Form 941p-Me - Pass-Through Entity Return Of Maine Income Tax Withheld From Members - 2014

ADVERTISEMENT

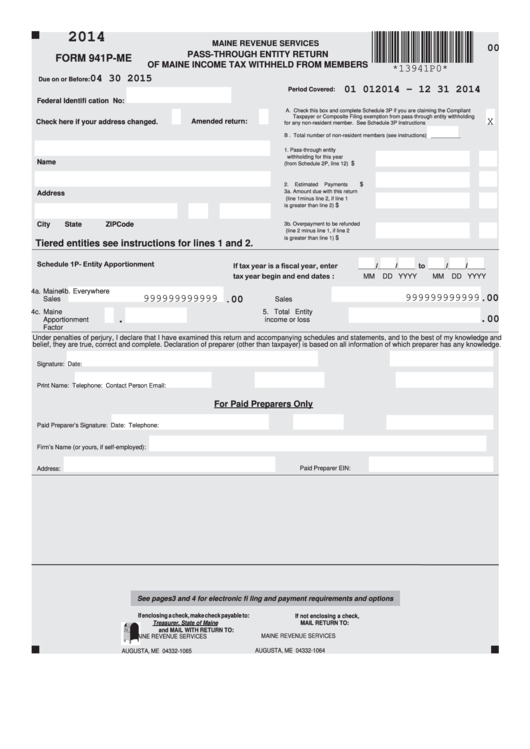

2014

MAINE REVENUE SERVICES

00

PASS-THROUGH ENTITY RETURN

FORM 941P-ME

OF MAINE INCOME TAX WITHHELD FROM MEMBERS

*13941P0*

04 30 2015

Due on or Before:

01 01 2014 - 12 31 2014

Period Covered:

Federal Identifi cation No:

A. Check this box and complete Schedule 3P if you are claiming the Compliant

Taxpayer or Composite Filing exemption from pass-through entity withholding

X

Amended return:

Check here if your address changed.

for any non-resident member. See Schedule 3P instructions ...........................

B . Total number of non-resident members (see instructions) __________

1.

Pass-through entity

withholding for this year

Name

$

(from Schedule 2P, line 12) ....

$

2.

Estimated Payments ..............

3a. Amount due with this return

Address

(line 1minus line 2, if line 1

$

is greater than line 2)..............

City

State

ZIPCode

3b. Overpayment to be refunded

(line 2 minus line 1, if line 2

$

is greater than line 1)..............

Tiered entities see instructions for lines 1 and 2.

Schedule 1P- Entity Apportionment

If tax year is a fiscal year, enter

_____/_____/_____ to _____/_____/_____

tax year begin and end dates :

MM

DD YYYY

MM

DD YYYY

4a. Maine

4b. Everywhere

999999999999

.00

999999999999

.00

Sales

Sales

4c. Maine

5. Total Entity

.

. 00

Apportionment

income or loss

Factor

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Signature:

Date:

Print Name:

Telephone:

Contact Person Email:

For Paid Preparers Only

Paid Preparer’s Signature:

Date:

Telephone:

Firm’s Name (or yours, if self-employed):

Paid Preparer EIN:

Address:

See pages 3 and 4 for electronic fi ling and payment requirements and options

If enclosing a check, make check payable to:

If not enclosing a check,

Treasurer, State of Maine

MAIL RETURN TO:

and MAIL WITH RETURN TO:

MAINE REVENUE SERVICES

MAINE REVENUE SERVICES

P.O. BOX 1065

P.O. BOX 1064

AUGUSTA, ME 04332-1064

AUGUSTA, ME 04332-1065

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4