Instructions For Miscellaneous Credits Form C-8000mc

ADVERTISEMENT

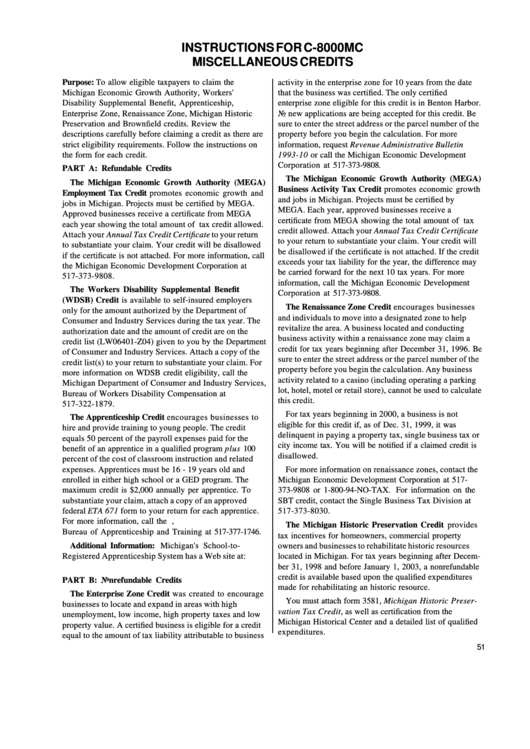

INSTRUCTIONS FOR C-8000MC

MISCELLANEOUS CREDITS

Purpose: To allow eligible taxpayers to claim the

activity in the enterprise zone for 10 years from the date

Michigan Economic Growth Authority, Workers'

that the business was certified. The only certified

Disability Supplemental Benefit, Apprenticeship,

enterprise zone eligible for this credit is in Benton Harbor.

Enterprise Zone, Renaissance Zone, Michigan Historic

No new applications are being accepted for this credit. Be

Preservation and Brownfield credits. Review the

sure to enter the street address or the parcel number of the

descriptions carefully before claiming a credit as there are

property before you begin the calculation. For more

strict eligibility requirements. Follow the instructions on

information, request Revenue Administrative Bulletin

the form for each credit.

1993-10 or call the Michigan Economic Development

Corporation at 517-373-9808.

PART A: Refundable Credits

The Michigan Economic Growth Authority (MEGA)

The Michigan Economic Growth Authority (MEGA)

Business Activity Tax Credit promotes economic growth

Employment Tax Credit promotes economic growth and

and jobs in Michigan. Projects must be certified by

jobs in Michigan. Projects must be certified by MEGA.

MEGA. Each year, approved businesses receive a

Approved businesses receive a certificate from MEGA

certificate from MEGA showing the total amount of tax

each year showing the total amount of tax credit allowed.

credit allowed. Attach your Annual Tax Credit Certificate

Attach your Annual Tax Credit Certificate to your return

to your return to substantiate your claim. Your credit will

to substantiate your claim. Your credit will be disallowed

be disallowed if the certificate is not attached. If the credit

if the certificate is not attached. For more information, call

exceeds your tax liability for the year, the difference may

the Michigan Economic Development Corporation at

be carried forward for the next 10 tax years. For more

517-373-9808.

information, call the Michigan Economic Development

The Workers Disability Supplemental Benefit

Corporation at 517-373-9808.

(WDSB) Credit is available to self-insured employers

The Renaissance Zone Credit encourages businesses

only for the amount authorized by the Department of

and individuals to move into a designated zone to help

Consumer and Industry Services during the tax year. The

revitalize the area. A business located and conducting

authorization date and the amount of credit are on the

business activity within a renaissance zone may claim a

credit list (LW06401-Z04) given to you by the Department

credit for tax years beginning after December 31, 1996. Be

of Consumer and Industry Services. Attach a copy of the

sure to enter the street address or the parcel number of the

credit list(s) to your return to substantiate your claim. For

property before you begin the calculation. Any business

more information on WDSB credit eligibility, call the

activity related to a casino (including operating a parking

Michigan Department of Consumer and Industry Services,

lot, hotel, motel or retail store), cannot be used to calculate

Bureau of Workers Disability Compensation at

this credit.

517-322-1879.

For tax years beginning in 2000, a business is not

The Apprenticeship Credit encourages businesses to

eligible for this credit if, as of Dec. 31, 1999, it was

hire and provide training to young people. The credit

delinquent in paying a property tax, single business tax or

equals 50 percent of the payroll expenses paid for the

city income tax. You will be notified if a claimed credit is

benefit of an apprentice in a qualified program plus 100

disallowed.

percent of the cost of classroom instruction and related

expenses. Apprentices must be 16 - 19 years old and

For more information on renaissance zones, contact the

enrolled in either high school or a GED program. The

Michigan Economic Development Corporation at 517-

maximum credit is $2,000 annually per apprentice. To

373-9808 or 1-800-94-NO-TAX. For information on the

substantiate your claim, attach a copy of an approved

SBT credit, contact the Single Business Tax Division at

federal ETA 671 form to your return for each apprentice.

517-373-8030.

For more information, call the U.S. Department of Labor,

The Michigan Historic Preservation Credit provides

Bureau of Apprenticeship and Training at 517-377-1746.

tax incentives for homeowners, commercial property

Additional Information: Michigan's School-to-

owners and businesses to rehabilitate historic resources

Registered Apprenticeship System has a Web site at:

located in Michigan. For tax years beginning after Decem-

ber 31, 1998 and before January 1, 2003, a nonrefundable

credit is available based upon the qualified expenditures

PART B: Nonrefundable Credits

made for rehabilitating an historic resource.

The Enterprise Zone Credit was created to encourage

You must attach form 3581, Michigan Historic Preser-

businesses to locate and expand in areas with high

vation Tax Credit, as well as certification from the

unemployment, low income, high property taxes and low

Michigan Historical Center and a detailed list of qualified

property value. A certified business is eligible for a credit

expenditures.

equal to the amount of tax liability attributable to business

51

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2