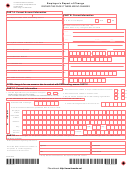

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

DP-87 PROP

BUSINESS TAXES PROPRIETORSHIP

REPORT OF CHANGE FOR IRS ADJUSTMENT ONLY

Page 2

SECTION 1 IRS ADJUSTMENTS TO INCOME

If the number of adjustments exceed the lines provided, attach a schedule and summarize on Line E.

ADJUSTMENT

AMOUNT ORIGINALLY

AMOUNT OF

BALANCE AFTER

FEDERAL FORM

DESCRIPTION

REPORTED

CHANGE

CHANGE

A

B

C

D

E

Total from attached schedule

Line 1 Enter total of Lines A through E here and on Page 1, Line 7 ................................................................ 1

SECTION 2 IRS ADJUSTMENTS TO ADDITIONS

If the number of adjustments exceed the lines provided, attach a schedule and summarize on Line E.

ADJUSTMENT

AMOUNT ORIGINALLY

AMOUNT OF

BALANCE AFTER

NH RETURN LINE NUMBER

DESCRIPTION

REPORTED

CHANGE

CHANGE

A

B

C

D

E

Line 2 Enter total of Lines A through E here and on Page 1, Line 11(b) .......................................................... 2

SECTION 3 IRS ADJUSTMENTS TO DEDUCTIONS

If the number of adjustments exceed the lines provided, attach a schedule and summarize on Line E.

ADJUSTMENT

AMOUNT ORIGINALLY

AMOUNT OF

BALANCE AFTER

NH RETURN LINE NUMBER

DESCRIPTION

REPORTED

CHANGE

CHANGE

A

B

C

D

E

Line 3 Enter total of Lines A through E here and on Page 1, Line 11(c) .......................................................... 3

SECTION 4 IRS ADJUSTMENTS TO BUSINESS ENTERPRISE TAX

A

NH Taxable Enterprise Value Tax Base (TEVTB) as originally fi led or previously adjusted (BET-PROP Line 4)

B

Internal Revenue Service adjustments to TEVTB (attach revised BET and/or BET-80)

C

NH TEVTB as adjusted by IRS Adjustments (Line A adjusted by Line B)

D

NH Business Enterprise Tax as adjusted by IRS Adjustments (Line C x tax rate, see DP-87 instructions)

E

NH Business Enterprise Tax as originally fi led or previously adjusted

F

Balance of Business Enterprise Tax due (Enter amount on Page 1, Line 19. If NEGATIVE, ENTER ZERO on Line 19.)

DP-87 PROP

Rev 02/2011

1

1 2

2