Form Oci 22-800 - Schedule Of Taxes And Fees Nondomestic Property And Casualty Instructions

ADVERTISEMENT

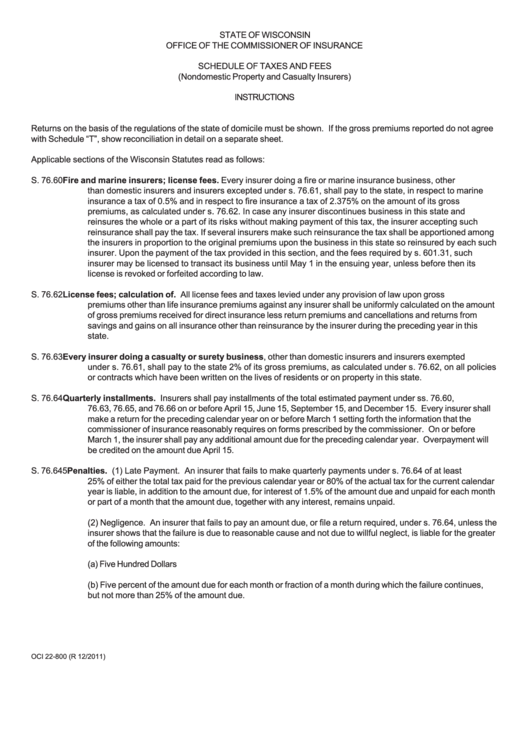

STATE OF WISCONSIN

OFFICE OF THE COMMISSIONER OF INSURANCE

SCHEDULE OF TAXES AND FEES

(Nondomestic Property and Casualty Insurers)

INSTRUCTIONS

Returns on the basis of the regulations of the state of domicile must be shown. If the gross premiums reported do not agree

with Schedule “T”, show reconciliation in detail on a separate sheet.

Applicable sections of the Wisconsin Statutes read as follows:

S. 76.60

Fire and marine insurers; license fees. Every insurer doing a fire or marine insurance business, other

than domestic insurers and insurers excepted under s. 76.61, shall pay to the state, in respect to marine

insurance a tax of 0.5% and in respect to fire insurance a tax of 2.375% on the amount of its gross

premiums, as calculated under s. 76.62. In case any insurer discontinues business in this state and

reinsures the whole or a part of its risks without making payment of this tax, the insurer accepting such

reinsurance shall pay the tax. If several insurers make such reinsurance the tax shall be apportioned among

the insurers in proportion to the original premiums upon the business in this state so reinsured by each such

insurer. Upon the payment of the tax provided in this section, and the fees required by s. 601.31, such

insurer may be licensed to transact its business until May 1 in the ensuing year, unless before then its

license is revoked or forfeited according to law.

S. 76.62

License fees; calculation of. All license fees and taxes levied under any provision of law upon gross

premiums other than life insurance premiums against any insurer shall be uniformly calculated on the amount

of gross premiums received for direct insurance less return premiums and cancellations and returns from

savings and gains on all insurance other than reinsurance by the insurer during the preceding year in this

state.

S. 76.63

Every insurer doing a casualty or surety business, other than domestic insurers and insurers exempted

under s. 76.61, shall pay to the state 2% of its gross premiums, as calculated under s. 76.62, on all policies

or contracts which have been written on the lives of residents or on property in this state.

S. 76.64

Quarterly installments. Insurers shall pay installments of the total estimated payment under ss. 76.60,

76.63, 76.65, and 76.66 on or before April 15, June 15, September 15, and December 15. Every insurer shall

make a return for the preceding calendar year on or before March 1 setting forth the information that the

commissioner of insurance reasonably requires on forms prescribed by the commissioner. On or before

March 1, the insurer shall pay any additional amount due for the preceding calendar year. Overpayment will

be credited on the amount due April 15.

S. 76.645

Penalties. (1) Late Payment. An insurer that fails to make quarterly payments under s. 76.64 of at least

25% of either the total tax paid for the previous calendar year or 80% of the actual tax for the current calendar

year is liable, in addition to the amount due, for interest of 1.5% of the amount due and unpaid for each month

or part of a month that the amount due, together with any interest, remains unpaid.

(2) Negligence. An insurer that fails to pay an amount due, or file a return required, under s. 76.64, unless the

insurer shows that the failure is due to reasonable cause and not due to willful neglect, is liable for the greater

of the following amounts:

(a) Five Hundred Dollars

(b) Five percent of the amount due for each month or fraction of a month during which the failure continues,

but not more than 25% of the amount due.

OCI 22-800 (R 12/2011)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4