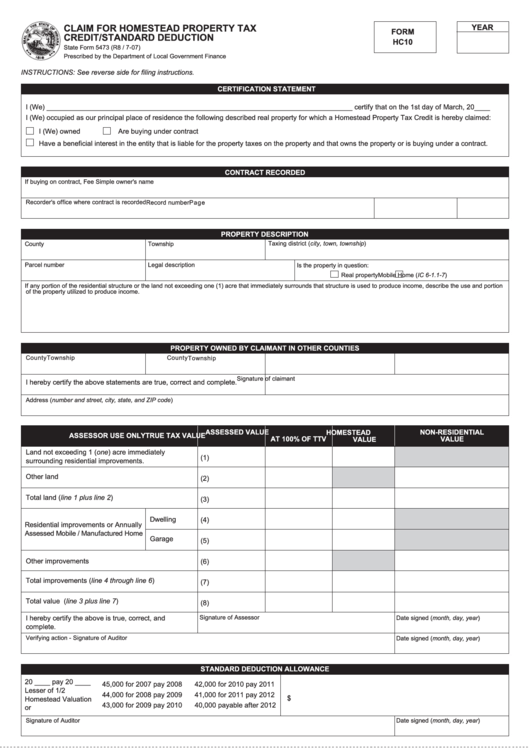

CLAIM FOR HOMESTEAD PROPERTY TAX

YEAR

FORM

CREDIT/STANDARD DEDUCTION

HC10

State Form 5473 (R8 / 7-07)

Prescribed by the Department of Local Government Finance

INSTRUCTIONS: See reverse side for filing instructions.

CERTIFICATION STATEMENT

I (We) ______________________________________________________________________________ certify that on the 1st day of March, 20____

I (We) occupied as our principal place of residence the following described real property for which a Homestead Property Tax Credit is hereby claimed:

I (We) owned

Are buying under contract

Have a beneficial interest in the entity that is liable for the property taxes on the property and that owns the property or is buying under a contract.

CONTRACT RECORDED

If buying on contract, Fee Simple owner's name

Recorder's office where contract is recorded

Record number

Page

PROPERTY DESCRIPTION

Taxing district (city, town, township)

County

Township

Parcel number

Legal description

Is the property in question:

Real property

Mobile Home (IC 6-1.1-7)

If any portion of the residential structure or the land not exceeding one (1) acre that immediately surrounds that structure is used to produce income, describe the use and portion

of the property utilized to produce income.

PROPERTY OWNED BY CLAIMANT IN OTHER COUNTIES

County

Township

County

Township

Signature of claimant

I hereby certify the above statements are true, correct and complete.

Address (number and street, city, state, and ZIP code)

TRUE TAX VALUE ASSESSED VALUE

NON-RESIDENTIAL

HOMESTEAD

ASSESSOR USE ONLY

AT 100% OF TTV

VALUE

VALUE

Land not exceeding 1 (one) acre immediately

(1)

surrounding residential improvements.

Other land

(2)

Total land (line 1 plus line 2)

(3)

Dwelling

(4)

Residential improvements or Annually

Assessed Mobile / Manufactured Home

Garage

(5)

Other improvements

(6)

Total improvements (line 4 through line 6)

(7)

Total value (line 3 plus line 7)

(8)

I hereby certify the above is true, correct, and

Signature of Assessor

Date signed (month, day, year)

complete.

Verifying action - Signature of Auditor

Date signed (month, day, year)

STANDARD DEDUCTION ALLOWANCE

20 ____ pay 20 ____

45,000 for 2007 pay 2008

42,000 for 2010 pay 2011

Lesser of 1/2

44,000 for 2008 pay 2009

41,000 for 2011 pay 2012

$

Homestead Valuation

43,000 for 2009 pay 2010

40,000 payable after 2012

or

Signature of Auditor

Date signed (month, day, year)

RECEIPT FOR APPLICATION FOR HOMESTEAD CREDIT

Name of claimant

Township

Description of property; county

Parcel number

Legal description

Date signed (month, day, year)

Signature of Auditor

1

1 2

2