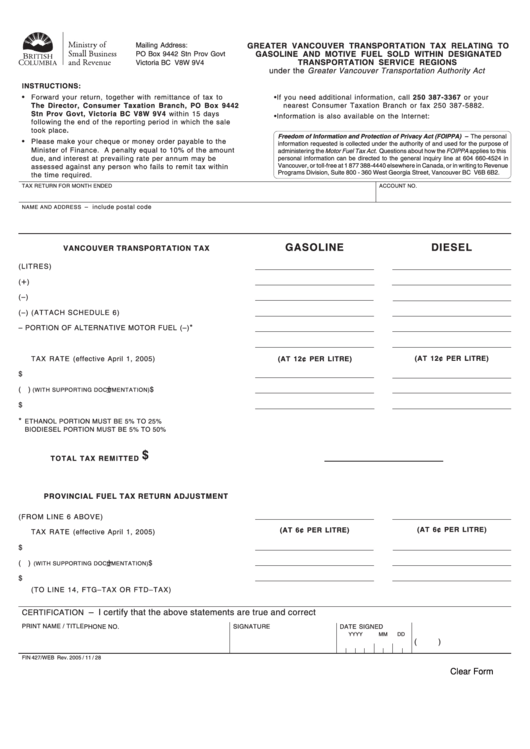

Form Fin 427/web - Transportation Tax Relating To Gasoline And Motive Fuel Within Designated

ADVERTISEMENT

Mailing Address:

GREATER VANCOUVER TRANSPORTATION TAX RELATING TO

PO Box 9442 Stn Prov Govt

GASOLINE AND MOTIVE FUEL SOLD WITHIN DESIGNATED

TRANSPORTATION SERVICE REGIONS

Victoria BC V8W 9V4

under the Greater Vancouver Transportation Authority Act

INSTRUCTIONS:

•

Forward your return, together with remittance of tax to

• If you need additional information, call 250 387-3367 or your

The Director, Consumer Taxation Branch, PO Box 9442

nearest Consumer Taxation Branch or fax 250 387-5882.

Stn Prov Govt, Victoria BC V8W 9V4 within 15 days

• Information is also available on the Internet:

following the end of the reporting period in which the sale

took place.

Freedom of Information and Protection of Privacy Act (FOIPPA) – The personal

•

Please make your cheque or money order payable to the

information requested is collected under the authority of and used for the purpose of

Minister of Finance. A penalty equal to 10% of the amount

administering the Motor Fuel Tax Act. Questions about how the FOIPPA applies to this

due, and interest at prevailing rate per annum may be

personal information can be directed to the general inquiry line at 604 660-4524 in

Vancouver, or toll-free at 1 877 388-4440 elsewhere in Canada, or in writing to Revenue

assessed against any person who fails to remit tax within

Programs Division, Suite 800 - 360 West Georgia Street, Vancouver BC V6B 6B2.

the time required.

TAX RETURN FOR MONTH ENDED

ACCOUNT NO.

– include postal code

NAME AND ADDRESS

GASOLINE

DIESEL

VANCOUVER TRANSPORTATION TAX

1. TOTAL SALES (LITRES)

+

2. OWN CONSUMPTION (

)

3. TAX-PAID PURCHASES (–)

4. EXEMPT SALES (–) (ATTACH SCHEDULE 6)

*

5. EXEMPTION – PORTION OF ALTERNATIVE MOTOR FUEL (–)

6. TAXABLE LITRES

TAX RATE (effective April 1, 2005)

(AT 12¢ PER LITRE)

(AT 12¢ PER LITRE)

7. TAX DUE

$

+

8. AUTHORIZED ADJ (

)

$

(WITH SUPPORTING DOCUMENTATION)

–

9. TOTAL TAX DUE

$

*

ETHANOL PORTION MUST BE 5% TO 25%

BIODIESEL PORTION MUST BE 5% TO 50%

$

TOTAL TAX REMITTED

PROVINCIAL FUEL TAX RETURN ADJUSTMENT

1. TAXABLE LITRES (FROM LINE 6 ABOVE)

(AT 6¢ PER LITRE)

(AT 6¢ PER LITRE)

TAX RATE (effective April 1, 2005)

2. TAX ADJUSTMENT

$

+

3. AUTHORIZED ADJ (

)

$

(WITH SUPPORTING DOCUMENTATION)

–

4. PROVINCIAL FUEL TAX ADJUSTMENT

$

(TO LINE 14, FTG–TAX OR FTD–TAX)

– I certify that the above statements are true and correct

CERTIFICATION

PRINT NAME / TITLE

SIGNATURE

DATE SIGNED

PHONE NO.

YYYY

MM

DD

(

)

FIN 427/WEB Rev. 2005 / 11 / 28

Clear Form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1