Changes In Local Communications Services Tax Rates Effective January 1, 2008

ADVERTISEMENT

TIP #07A19-04

DATE ISSUED: November 21, 2007

CHANGES IN LOCAL COMMUNICATIONS SERVICES TAX RATES

EFFECTIVE JANUARY 1, 2008

Effective January 1, 2008, numerous local communications services tax (CST) rates will

change. These local tax rate changes are pursuant to an ordinance adopted by the

governing authority of the county or municipality. The local tax rate for CST includes both

the local rate imposed under the CST statute (Section 202.19, Florida Statutes) and the

discretionary sales surtax imposed under the sales and use tax statute (Section 212.055,

F.S.). The new rates are effective for all bills issued on or after January 1, 2008, regardless

of the date that the service is rendered or transacted. These rates will stay in effect until

further notice by the Department. This Tax Information Publication (TIP) includes rate

changes due to changes in the county discretionary sales surtax.

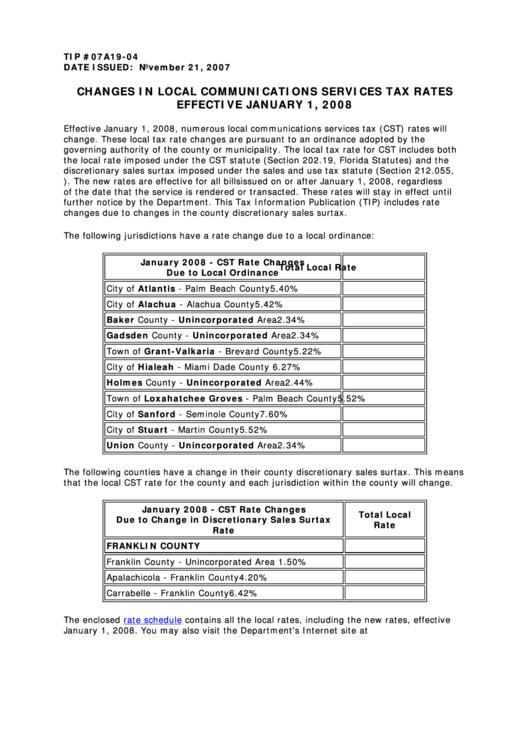

The following jurisdictions have a rate change due to a local ordinance:

January 2008 - CST Rate Changes

Total Local Rate

Due to Local Ordinance

City of Atlantis - Palm Beach County

5.40%

City of Alachua - Alachua County

5.42%

Baker County - Unincorporated Area

2.34%

Gadsden County - Unincorporated Area

2.34%

Town of Grant-Valkaria - Brevard County

5.22%

City of Hialeah - Miami Dade County

6.27%

Holmes County - Unincorporated Area

2.44%

Town of Loxahatchee Groves - Palm Beach County

5.52%

City of Sanford - Seminole County

7.60%

City of Stuart - Martin County

5.52%

Union County - Unincorporated Area

2.34%

The following counties have a change in their county discretionary sales surtax. This means

that the local CST rate for the county and each jurisdiction within the county will change.

January 2008 - CST Rate Changes

Total Local

Due to Change in Discretionary Sales Surtax

Rate

Rate

FRANKLIN COUNTY

Franklin County - Unincorporated Area

1.50%

Apalachicola - Franklin County

4.20%

Carrabelle - Franklin County

6.42%

The enclosed

rate schedule

contains all the local rates, including the new rates, effective

January 1, 2008. You may also visit the Department's Internet site at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7