Individual Reading Earnings Tax Return - 2006

ADVERTISEMENT

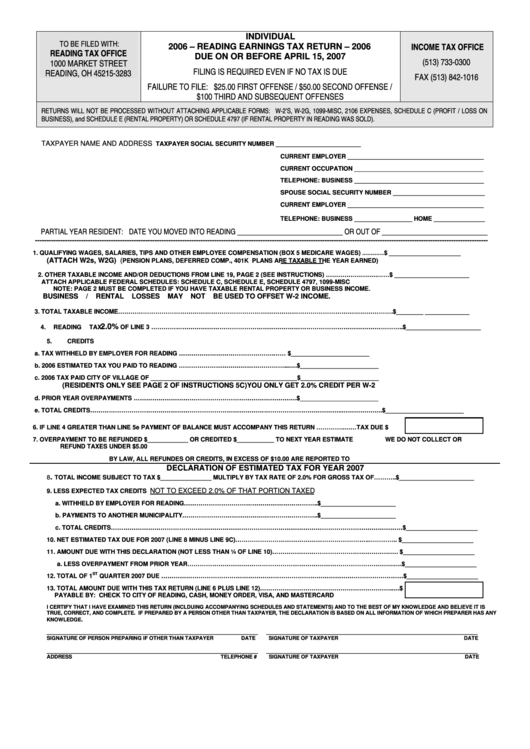

INDIVIDUAL

TO BE FILED WITH:

INCOME TAX OFFICE

2006 – READING EARNINGS TAX RETURN – 2006

READING TAX OFFICE

DUE ON OR BEFORE APRIL 15, 2007

(513) 733-0300

1000 MARKET STREET

FILING IS REQUIRED EVEN IF NO TAX IS DUE

READING, OH 45215-3283

FAX (513) 842-1016

FAILURE TO FILE: $25.00 FIRST OFFENSE / $50.00 SECOND OFFENSE /

$100 THIRD AND SUBSEQUENT OFFENSES

RETURNS WILL NOT BE PROCESSED WITHOUT ATTACHING APPLICABLE FORMS: W-2’S, W-2G, 1099-MISC, 2106 EXPENSES, SCHEDULE C (PROFIT / LOSS ON

BUSINESS), and SCHEDULE E (RENTAL PROPERTY) OR SCHEDULE 4797 (IF RENTAL PROPERTY IN READING WAS SOLD).

TAXPAYER NAME AND ADDRESS

TAXPAYER SOCIAL SECURITY NUMBER _________________________

CURRENT EMPLOYER ________________________________________

CURRENT OCCUPATION ______________________________________

TELEPHONE: BUSINESS ______________________________________

SPOUSE SOCIAL SECURITY NUMBER ___________________________

CURRENT EMPLOYER ________________________________________

TELEPHONE: BUSINESS _________________ HOME _______________

PARTIAL YEAR RESIDENT: DATE YOU MOVED INTO READING ______________________________ OR OUT OF ______________________________

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

1. QUALIFYING WAGES, SALARIES, TIPS AND OTHER EMPLOYEE COMPENSATION (BOX 5 MEDICARE WAGES) .…….…$ _____________________

(ATTACH W2s, W2G) (

PENSION PLANS, DEFERRED COMP., 401K PLANS ARE TAXABLE THE YEAR EARNED)

2. OTHER TAXABLE INCOME AND/OR DEDUCTIONS FROM LINE 19, PAGE 2 (SEE INSTRUCTIONS) …………………….……$ ______________________

ATTACH APPLICABLE FEDERAL SCHEDULES: SCHEDULE C, SCHEDULE E, SCHEDULE 4797, 1099-MISC

NOTE: PAGE 2 MUST BE COMPLETED IF YOU HAVE TAXABLE RENTAL PROPERTY OR BUSINESS INCOME.

BUSINESS / RENTAL LOSSES MAY NOT BE USED TO OFFSET W-2 INCOME.

3. TOTAL TAXABLE INCOME…………………………………………………………………………………………………………………….$________ _____________

2.0%

4. READING TAX:

OF LINE 3 …………………………………………………………………………………………………………..$______________________

5. CREDITS

a. TAX WITHHELD BY EMPLOYER FOR READING ……………………………………….…….....$_______________________

b. 2006 ESTIMATED TAX YOU PAID TO READING ……………………………………………...….$_______________________

c. 2006 TAX PAID CITY OF VILLAGE OF ___________________________________________$_______________________

(RESIDENTS ONLY SEE PAGE 2 OF INSTRUCTIONS 5C) YOU ONLY GET 2.0% CREDIT PER W-2

d. PRIOR YEAR OVERPAYMENTS …………………………………………………………………….$_______________________

e. TOTAL CREDITS…………………………………………………………………………………………………………..………………..$_______________________

6. IF LINE 4 GREATER THAN LINE 5e PAYMENT OF BALANCE MUST ACCOMPANY THIS RETURN ………….….…TAX DUE $

7. OVERPAYMENT TO BE REFUNDED $____________ OR CREDITED $___________ TO NEXT YEAR ESTIMATE

WE DO NOT COLLECT OR

REFUND TAXES UNDER $5.00

BY LAW, ALL REFUNDES OR CREDITS, IN EXCESS OF $10.00 ARE REPORTED TO I.R.S. ON FORMS 1099-G

DECLARATION OF ESTIMATED TAX FOR YEAR 2007

.

8

TOTAL INCOME SUBJECT TO TAX $_______________ MULTIPLY BY TAX RATE OF 2.0% FOR GROSS TAX OF………..$______________________

NOT TO EXCEED 2.0% OF THAT PORTION TAXED

9. LESS EXPECTED TAX CREDITS

a. WITHHELD BY EMPLOYER FOR READING………………………………………………………..$______________________

b. PAYMENTS TO ANOTHER MUNICIPALITY…………………………………………….…………..$______________________

c. TOTAL CREDITS……………………………………………………………………………………………………………………………$_____________________

10. NET ESTIMATED TAX DUE FOR 2007 (LINE 8 MINUS LINE 9C)………………………………………………………..………….. $_____________________

11. AMOUNT DUE WITH THIS DECLARATION (NOT LESS THAN ¼ OF LINE 10)……………………………………………………. $_____________________

a. LESS OVERPAYMENT FROM PRIOR YEAR……………………………………………………………………………………….….$_____________________

ST

12. TOTAL OF 1

QUARTER 2007 DUE ………………………………………………………………………………………………………$_____________________

13. TOTAL AMOUNT DUE WITH THIS TAX RETURN (LINE 6 PLUS LINE 12)……………………………………………………….….$

PAYABLE BY: CHECK TO CITY OF READING, CASH, MONEY ORDER, VISA, AND MASTERCARD

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLDUING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE AND BELIEVE IT IS

TRUE, CORRECT, AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THE DECLARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY

.

KNOWLEDGE

______________________________________________________________

______________________________________________________________

SIGNATURE OF PERSON PREPARING IF OTHER THAN TAXPAYER

DATE

SIGNATURE OF TAXPAYER

DATE

______________________________________________________________

______________________________________________________________

ADDRESS

TELEPHONE #

SIGNATURE OF TAXPAYER

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2