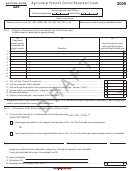

Form 150-102-029 - Pollution Control Facility Credit Page 2

ADVERTISEMENT

INSTRUCTIONS

General Information

Line Instructions

You can take a tax credit for part of the cost of a pollution

For lines not fully explained on the form.

control facility. The facility must be completed and placed

Heading. Enter the tax year covered by this return. Enter the

into service by December 31, 2007. Contact the DEQ for cer-

name of the taxpayer who is claiming the credit, the sepa-

tification requirements. You must attach to your tax return

rate business name, if any, and the identification number(s).

a copy of the pollution control facility certificate issued by

DEQ (ORS 468.155 or 468.190).

Certificate number and lines 1 through 5. Copy this infor-

mation from the certificate issued by the DEQ.

The credit may be claimed beginning in the tax year in which

the facility is certified. The credit cannot be claimed beyond

Line 7. Use the percentage amount as it applies to the certi-

the 10-year certification period, except for the carryforward

fication of the facility. The percentage is limited to 50 per-

of any unused credit.

cent, 35 percent, 25 percent, or 15 percent as determined by

the Oregon Department of Environmental Quality.

You can deduct depreciation on a facility even though the

credit is being claimed. Credits claimed don’t reduce your

Line 8. The estimated useful life of a facility is the estimated

basis in the facility. See Oregon Administrative Rule (OAR)

number of years of useful life remaining at the time the fa-

150-315.304(10). If you sell the facility or otherwise dispose

cility is certified. It may not be less than 1 year or more than

of it, you must notify the DEQ. DEQ will revise the certifi-

10 years.

cate. The new owner may claim only the remaining credits

Line 10. There are two limitations on the tentative current

not used by the first owner. See OAR 150-315.304(8).

year credit:

If you are a shareholder in an S corporation, the credit is

1. For facilities certified before January 1, 1989, the tentative

claimed on your individual return. Your credit is based on

credit must be reduced by any federal grants or credits

your share of the certified cost of the facility. Your share is

(other than the investment credit under IRC 46) received

determined by your percent of stock ownership on each day

by the taxpayer for pollution control.

of the corporation’s tax year.

2. The tentative credit on any particular facility cannot be

If you are a partner in a partnership, you can claim a credit

greater than the remaining maximum total credit (50 per-

on your individual return. Your credit is based on your share

cent or lesser applicable percentage of certified cost) that

of the certified cost of the facility.

hasn’t already been taken as a credit in prior taxable years.

If you are a corporation, attach this form to your Oregon

Line 12. Prepare a schedule to show how you computed the

corporation tax return if a credit is claimed. Other taxpay-

credit carryover amount. A pollution control facility credit

ers should keep a copy of this form in their files for audit

can generally be carried forward three tax years. The oldest

verification.

credit carryover should be used first.

Generally, the taxpayer using the pollution control facility

Exception: If you have credits that have not expired prior to

in their trade or business, either the owner or lessee, may

2001 and were not fully used, the unused credits are eligible

claim the credit. The taxpayer who will claim the credit must

for an additional carryforward period of up to three years.

be designated in a written statement signed by all persons

To claim an additional carryforward year, the facility must

with an interest in the facility. This statement must be filed

be in operation during that year. See OAR 150-315.304(9).

with the Department of Revenue before the last day of the

first tax year in which the credit is claimed.

Line 14. You are allowed to choose the order in which tax

credits will be used to reduce the current year tax. Prepare

a schedule to show which credits you want to apply to your

tax liability before the pollution control credit. Enter the net

tax from your schedule on line 14.

Line 15. Enter the lesser of line 13 or line 14. If the total credit

available (line 13) is greater than the amount needed to off-

set the tax liability of the current taxable year, the excess can

be carried forward. Ordinarily, a credit cannot be carried for-

ward for more than three tax years. See information for line

12 regarding an exception.

Oregon Department of Revenue

Oregon Department of Environmental Quality

955 Center St NE

811 SW Sixth Ave

Salem OR 97301-2555

Portland OR 97204

Web site:

Web site:

150-102-029 (Rev. 10-01) Web

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2