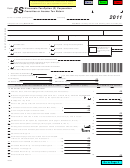

Form 5s - Wisconsin Tax-Option (S) Corporation Franchise Or Income Tax Return - 2001 Page 2

ADVERTISEMENT

Page 2

2001 Form 5S

Schedule 5K – Shareholders’ Shares of Income, Deductions, etc.

(a) Pro rata share items

(b) Federal amount

(c) Adjustment

(d) Wis. amount

1 Ordinary income (loss) from trade or business activities . . . . . . . . . . .

2 Net income (loss) from rental real estate activities (attach From 8825) .

3 Net income (loss) from other rental activities . . . . . . . . . . . . . . . . . . . . .

4 Portfolio income (loss): a Interest income . . . . . . . . . . . . . . . . . . . . . .

b Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Royalty income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d Net short-term capital gain (loss) (attach Schedule D) . . . . . . . . . .

e Net long-term capital gain (loss) (attach Schedule D) . . . . . . . . . . .

f

Other portfolio income (loss) (attach schedule) . . . . . . . . . . . . . . . .

5 Net section 1231 gain (loss) (other than due to casualty or theft) . . . .

6 Other income (loss) (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Charitable contributions (attach schedule) . . . . . . . . . . . . . . . . . . . . . . .

8 Section 179 expense deduction (attach Form 4562) . . . . . . . . . . . . . . .

9 Deductions related to portfolio income (loss) (attach schedule) . . . . . .

10 Other deductions (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 a Interest expense on investment debts . . . . . . . . . . . . . . . . . . . . . . . .

b (1) Investment income included on lines 4a, 4b, 4c, and 4f above .

(2) Investment expenses included on line 9 above . . . . . . . . . . . . .

12 a Manufacturer’s sales tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Development zones credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Supplement to federal historic rehabilitation credit . . . . . . . . . . . . . .

13 Tax paid to other states (enter name of state) a _________________

b _________________

c _________________

14 a Depreciation adjustment on property placed in service after 1986 .

b Adjusted gain or loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Depletion (other than oil and gas) . . . . . . . . . . . . . . . . . . . . . . . . . . .

d (1) Gross income from oil, gas, or geothermal properties . . . . . . . .

(2) Deductions allocable to oil, gas, or geothermal properties . . . .

e Other adjustments and tax preference items (attach schedule) . . .

15 Section 59(e)(2) expenditures: a Type ______________________

b Amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16 Tax-exempt interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17 Other tax-exempt income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18 Nondeductible expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19 Total property distributions (including cash) other than dividends

reported on line 20 below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20 Total dividend distributions paid from accumulated earnings and profits .

21 Other items and amounts required to be reported separately to

shareholders (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22 Gross income (before deducting expenses) from all activities . . . . . . .

23 Income (loss) (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule 5M – Analysis of Wisconsin Accumulated Adjustments Account

and Other Adjustments Account

(a) Accumulated

(b) Other Adjustments

Adjustments Account

Account

1 Balance at beginning of taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Ordinary income from Schedule 5K, line 1, column d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Other additions (including separately stated items which increase income) (attach schedule) . . . .

(

)

4 Loss from Schedule 5K, line 1, column d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(

) (

)

5 Other reductions (including separately stated items which reduce income) (attach schedule) . . . .

6 Combine lines 1 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Distributions other than dividend distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Subtract line 7 from line 6. This is balance at end of taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2