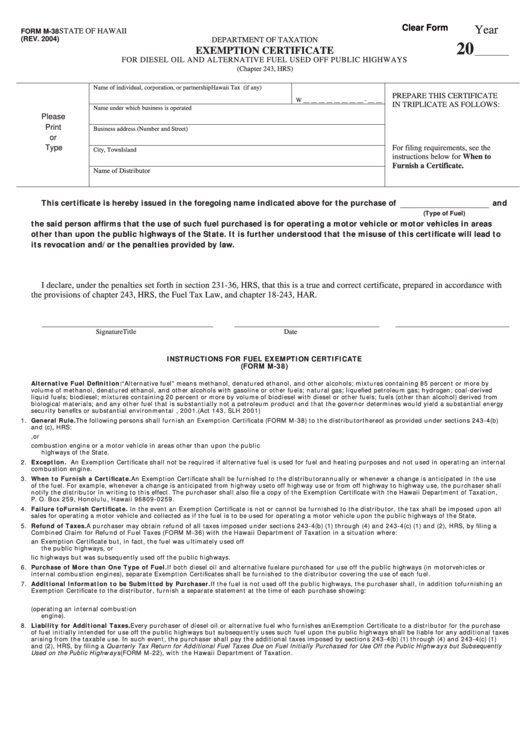

Clear Form

Year

FORM M-38

STATE OF HAWAII

(REV. 2004)

DEPARTMENT OF TAXATION

20

EXEMPTION CERTIFICATE

FOR DIESEL OIL AND ALTERNATIVE FUEL USED OFF PUBLIC HIGHWAYS

(Chapter 243, HRS)

Name of individual, corporation, or partnership

Hawaii Tax I.D. No. (if any)

PREPARE THIS CERTIFICATE

W __ __ __ __ __ __ __ __ - __ __

IN TRIPLICATE AS FOLLOWS:

Name under which business is operated

1. Original for Distributor

Please

2. Copy for Tax Office

Print

Business address (Number and Street)

3. Copy for Taxpayer

or

Type

For filing requirements, see the

City, Town

Island

instructions below for When to

Furnish a Certificate.

Name of Distributor

This certificate is hereby issued in the foregoing name indicated above for the purchase of

and

(Type of Fuel)

the said person affirms that the use of such fuel purchased is for operating a motor vehicle or motor vehicles in areas

other than upon the public highways of the State. It is further understood that the misuse of this certificate will lead to

its revocation and/or the penalties provided by law.

I declare, under the penalties set forth in section 231-36, HRS, that this is a true and correct certificate, prepared in accordance with

the provisions of chapter 243, HRS, the Fuel Tax Law, and chapter 18-243, HAR.

Signature

Title

Date

INSTRUCTIONS FOR FUEL EXEMPTION CERTIFICATE

(FORM M-38)

Alternative Fuel Definition: “Alternative fuel” means methanol, denatured ethanol, and other alcohols; mixtures containing 85 percent or more by

volume of methanol, denatured ethanol, and other alcohols with gasoline or other fuels; natural gas; liquefied petroleum gas; hydrogen; coal-derived

liquid fuels; biodiesel; mixtures containing 20 percent or more by volume of biodiesel with diesel or other fuels; fuels (other than alcohol) derived from

biological materials; and any other fuel that is substantially not a petroleum product and that the governor determines would yield a substantial energy

security benefits or substantial environmental benefits. Effective for taxable years beginning after December 31, 2001. (Act 143, SLH 2001)

1. General Rule. The following persons shall furnish an Exemption Certificate (FORM M-38) to the distributor thereof as provided under sections 243-4(b)

and (c), HRS:

a. Every purchaser of diesel oil who uses such fuel in a motor vehicle in areas other than upon the public highways of the State, or

b. Every purchaser of alternative fuel who uses such fuel in an internal combustion engine or a motor vehicle in areas other than upon the public

highways of the State.

2. Exception. An Exemption Certificate shall not be required if alternative fuel is used for fuel and heating purposes and not used in operating an internal

combustion engine.

3. When to Furnish a Certificate. An Exemption Certificate shall be furnished to the distributor annually or whenever a change is anticipated in the use

of the fuel. For example, whenever a change is anticipated from highway use to off highway use or from off highway to highway use, the purchaser shall

notify the distributor in writing to this effect. The purchaser shall also file a copy of the Exemption Certificate with the Hawaii Department of Taxation,

P. O. Box 259, Honolulu, Hawaii 96809-0259.

4. Failure to Furnish Certificate. In the event an Exemption Certificate is not or cannot be furnished to the distributor, the tax shall be imposed upon all

sales for operating a motor vehicle and collected as if the fuel is to be used for operating a motor vehicle upon the public highways of the State.

5. Refund of Taxes. A purchaser may obtain refund of all taxes imposed under sections 243-4(b) (1) through (4) and 243-4(c) (1) and (2), HRS, by filing a

Combined Claim for Refund of Fuel Taxes (FORM M-36) with the Hawaii Department of Taxation in a situation where:

a. The tax was imposed and collected because the purchaser failed to furnish an Exemption Certificate but, in fact, the fuel was ultimately used off

the public highways, or

b. The fuel purchased was initially intended for use upon the public highways but was subsequently used off the public highways.

6. Purchase of More than One Type of Fuel. If both diesel oil and alternative fuel are purchased for use off the public highways (in motor vehicles or

internal combustion engines), separate Exemption Certificates shall be furnished to the distributor covering the use of each fuel.

7. Additional Information to be Submitted by Purchaser. If the fuel is not used off the public highways, the purchaser shall, in addition to furnishing an

Exemption Certificate to the distributor, furnish a separate statement at the time of each purchase showing:

a. Breakdown as to the diesel oil to be used upon the public highways and/or off the public highways.

b. Breakdown as to the alternative fuel to be used upon the public highways and/or off the public highways (operating an internal combustion

engine).

8. Liability for Additional Taxes. Every purchaser of diesel oil or alternative fuel who furnishes an Exemption Certificate to a distributor for the purchase

of fuel initially intended for use off the public highways but subsequently uses such fuel upon the public highways shall be liable for any additional taxes

arising from the taxable use. In such event, the purchaser shall pay the additional taxes imposed by sections 243-4(b) (1) through (4) and 243-4(c) (1)

and (2), HRS, by filing a Quarterly Tax Return for Additional Fuel Taxes Due on Fuel Initially Purchased for Use Off the Public Highways but Subsequently

Used on the Public Highways (FORM M-22), with the Hawaii Department of Taxation.

1

1