Form 941p-Me - Pass-Through Entity Return Of Maine Income Tax Withheld - 2003

ADVERTISEMENT

*030626000*

MAINE

REVENUE SERVICES

030626000

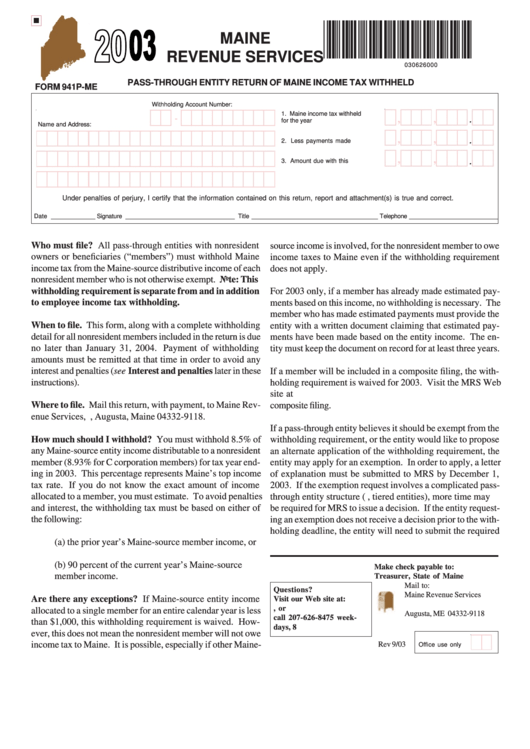

PASS-THROUGH ENTITY RETURN OF MAINE INCOME TAX WITHHELD

FORM 941P-ME

Withholding Account Number:

1. Maine income tax withheld

-

,

,

.

for the year ................................ 1

Name and Address:

,

,

.

2. Less payments made ............. 2

,

,

3. Amount due with this return ..... 3

.

Under penalties of perjury, I certify that the information contained on this return, report and attachment(s) is true and correct.

Date _____________ Signature ________________________________ Title _____________________________________ Telephone __________________________

Who must file? All pass-through entities with nonresident

source income is involved, for the nonresident member to owe

owners or beneficiaries (“members”) must withhold Maine

income taxes to Maine even if the withholding requirement

income tax from the Maine-source distributive income of each

does not apply.

nonresident member who is not otherwise exempt. Note: This

withholding requirement is separate from and in addition

For 2003 only, if a member has already made estimated pay-

to employee income tax withholding.

ments based on this income, no withholding is necessary. The

member who has made estimated payments must provide the

When to file. This form, along with a complete withholding

entity with a written document claiming that estimated pay-

detail for all nonresident members included in the return is due

ments have been made based on the entity income. The en-

no later than January 31, 2004. Payment of withholding

tity must keep the document on record for at least three years.

amounts must be remitted at that time in order to avoid any

interest and penalties (see Interest and penalties later in these

If a member will be included in a composite filing, the with-

instructions).

holding requirement is waived for 2003. Visit the MRS Web

site at for more information about

Where to file. Mail this return, with payment, to Maine Rev-

composite filing.

enue Services, P.O. Box 9118, Augusta, Maine 04332-9118.

If a pass-through entity believes it should be exempt from the

How much should I withhold? You must withhold 8.5% of

withholding requirement, or the entity would like to propose

any Maine-source entity income distributable to a nonresident

an alternate application of the withholding requirement, the

member (8.93% for C corporation members) for tax year end-

entity may apply for an exemption. In order to apply, a letter

ing in 2003. This percentage represents Maine’s top income

of explanation must be submitted to MRS by December 1,

tax rate. If you do not know the exact amount of income

2003. If the exemption request involves a complicated pass-

allocated to a member, you must estimate. To avoid penalties

through entity structure (i.e., tiered entities), more time may

and interest, the withholding tax must be based on either of

be required for MRS to issue a decision. If the entity request-

the following:

ing an exemption does not receive a decision prior to the with-

holding deadline, the entity will need to submit the required

(a) the prior year’s Maine-source member income, or

(b) 90 percent of the current year’s Maine-source

Make check payable to:

member income.

Treasurer, State of Maine

Mail to:

Questions?

Maine Revenue Services

Are there any exceptions? If Maine-source entity income

Visit our Web site at:

P.O. Box 9118

, or

allocated to a single member for an entire calendar year is less

Augusta, ME 04332-9118

call 207-626-8475 week-

than $1,000, this withholding requirement is waived. How-

days, 8 a.m. through 5 p.m.

ever, this does not mean the nonresident member will not owe

income tax to Maine. It is possible, especially if other Maine-

Rev 9/03

Office use only

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3