Form Ct-W4t-2011 - Wihholding Certificate

ADVERTISEMENT

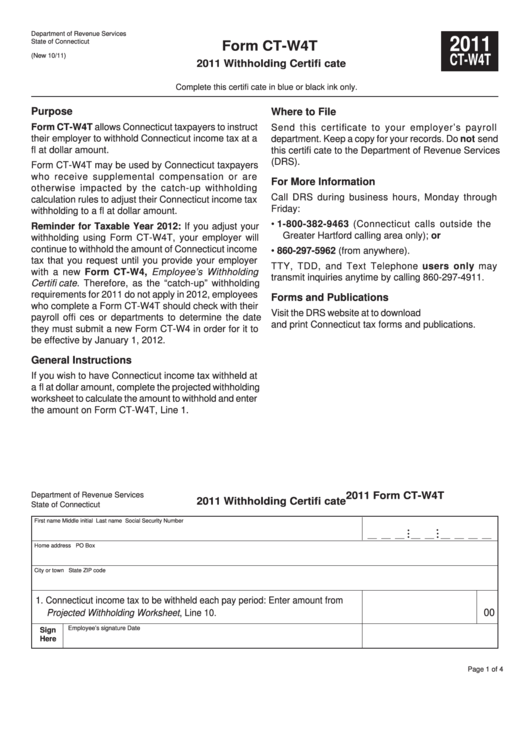

Department of Revenue Services

2011

State of Connecticut

Form CT-W4T

(New 10/11)

CT-W4T

2011 Withholding Certifi cate

Complete this certifi cate in blue or black ink only.

Purpose

Where to File

Form CT-W4T allows Connecticut taxpayers to instruct

Send this certificate to your employer’s payroll

their employer to withhold Connecticut income tax at a

department. Keep a copy for your records. Do not send

fl at dollar amount.

this certifi cate to the Department of Revenue Services

(DRS).

Form CT-W4T may be used by Connecticut taxpayers

who receive supplemental compensation or are

For More Information

otherwise impacted by the catch-up withholding

Call DRS during business hours, Monday through

calculation rules to adjust their Connecticut income tax

Friday:

withholding to a fl at dollar amount.

• 1-800-382-9463 (Connecticut calls outside the

Reminder for Taxable Year 2012: If you adjust your

Greater Hartford calling area only); or

withholding using Form CT-W4T, your employer will

continue to withhold the amount of Connecticut income

• 860-297-5962 (from anywhere).

tax that you request until you provide your employer

TTY, TDD, and Text Telephone users only may

with a new Form CT-W4, Employee’s Withholding

transmit inquiries anytime by calling 860-297-4911.

Certifi cate. Therefore, as the “catch-up” withholding

requirements for 2011 do not apply in 2012, employees

Forms and Publications

who complete a Form CT-W4T should check with their

Visit the DRS website at to download

payroll offi ces or departments to determine the date

and print Connecticut tax forms and publications.

they must submit a new Form CT-W4 in order for it to

be effective by January 1, 2012.

General Instructions

If you wish to have Connecticut income tax withheld at

a fl at dollar amount, complete the projected withholding

worksheet to calculate the amount to withhold and enter

the amount on Form CT-W4T, Line 1.

2011 Form CT-W4T

Department of Revenue Services

2011 Withholding Certifi cate

State of Connecticut

First name

Middle initial

Last name

Social Security Number

•

•

___ ___ ___ ___ ___ ___ ___ ___ ___

•

•

•

•

Home address

PO Box

City or town

State

ZIP code

1. Connecticut income tax to be withheld each pay period: Enter amount from

00

Projected Withholding Worksheet, Line 10. ....................................................1.

Employee’s signature

Date

Sign

Here

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1