Form Wv-284 - Instructions Authorization Of Power Of Attorney

ADVERTISEMENT

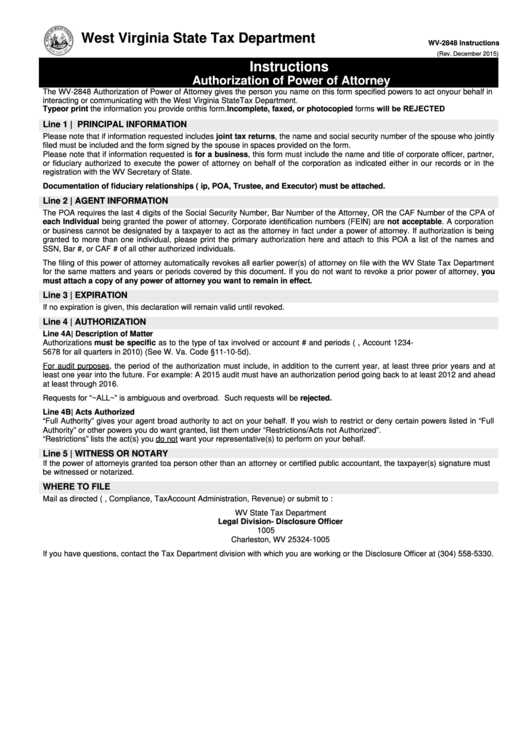

West Virginia State Tax Department

WV-2848 Instructions

(Rev. December 2015)

Instructions

Authorization of Power of Attorney

The WV-2848 Authorization of Power of Attorney gives the person you name on this form specified powers to act on your behalf in

interacting or communicating with the West Virginia State Tax Department.

Type or print the information you provide on this form. Incomplete, faxed, or photocopied forms will be REJECTED

Line 1 | PRINCIPAL INFORMATION

Please note that if information requested includes joint tax returns, the name and social security number of the spouse who jointly

filed must be included and the form signed by the spouse in spaces provided on the form.

Please note that if information requested is for a business, this form must include the name and title of corporate officer, partner,

or fiduciary authorized to execute the power of attorney on behalf of the corporation as indicated either in our records or in the

registration with the WV Secretary of State.

Documentation of fiduciary relationships (e.g. Guardianship, POA, Trustee, and Executor) must be attached.

Line 2 | AGENT INFORMATION

The POA requires the last 4 digits of the Social Security Number, Bar Number of the Attorney, OR the CAF Number of the CPA of

each Individual being granted the power of attorney. Corporate identification numbers (FEIN) are not acceptable. A corporation

or business cannot be designated by a taxpayer to act as the attorney in fact under a power of attorney. If authorization is being

granted to more than one individual, please print the primary authorization here and attach to this POA a list of the names and

SSN, Bar #, or CAF # of all other authorized individuals.

The filing of this power of attorney automatically revokes all earlier power(s) of attorney on file with the WV State Tax Department

for the same matters and years or periods covered by this document. If you do not want to revoke a prior power of attorney, you

must attach a copy of any power of attorney you want to remain in effect.

Line 3 | EXPIRATION

If no expiration is given, this declaration will remain valid until revoked.

Line 4 | AUTHORIZATION

Line 4A| Description of Matter

Authorizations must be specific as to the type of tax involved or account # and periods (e.g. Sales and Use Tax, Account 1234-

5678 for all quarters in 2010) (See W. Va. Code §11-10-5d).

For audit purposes, the period of the authorization must include, in addition to the current year, at least three prior years and at

least one year into the future. For example: A 2015 audit must have an authorization period going back to at least 2012 and ahead

at least through 2016.

Requests for “~ALL~” is ambiguous and overbroad. Such requests will be rejected.

Line 4B| Acts Authorized

“Full Authority” gives your agent broad authority to act on your behalf. If you wish to restrict or deny certain powers listed in “Full

Authority” or other powers you do want granted, list them under “Restrictions/Acts not Authorized”.

“Restrictions” lists the act(s) you do not want your representative(s) to perform on your behalf.

Line 5 | WITNESS OR NOTARY

If the power of attorney is granted to a person other than an attorney or certified public accountant, the taxpayer(s) signature must

be witnessed or notarized.

WHERE TO FILE

Mail as directed (e.g. Auditing, Compliance, Tax Account Administration, Revenue) or submit to :

WV State Tax Department

Legal Division- Disclosure Officer

P.O. Box 1005

Charleston, WV 25324-1005

If you have questions, contact the Tax Department division with which you are working or the Disclosure Officer at (304) 558-5330.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1