Form Oci 22-801 - Schedule Of Taxes And Fees Template - Wisconsin Page 5

ADVERTISEMENT

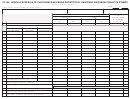

Insurer Name

II.

Schedule 2—Interest on Accident & Health Reserves (continued)

13.

Interest Rate* .................................................................................................................

%

14.

Interest on A&H reserves [Line 12 x Line 13]. Carry total to Section III., Line 17b .....

III.

Deductions

15.

Interest on U.S. Government Bonds

a. Interest on U.S. Government Bonds owned [Annual Statement, Schedule D, Part 1,

Column 20 plus Schedule DA, Part 1, Column 20] ....................................................

b. Interest on U.S. Government Bonds sold [Annual Statement, Schedule D, Part 4,

Column 20 and Part 5, Column 20] .........................................................................

c. Interest on short-term U.S. Government Bonds sold, redeemed, or otherwise

disposed of during the current year plus interest on short-term U.S. Government

Bonds acquired during the current year and fully disposed of during the current year

16.

Increase in book value of U.S. Government Bonds

a. Increase in book value of Treasury bills owned [Annual Statement, Schedule D,

Part 1, Columns 12 through 15] ...............................................................................

b. Increase in book value of U.S. Government Bonds sold [Annual Statement,

Schedule D, Part 4, Columns 11 through 15 and Part 5, Columns 12 through 16] .

c. Interest on short-term Treasury bills sold, redeemed, or otherwise disposed of

during the current year plus interest on short-term Treasury bills acquired during

the current year and fully disposed of during the current year ..................................

17.

Interest on reserves

a. Tabular interest on reserves [Annual Statement, Page 7, Line 4, Column 1, not

including interest on premium deposit funds] ...........................................................

b. Interest on A&H reserves [Line 14, from Schedule II above] .......................................

18.

Gross Interest Deduction Subtotal [Sum of Lines 15a. through 17b.] .............................

19.

Interest purchased on U.S. Government Bonds

a. Interest on U.S. Government Bonds acquired [Annual Statement, Schedule D,

Part 3, Column 9] ....................................................................................................

b. Interest purchased on short-term U.S. Government Bonds Owned [Annual

Statement, Schedule DA, Part 1, Column 21] ..........................................................

c. Interest purchased on short-term U.S. Government Bonds acquired during the

current year and fully disposed of during the current year ........................................

d. Subtotal [Sum of Lines 19a., 19b., and 19c.] ............................................................

20.

Net Interest Deduction [Line 18 less Line 19d.] ..............................................................

*

Interest Rate is the ratio of Net Investment Income to Mean Assets calculated as:

where A and B are the sums of Annual Statement lines 12 and 14, Page 2 minus line 22, page 3 at the beginning

2I

and end of the year, respectively, and I is the net investment income. In calculating this ratio, add back to net

A+B-I

investment income the amount of Separate Account investment expenses, taxes, and fees from the Exhibit of Net

Investment Income, footnote (g).

OCI 22-801 (R 12/2011)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6