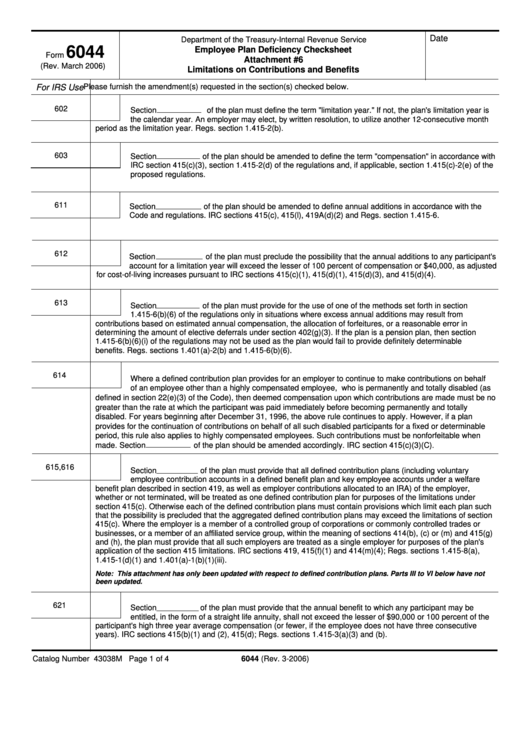

Date

Department of the Treasury-Internal Revenue Service

6044

Employee Plan Deficiency Checksheet

Form

Attachment #6

(Rev. March 2006)

Limitations on Contributions and Benefits

For IRS Use

Please furnish the amendment(s) requested in the section(s) checked below.

602

Section

of the plan must define the term "limitation year." If not, the plan's limitation year is

the calendar year. An employer may elect, by written resolution, to utilize another 12-consecutive month

period as the limitation year. Regs. section 1.415-2(b).

I.a.

603

Section

of the plan should be amended to define the term "compensation" in accordance with

IRC section 415(c)(3), section 1.415-2(d) of the regulations and, if applicable, section 1.415(c)-2(e) of the

proposed regulations.

I.b.

611

Section

of the plan should be amended to define annual additions in accordance with the

Code and regulations. IRC sections 415(c), 415(l), 419A(d)(2) and Regs. section 1.415-6.

Il.a.

612

Section

of the plan must preclude the possibility that the annual additions to any participant's

account for a limitation year will exceed the lesser of 100 percent of compensation or $40,000, as adjusted

for cost-of-living increases pursuant to IRC sections 415(c)(1), 415(d)(1), 415(d)(3), and 415(d)(4).

Il.b.

613

Section

of the plan must provide for the use of one of the methods set forth in section

1.415-6(b)(6) of the regulations only in situations where excess annual additions may result from

contributions based on estimated annual compensation, the allocation of forfeitures, or a reasonable error in

ll.c.

determining the amount of elective deferrals under section 402(g)(3). If the plan is a pension plan, then section

1.415-6(b)(6)(i) of the regulations may not be used as the plan would fail to provide definitely determinable

benefits. Regs. sections 1.401(a)-2(b) and 1.415-6(b)(6).

614

Where a defined contribution plan provides for an employer to continue to make contributions on behalf

of an employee other than a highly compensated employee, who is permanently and totally disabled (as

defined in section 22(e)(3) of the Code), then deemed compensation upon which contributions are made must be no

Il.d.

greater than the rate at which the participant was paid immediately before becoming permanently and totally

disabled. For years beginning after December 31, 1996, the above rule continues to apply. However, if a plan

provides for the continuation of contributions on behalf of all such disabled participants for a fixed or determinable

period, this rule also applies to highly compensated employees. Such contributions must be nonforfeitable when

made. Section

of the plan should be amended accordingly. IRC section 415(c)(3)(C).

615,616

Section

of the plan must provide that all defined contribution plans (including voluntary

employee contribution accounts in a defined benefit plan and key employee accounts under a welfare

benefit plan described in section 419, as well as employer contributions allocated to an IRA) of the employer,

Il.e.

whether or not terminated, will be treated as one defined contribution plan for purposes of the limitations under

section 415(c). Otherwise each of the defined contribution plans must contain provisions which limit each plan such

that the possibility is precluded that the aggregated defined contribution plans may exceed the limitations of section

415(c). Where the employer is a member of a controlled group of corporations or commonly controlled trades or

businesses, or a member of an affiliated service group, within the meaning of sections 414(b), (c) or (m) and 415(g)

and (h), the plan must provide that all such employers are treated as a single employer for purposes of the plan's

application of the section 415 limitations. IRC sections 419, 415(f)(1) and 414(m)(4); Regs. sections 1.415-8(a),

1.415-1(d)(1) and 1.401(a)-1(b)(1)(iii).

Note: This attachment has only been updated with respect to defined contribution plans. Parts III to VI below have not

been updated.

621

Section

of the plan must provide that the annual benefit to which any participant may be

entitled, in the form of a straight life annuity, shall not exceed the lesser of $90,000 or 100 percent of the

participant's high three year average compensation (or fewer, if the employee does not have three consecutive

III.a.

years). IRC sections 415(b)(1) and (2), 415(d); Regs. sections 1.415-3(a)(3) and (b).

Catalog Number 43038M Page 1 of 4

Form 6044 (Rev. 3-2006)

1

1 2

2 3

3 4

4