Comptroller

57-200

E

T

of Public

S

X

(Rev.12-98/2)

Accounts

A

FORM

b.

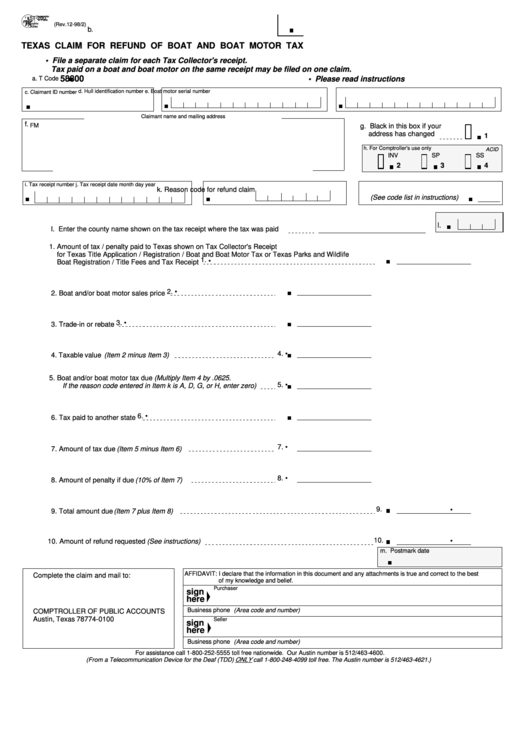

TEXAS CLAIM FOR REFUND OF BOAT AND BOAT MOTOR TAX

• File a separate claim for each Tax Collector's receipt.

Tax paid on a boat and boat motor on the same receipt may be filed on one claim.

58800

• Please read instructions

a. T Code

d. Hull identification number

e. Boat motor serial number

c. Claimant ID number

Claimant name and mailing address

f.

g. Black in this box if your

FM

address has changed

1

h. For Comptroller's use only

ACID

INV

SP

SS

2

3

4

i. Tax receipt number

j. Tax receipt date

month

day

year

k. Reason code for refund claim

(See code list in instructions)

l.

l. Enter the county name shown on the tax receipt where the tax was paid

1. Amount of tax / penalty paid to Texas shown on Tax Collector's Receipt

for Texas Title Application / Registration / Boat and Boat Motor Tax or Texas Parks and Wildlife

1.

•

Boat Registration / Title Fees and Tax Receipt

2.

•

2. Boat and/or boat motor sales price

3.

•

3. Trade-in or rebate

4.

•

4. Taxable value (Item 2 minus Item 3)

5. Boat and/or boat motor tax due (Multiply Item 4 by .0625.

5.

•

If the reason code entered in Item k is A, D, G, or H, enter zero)

6.

•

6. Tax paid to another state

7.

•

7. Amount of tax due (Item 5 minus Item 6)

8.

•

8. Amount of penalty if due (10% of Item 7)

9.

•

9. Total amount due (Item 7 plus Item 8)

10.

•

10. Amount of refund requested (See instructions)

m. Postmark date

AFFIDAVIT: I declare that the information in this document and any attachments is true and correct to the best

Complete the claim and mail to:

of my knowledge and belief.

Purchaser

sign

here

Business phone (Area code and number)

COMPTROLLER OF PUBLIC ACCOUNTS

Austin, Texas 78774-0100

Seller

sign

here

Business phone (Area code and number)

For assistance call 1-800-252-5555 toll free nationwide. Our Austin number is 512/463-4600.

ONLY

(From a Telecommunication Device for the Deaf (TDD)

call 1-800-248-4099 toll free. The Austin number is 512/463-4621.)

1

1 2

2