Changes Enacted in 2005

This TSB-M is the summary of corporation tax legislation enacted in 2005 that was not

addressed in TSB-M-05(3)C, Summary of Corporation Tax Legislative Changes Enacted in

2005.

The following legislative changes are summarized in this memo:

• Investment tax credit for qualified film production facilities;

• Fuel cell electric generating equipment credit;

• Security officer training tax credit;

• Enhancement of farmer’s school tax credit eligibility;

• Exception to the recapture of the empire zone investment tax credit;

• Alternative fuels credit for clean fuel vehicle refueling property;

• Power for jobs tax credit extension; and

• World Trade Center Memorial Foundation contribution.

Investment tax credit for qualified film production facilities (Article 9-A)

The Tax Law has been amended to provide an investment tax credit to a taxpayer subject

to tax under Article 9-A that acquires property where (a) the property is principally used as a

qualified film production facility, including qualified film production facilities located in an

empire zone as designated pursuant to Article 18-B of the General Municipal Law, and (b) the

taxpayer provides three or more services to any qualified film production company using that

facility. These services include, but are not limited to, the provision of:

• a studio lighting grid,

• lighting and grip equipment,

• multi-line phone service,

• broadband information technology access,

• industrial scale electrical capacity,

• food services,

• security services, and

• heating, ventilation, and air conditioning.

For purposes of the investment tax credit, the use of a qualified film production facility

by a qualified film production company is not considered a lease of such facility to such

company. In addition, qualified film production facility and qualified film production company

means those facilities and companies as defined under section 24 of the Tax Law (relating to the

Empire State film production credit.) However, any property used to claim the Empire State film

production credit cannot be used to claim the investment tax credit.

W A Harriman Campus, Albany NY 12227

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6