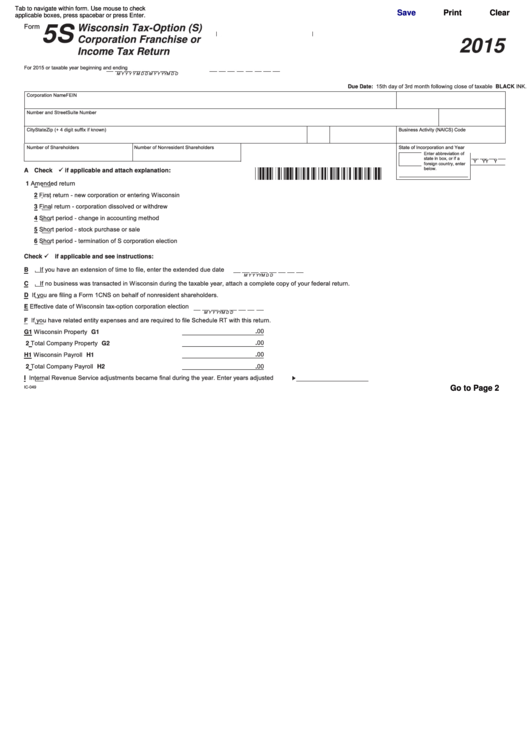

Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

Form

5S

Wisconsin Tax-Option (S)

Corporation Franchise or

2015

Income Tax Return

For 2015 or taxable year beginning

and ending

M

M

D

D

Y

Y

Y

Y

M

M

D

D

Y

Y

Y

Y

Complete form using BLACK INK.

Due Date: 15th day of 3rd month following close of taxable year.

Corporation Name

FEIN

Number and Street

Suite Number

City

State

Zip (+ 4 digit suffix if known)

Business Activity (NAICS) Code

Number of Shareholders

Number of Nonresident Shareholders

State of Incorporation

and

Year

Enter abbreviation of

state in box, or if a

Y

Y

Y

Y

foreign country, enter

below.

A Check

if applicable and attach explanation:

Amended return

1

First return - new corporation or entering Wisconsin

2

Final return - corporation dissolved or withdrew

3

Short period - change in accounting method

4

Short period - stock purchase or sale

5

Short period - termination of S corporation election

6

Check

if applicable and see instructions:

If you have an extension of time to file, enter the extended due date

B

M

M

D

D

Y

Y

Y

Y

If no business was transacted in Wisconsin during the taxable year, attach a complete copy of your federal return.

C

If you are filing a Form 1CNS on behalf of nonresident shareholders.

D

E Effective date of Wisconsin tax-option corporation election

M

M

D

D

Y

Y

Y

Y

If you have related entity expenses and are required to file Schedule RT with this return.

F

G1 Wisconsin Property . . . . . . . . . . . . . . . . . . . . . . G1

.00

2 Total Company Property. . . . . . . . . . . . . . . . . . . G2

.00

H1 Wisconsin Payroll. . . . . . . . . . . . . . . . . . . . . . . . H1

.00

2 Total Company Payroll . . . . . . . . . . . . . . . . . . . . H2

.00

Internal Revenue Service adjustments became final during the year. Enter years adjusted

I

IC-049

Go to Page 2

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9