Reset Form

Print Form

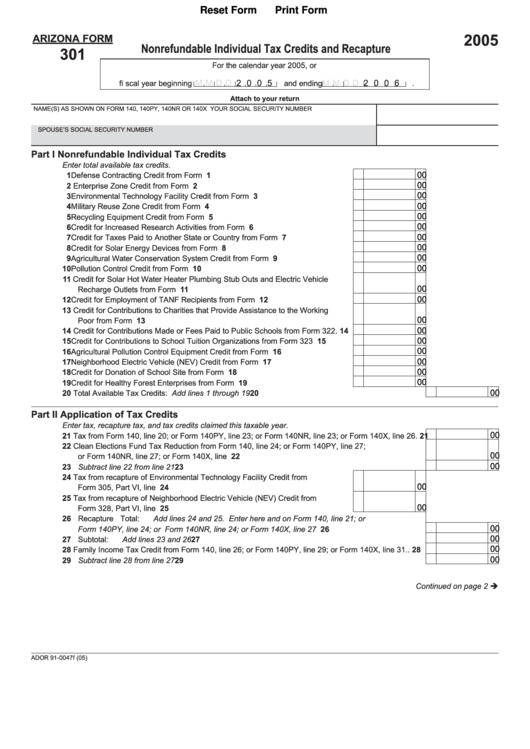

ARIZONA FORM

2005

Nonrefundable Individual Tax Credits and Recapture

301

For the calendar year 2005, or

M M D D

2 0 0 5

M M D D

2 0 0 6

fi scal year beginning

and ending

.

Attach to your return

NAME(S) AS SHOWN ON FORM 140, 140PY, 140NR OR 140X

YOUR SOCIAL SECURITY NUMBER

SPOUSE’S SOCIAL SECURITY NUMBER

Part I Nonrefundable Individual Tax Credits

Enter total available tax credits.

00

1 Defense Contracting Credit from Form 302 ......................................................

1

00

2 Enterprise Zone Credit from Form 304 .............................................................

2

00

3 Environmental Technology Facility Credit from Form 305 ................................

3

00

4 Military Reuse Zone Credit from Form 306.......................................................

4

00

5 Recycling Equipment Credit from Form 307 .....................................................

5

00

6 Credit for Increased Research Activities from Form 308-I ................................

6

00

7 Credit for Taxes Paid to Another State or Country from Form 309 ...................

7

00

8 Credit for Solar Energy Devices from Form 310 ...............................................

8

00

9 Agricultural Water Conservation System Credit from Form 312 .......................

9

00

10 Pollution Control Credit from Form 315 ............................................................

10

11 Credit for Solar Hot Water Heater Plumbing Stub Outs and Electric Vehicle

00

Recharge Outlets from Form 319 .....................................................................

11

00

12 Credit for Employment of TANF Recipients from Form 320..............................

12

13 Credit for Contributions to Charities that Provide Assistance to the Working

00

Poor from Form 321..........................................................................................

13

00

14 Credit for Contributions Made or Fees Paid to Public Schools from Form 322.

14

00

15 Credit for Contributions to School Tuition Organizations from Form 323 .........

15

00

16 Agricultural Pollution Control Equipment Credit from Form 325 .......................

16

00

17 Neighborhood Electric Vehicle (NEV) Credit from Form 328 ............................

17

00

18 Credit for Donation of School Site from Form 331 ............................................

18

00

19 Credit for Healthy Forest Enterprises from Form 332 .......................................

19

00

20 Total Available Tax Credits: Add lines 1 through 19 ..........................................................................

20

Part II Application of Tax Credits

Enter tax, recapture tax, and tax credits claimed this taxable year.

00

21 Tax from Form 140, line 20; or Form 140PY, line 23; or Form 140NR, line 23; or Form 140X, line 26. 21

22 Clean Elections Fund Tax Reduction from Form 140, line 24; or Form 140PY, line 27;

00

or Form 140NR, line 27; or Form 140X, line 29 .................................................................................

22

00

23 Subtract line 22 from line 21 ..............................................................................................................

23

24 Tax from recapture of Environmental Technology Facility Credit from

00

Form 305, Part VI, line 34 .................................................................................

24

25 Tax from recapture of Neighborhood Electric Vehicle (NEV) Credit from

00

Form 328, Part VI, line 21 .................................................................................

25

26 Recapture Total: Add lines 24 and 25. Enter here and on Form 140, line 21; or

00

Form 140PY, line 24; or Form 140NR, line 24; or Form 140X, line 27 .............................................

26

00

27 Subtotal: Add lines 23 and 26 ...........................................................................................................

27

00

28 Family Income Tax Credit from Form 140, line 26; or Form 140PY, line 29; or Form 140X, line 31 ..

28

00

29 Subtract line 28 from line 27 ..............................................................................................................

29

Continued on page 2

ADOR 91-0047f (05)

1

1 2

2