Reset Form

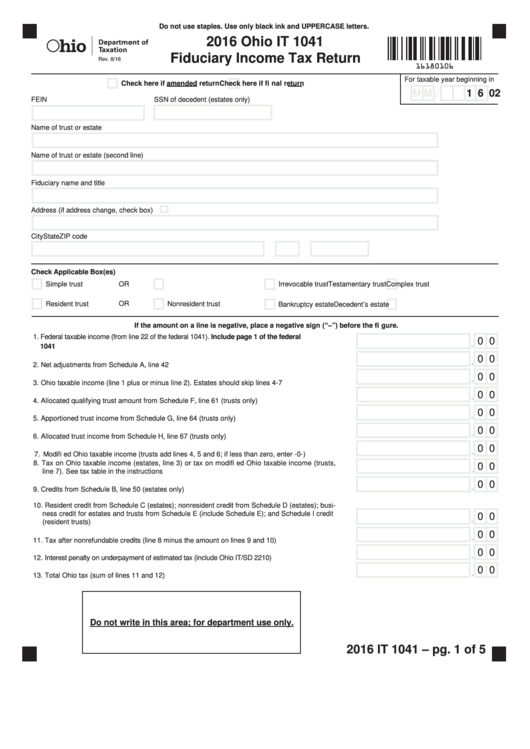

Do not use staples. Use only black ink and UPPERCASE letters.

2016 Ohio IT 1041

Fiduciary Income Tax Return

Rev. 8/16

16180106

For taxable year beginning in

Check here if amended return

Check here if fi nal return

/

M M

2

0

1 6

FEIN

SSN of decedent (estates only)

Name of trust or estate

Name of trust or estate (second line)

Fiduciary name and title

Address (if address change, check box)

City

State

ZIP code

Check Applicable Box(es)

Simple trust

OR

Complex trust

Irrevocable trust

Testamentary trust

Resident trust

OR

Nonresident trust

Bankruptcy estate

Decedent’s estate

If the amount on a line is negative, place a negative sign (“–”) before the fi gure.

1. Federal taxable income (from line 22 of the federal 1041). Include page 1 of the federal

0 0

.

1041

...................................................................................................................................................... 1.

0 0

.

2. Net adjustments from Schedule A, line 42

............................................................................................ 2.

0 0

.

3. Ohio taxable income (line 1 plus or minus line 2). Estates should skip lines 4-7

.................................. 3.

0 0

.

4. Allocated qualifying trust amount from Schedule F, line 61 (trusts only)

............................................... 4.

0 0

.

5. Apportioned trust income from Schedule G, line 64 (trusts only)

.......................................................... 5.

0 0

.

6. Allocated trust income from Schedule H, line 67 (trusts only)

.............................................................. 6.

0 0

.

....................... 7.

7. Modifi ed Ohio taxable income (trusts add lines 4, 5 and 6; if less than zero, enter -0-)

8. Tax on Ohio taxable income (estates, line 3) or tax on modifi ed Ohio taxable income (trusts,

0 0

.

line 7). See tax table in the instructions

................................................................................................ 8.

0 0

.

9. Credits from Schedule B, line 50 (estates only)

.................................................................................... 9.

10. Resident credit from Schedule C (estates); nonresident credit from Schedule D (estates); busi-

ness credit for estates and trusts from Schedule E (include Schedule E); and Schedule I credit

0 0

.

(resident trusts)

................................................................................................................................... 10.

0 0

.

.................................... 11.

11. Tax after nonrefundable credits (line 8 minus the amount on lines 9 and 10)

0 0

.

12. Interest penalty on underpayment of estimated tax (include Ohio IT/SD 2210)

....................................... 12.

0 0

.

............................................................................................... 13.

13. Total Ohio tax (sum of lines 11 and 12)

Do not write in this area; for department use only.

2016 IT 1041 – pg. 1 of 5

1

1 2

2 3

3 4

4 5

5 6

6