Form Ar1002nr - Nonresident Fiduciary Income Tax Return - 2016

ADVERTISEMENT

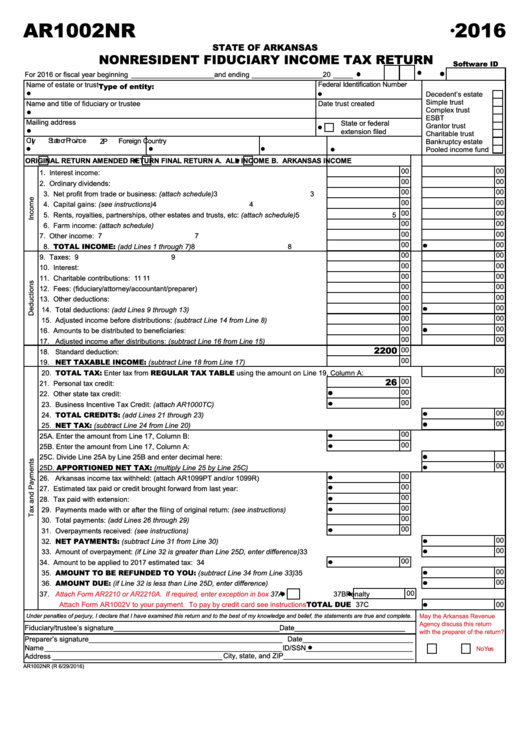

AR1002NR

2016

STATE OF ARKANSAS

NONRESIDENT FIDUCIARY INCOME TAX RETURN

Software ID

For 2016 or fiscal year beginning _____________________ and ending __________________ 20 _____

Name of estate or trust

Federal Identification Number

Type of entity:

Decedent’s estate

Simple trust

Name and title of fiduciary or trustee

Date trust created

Complex trust

ESBT

Mailing address

State or federal

Grantor trust

extension filed

Charitable trust

City

State or Province

Foreign Country

ZIP

Bankruptcy estate

Pooled income fund

ORIGINAL RETURN

AMENDED RETURN

FINAL RETURN

A. ALL INCOME

B. ARKANSAS INCOME

00

00

1. Interest income: .............................................................................................................. 1

1

00

00

2. Ordinary dividends: ........................................................................................................ 2

2

00

00

3. Net profit from trade or business: (attach schedule) ...................................................... 3

3

00

00

4. Capital gains: (see instructions) ..................................................................................... 4

4

00

00

5. Rents, royalties, partnerships, other estates and trusts, etc: (attach schedule) ............. 5

5

00

00

6. Farm income: (attach schedule) ..................................................................................... 6

6

00

00

7. Other income: ................................................................................................................. 7

7

00

00

8. TOTAL INCOME: (add Lines 1 through 7) .................................................................. 8

8

00

00

9. Taxes: ............................................................................................................................. 9

9

00

00

10. Interest: ........................................................................................................................ 10

10

00

00

11. Charitable contributions: ................................................................................................11

11

00

00

12. Fees: (fiduciary/attorney/accountant/preparer) ............................................................ 12

12

00

00

13. Other deductions: ......................................................................................................... 13

13

00

00

14. Total deductions: (add Lines 9 through 13) .................................................................. 14

14

00

00

15. Adjusted income before distributions: (subtract Line 14 from Line 8) .......................... 15

15

00

00

16. Amounts to be distributed to beneficiaries: .................................................................. 16

16

00

00

17. Adjusted income after distributions: (subtract Line 16 from Line 15) ........................... 17

17

2200

00

18. Standard deduction: ..................................................................................................... 18

00

19. NET TAXABLE INCOME: (subtract Line 18 from Line 17) ..................................... 19

00

20. TOTAL TAX: Enter tax from REGULAR TAX TABLE using the amount on Line 19, Column A: ............................20

26

00

21. Personal tax credit: ....................................................................................................... 21

00

22. Other state tax credit: ................................................................................................... 22

00

23. Business Incentive Tax Credit: (attach AR1000TC) ..................................................... 23

00

24. TOTAL CREDITS: (add Lines 21 through 23) ............................................................................................................24

00

25. NET TAX: (subtract Line 24 from Line 20) ...................................................................................................................25

00

25A. Enter the amount from Line 17, Column B: ................................................................25A

00

25B. Enter the amount from Line 17, Column A: ............................................................... 25B

25C. Divide Line 25A by Line 25B and enter decimal here: ................................................................................................25C

00

25D. APPORTIONED NET TAX: (multiply Line 25 by Line 25C) ..................................................................................25D

00

26. Arkansas income tax withheld: (attach AR1099PT and/or 1099R) .............................. 26

00

27. Estimated tax paid or credit brought forward from last year: ........................................ 27

00

28. Tax paid with extension: ............................................................................................... 28

00

29. Payments made with or after the filing of original return: (see instructions) ................. 29

00

30. Total payments: (add Lines 26 through 29) .................................................................. 30

00

31. Overpayments received: (see instructions) .................................................................. 31

00

32. NET PAYMENTS: (subtract Line 31 from Line 30) .....................................................................................................32

00

33. Amount of overpayment: (if Line 32 is greater than Line 25D, enter difference) ............................................................33

00

34. Amount to be applied to 2017 estimated tax: ............................................................... 34

00

35. AMOUNT TO BE REFUNDED TO YOU: (subtract Line 34 from Line 33)..............................................................35

00

36. AMOUNT DUE: (if Line 32 is less than Line 25D, enter difference) ...........................................................................36

00

Penalty

37B

37.

Attach Form AR2210 or AR2210A. If required, enter exception in box

37A

...............................TOTAL DUE 37C

Attach Form AR1002V to your payment. To pay by credit card see instructions

00

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief, the statements are true and complete.

May the Arkansas Revenue

Agency discuss this return

Fiduciary/trustee’s signature__________________________________________

Date____________________________

with the preparer of the return?

Preparer’s signature_________________________________________________

Date____________________________

Name ____________________________________________________________

ID/SSN___________________________

Yes

No

Address ___________________________________________

City, state, and ZIP_________________________________

AR1002NR (R 6/29/2016)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2