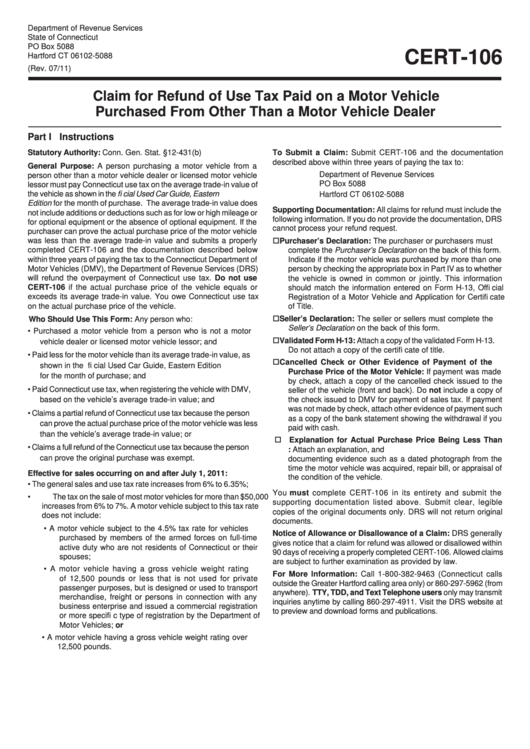

Form Cert-106 - Claim For Refund Of Use Tax Paid On A Motor Vehicle Purchased From Other Than A Motor Vehicle Dealer

ADVERTISEMENT

Department of Revenue Services

State of Connecticut

PO Box 5088

CERT-106

Hartford CT 06102-5088

(Rev. 07/11)

Claim for Refund of Use Tax Paid on a Motor Vehicle

Purchased From Other Than a Motor Vehicle Dealer

Part I Instructions

Statutory Authority: Conn. Gen. Stat. §12-431(b)

To Submit a Claim: Submit CERT-106 and the documentation

described above within three years of paying the tax to:

General Purpose: A person purchasing a motor vehicle from a

Department of Revenue Services

person other than a motor vehicle dealer or licensed motor vehicle

PO Box 5088

lessor must pay Connecticut use tax on the average trade-in value of

the vehicle as shown in the N.A.D.A. Offi cial Used Car Guide, Eastern

Hartford CT 06102-5088

Edition for the month of purchase. The average trade-in value does

Supporting Documentation: All claims for refund must include the

not include additions or deductions such as for low or high mileage or

following information. If you do not provide the documentation, DRS

for optional equipment or the absence of optional equipment. If the

cannot process your refund request.

purchaser can prove the actual purchase price of the motor vehicle

was less than the average trade-in value and submits a properly

Purchaser’s Declaration: The purchaser or purchasers must

completed CERT-106 and the documentation described below

complete the Purchaser’s Declaration on the back of this form.

within three years of paying the tax to the Connecticut Department of

Indicate if the motor vehicle was purchased by more than one

Motor Vehicles (DMV), the Department of Revenue Services (DRS)

person by checking the appropriate box in Part IV as to whether

will refund the overpayment of Connecticut use tax. Do not use

the vehicle is owned in common or jointly. This information

CERT-106 if the actual purchase price of the vehicle equals or

should match the information entered on Form H-13, Offi cial

exceeds its average trade-in value. You owe Connecticut use tax

Registration of a Motor Vehicle and Application for Certifi cate

on the actual purchase price of the vehicle.

of Title.

Seller’s Declaration: The seller or sellers must complete the

Who Should Use This Form: Any person who:

Seller’s Declaration on the back of this form.

•

Purchased a motor vehicle from a person who is not a motor

Validated Form H-13: Attach a copy of the validated Form H-13.

vehicle dealer or licensed motor vehicle lessor; and

Do not attach a copy of the certifi cate of title.

•

Paid less for the motor vehicle than its average trade-in value, as

Cancelled Check or Other Evidence of Payment of the

shown in the N.A.D.A. Offi cial Used Car Guide, Eastern Edition

Purchase Price of the Motor Vehicle: If payment was made

for the month of purchase; and

by check, attach a copy of the cancelled check issued to the

•

Paid Connecticut use tax, when registering the vehicle with DMV,

seller of the vehicle (front and back). Do not include a copy of

based on the vehicle’s average trade-in value; and

the check issued to DMV for payment of sales tax. If payment

was not made by check, attach other evidence of payment such

•

Claims a partial refund of Connecticut use tax because the person

as a copy of the bank statement showing the withdrawal if you

can prove the actual purchase price of the motor vehicle was less

paid with cash.

than the vehicle’s average trade-in value; or

Explanation for Actual Purchase Price Being Less Than

•

Claims a full refund of the Connecticut use tax because the person

N.A.D.A. Average Trade-In Value: Attach an explanation, and

can prove the original purchase was exempt.

documenting evidence such as a dated photograph from the

time the motor vehicle was acquired, repair bill, or appraisal of

Effective for sales occurring on and after July 1, 2011:

the condition of the vehicle.

•

The general sales and use tax rate increases from 6% to 6.35%;

You must complete CERT-106 in its entirety and submit the

•

The tax on the sale of most motor vehicles for more than $50,000

supporting documentation listed above. Submit clear, legible

increases from 6% to 7%. A motor vehicle subject to this tax rate

copies of the original documents only. DRS will not return original

does not include:

documents.

•

A motor vehicle subject to the 4.5% tax rate for vehicles

Notice of Allowance or Disallowance of a Claim: DRS generally

purchased by members of the armed forces on full-time

gives notice that a claim for refund was allowed or disallowed within

active duty who are not residents of Connecticut or their

90 days of receiving a properly completed CERT-106. Allowed claims

spouses;

are subject to further examination as provided by law.

•

A motor vehicle having a gross vehicle weight rating

For More Information: Call 1-800-382-9463 (Connecticut calls

of 12,500 pounds or less that is not used for private

outside the Greater Hartford calling area only) or 860-297-5962 (from

passenger purposes, but is designed or used to transport

anywhere). TTY, TDD, and Text Telephone users only may transmit

merchandise, freight or persons in connection with any

inquiries anytime by calling 860-297-4911. Visit the DRS website at

business enterprise and issued a commercial registration

to preview and download forms and publications.

or more specifi c type of registration by the Department of

Motor Vehicles; or

•

A motor vehicle having a gross vehicle weight rating over

12,500 pounds.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2